PCI Compliance for Focus

Introduction

What is PCI?

Payment Card Industry Data Security Standards (PCI DSS) compliance is mandated by credit card companies and the payment network to ensure the security of credit card transactions and cardholder data. It exists to protect cardholders from having their sensitive card data stolen and subsequently used without their consent.

Are we required to complete this?

Even if you do not actively accept card payments, this PCI questionnaire is required.

What is the benefit or cost?

PCI questionnaires that are left uncompleted and fined by the card network and processor. The current processor fee is $39.95/mo. This fee is $0 with a completed PCI questionnaire.

Overview

This guide will assist you with the login and profile questions for your business. This form will not provide answers to the questionnaire and only the merchant can complete the questionnaire. We are not authorized to complete this questionnaire for you and this is not legal or compliance advice.

Step-by-Step Guide:

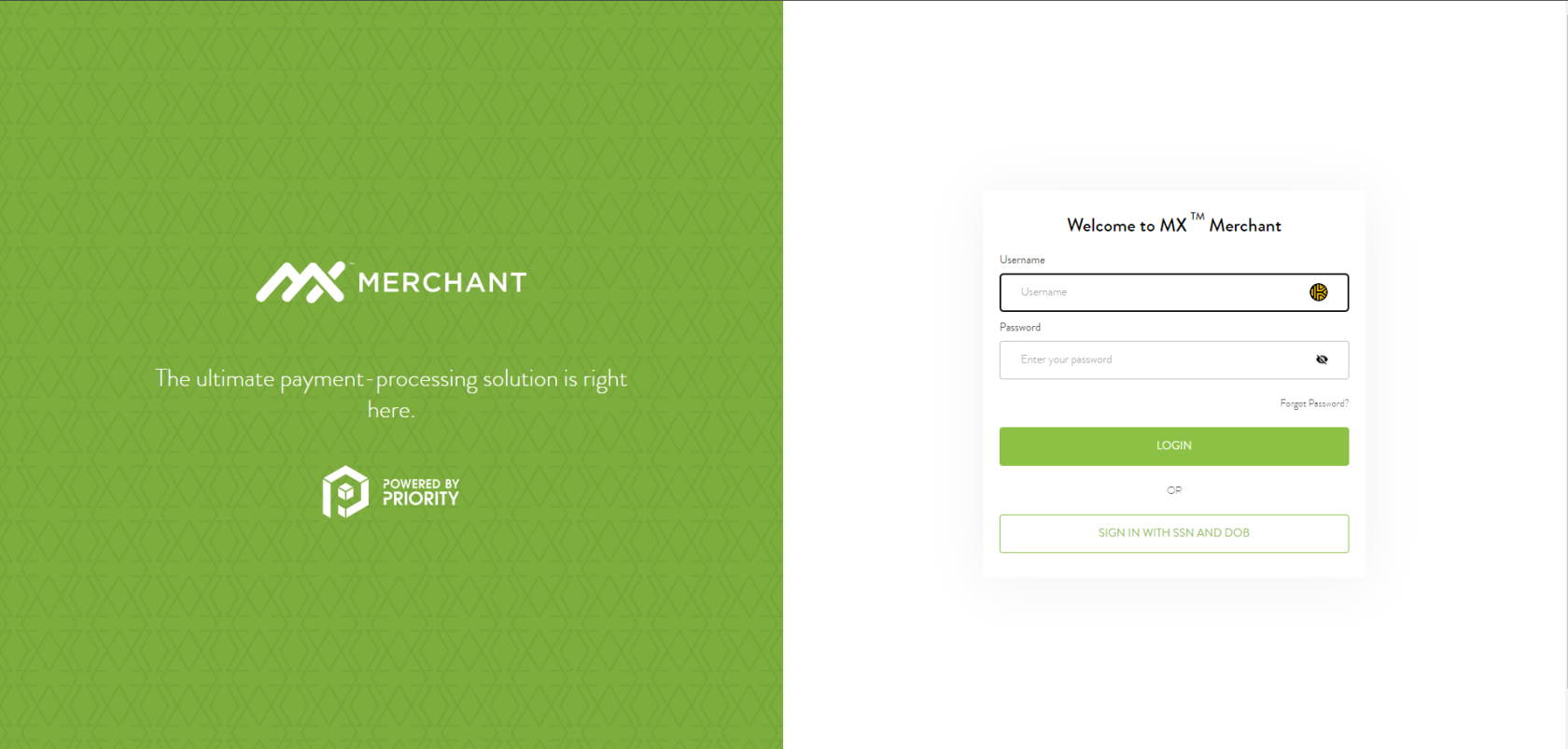

Step 1 - Login to MX Merchant

Click the link in the email from norely@mxmerchant.com or go to www.mxmerchant.com

You must use the Google Chrome web browser. Other web browsers are not fully supported for all features and may cause technical issues.

Then, login using your existing username and password. If you forgot your password, click the "Forgot Password" link to reset. If you forgot your username or are having another issue/error, call or email us:

Step 2 - Select Location

If you only have one location, skip to Step 3.

If you have more than one location, verify you are connected to the right account. You may have to edit your "Location". To do this, select the ![]() in the top right-hand corner. Select "Edit" next to "Location". A pop-up will appear. Search for the correct location by name. Select the checkbox next to the correct location and hit "Save".

in the top right-hand corner. Select "Edit" next to "Location". A pop-up will appear. Search for the correct location by name. Select the checkbox next to the correct location and hit "Save".

Please note, that many merchants have both an in-person, “Brick & Mortar” account as well as an online, “e-Commerce” account. Ensure you have the proper account selected before you begin.

