Bank Letter Requirements and ACH Banking IDs

Valid Bank Letter

Various scenarios, such as ACH re-authorization and bank information changes, require a bank letter to be resolved or proceed. The requirements for a bank letter to be considered valid are very specific, so it is important to make sure your document is put together carefully before submitting.

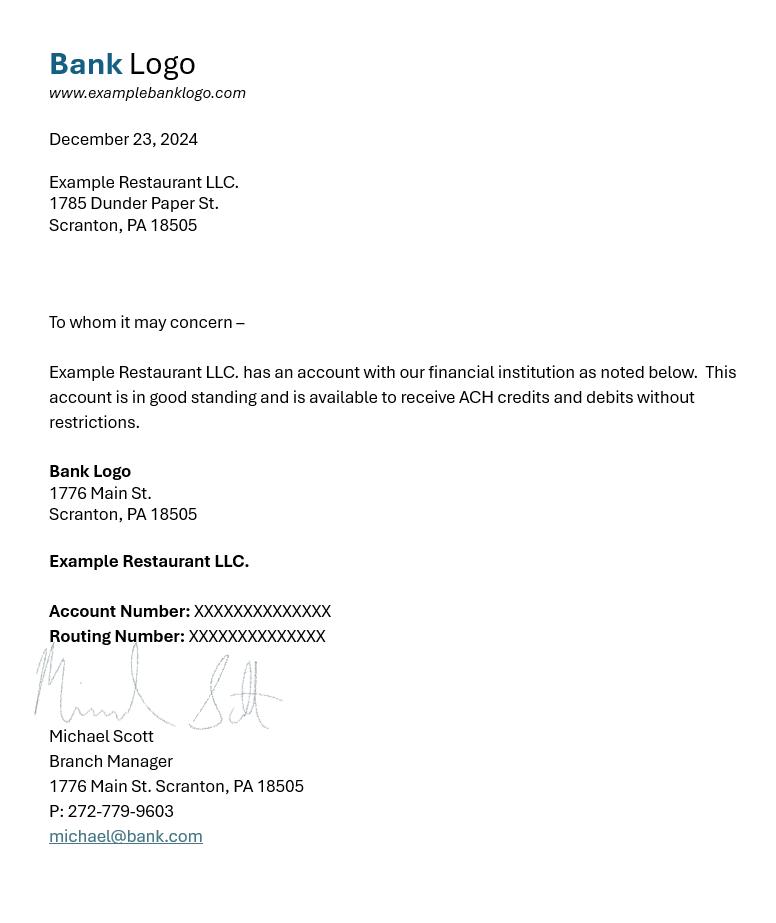

The Following are Required for a Valid Bank Letter:

- On bank letterhead paper

- Dated within 30 days

- States the name of the business

- List the account number and routing number (if you desire to have separate accounts for deposits and withdrawals, list each account and routing number next to a heading with "Withdrawals" and "Deposits")

- Have a sentence on the letter that states the bank account is open and available for ACH credits and debits without any restrictions

- Signed by a bank representative

Sample Bank Letter Format

ACH Banking Information

ACH identifications numbers or NACHA ACH company IDs, are essential for the identification of facilities transferring money within the United States.

"Whitelist" (or "safe list") your account information and the processor information to avoid ACH rejections that can cause delays in funding or ACH reject fees.

This whitelisting is for the credit of deposits and the debit of fees relating to your card and ACH batches. This is NOT whitelisting for transactions with your customers and will not affect returns or rejects between you and your customer directly, or for any transactions that may occur outside of our payment systems (such as wire payments).

Why this is Important:

- Avoid ACH "Return" or "Stop Payment" Fees

- Avoid a "Funds Hold" or "Funds Delay" because of a mistaken ACH return

- Help your financial institution and internal accounting identify transactions from safe vendors

What You Need to Do

Provide this information to your bank to whitelist these IDs for transactions to your account.

ACH Transactions - Deposits and Withdrawals

The following are various formats for bank records regarding ACH processing for your account, fees/deposits from INGAGE directly, and for activity from the ACH Processor (such as returns/corrections)

ACH Debits/Credits directly from INGAGE:

Name: INGAGE I.T.

ACH ID: 9-00000562

SEC Code: CCD

ACH Processing from your Merchant Account:

Name: “Your Exact Merchant Name” (as it appears on your ACH account) *

ACH ID: 9-XXXXXXXX

SEC Code: CCD

*This is commonly your DBA name; however, it may vary from DBA. Check with INGAGE for questions.

ACH Returns/Rejects/Processor Adjustments:

Name: ACH Dept INH

ACH ID: 1002003023

SEC Code: CCD

This account is used for ACH returns/chargebacks and adjustments

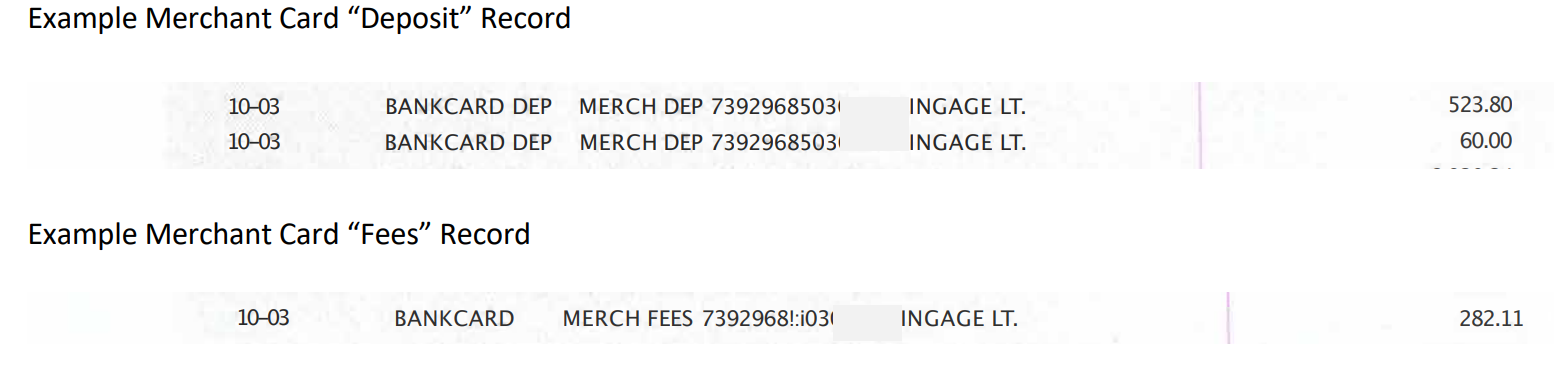

Card Transactions - Deposits and Withdrawals

The following are various formats for bank records regarding Card processing for your account, including deposits and withdrawals.

Name: BANKCARD

ACH ID: 0203050521

SEC Code: CCD

Description: Merchant Fees “Merchant Name” and “Merchant ID (000xxxx)