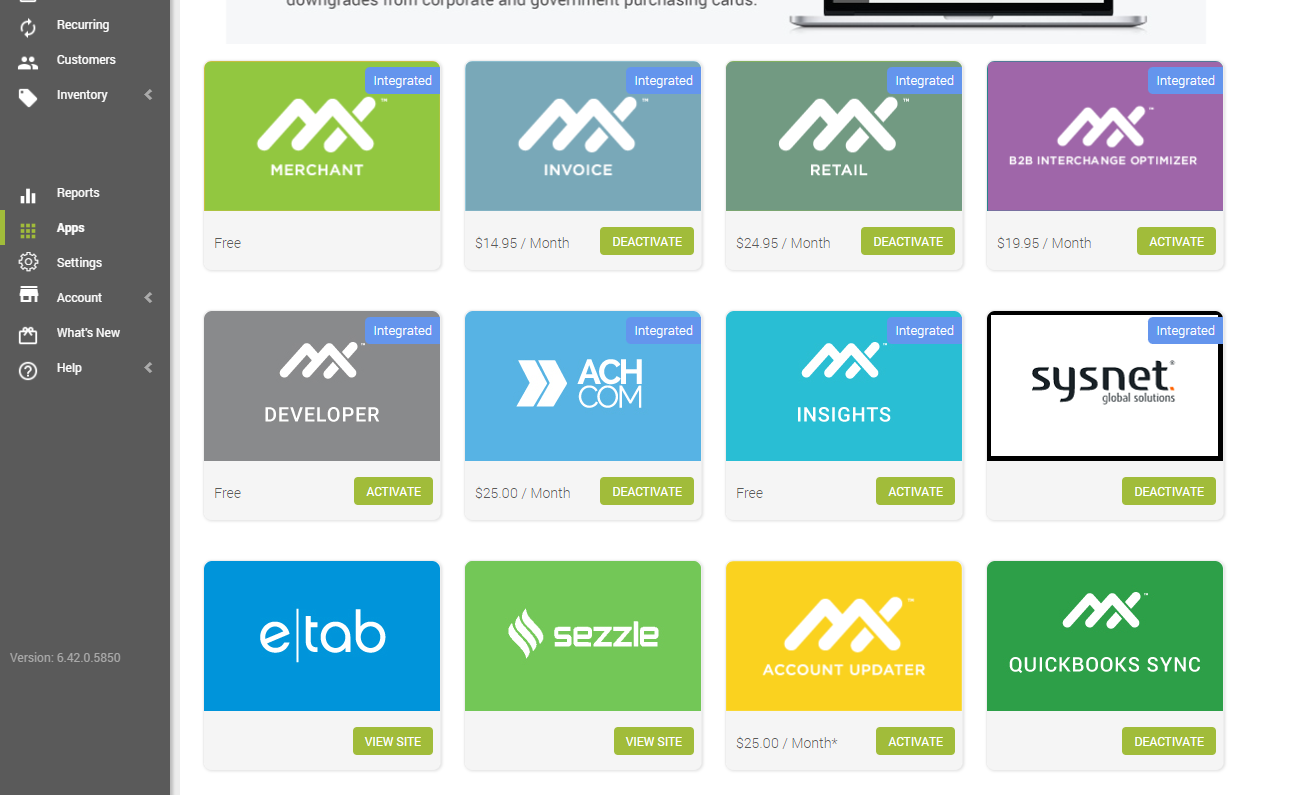

Step 3 - Enable Application

An activation confirmation message will appear. Select "OK".

A green bar will appear at the top of your web browser window confirming the app has successfully been activated.

On the app, you should now see the  button where the

button where the  button was before. This means the app is now activated.

button was before. This means the app is now activated.

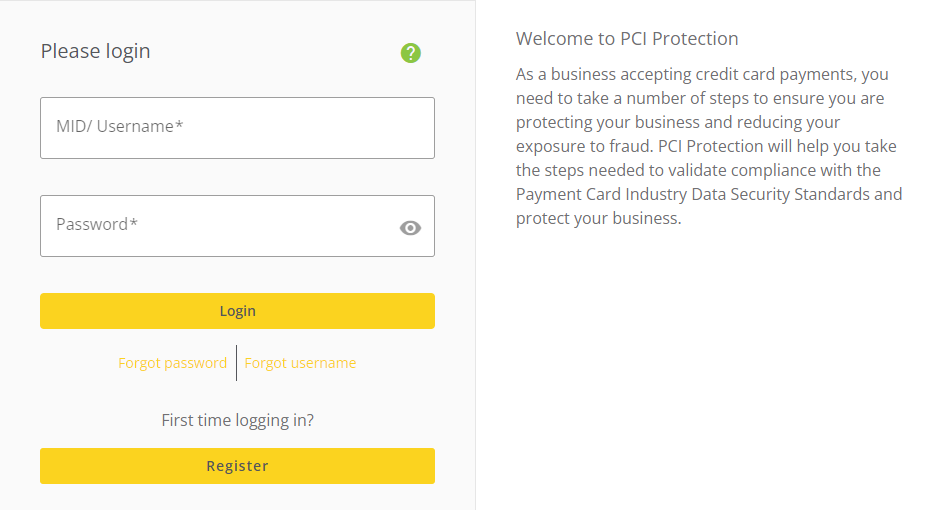

Step 4 - Create Your Account

The application has been activated, but you must create an account. For security, you will be required to re-login after creating your account for the first time.

Hover over the Sysnet app with your mouse. Click  . You will be redirected to a webpage at https://pciprotection.com.

. You will be redirected to a webpage at https://pciprotection.com.

Create a username and password by selecting "Register" and following the prompts.

A pop-up confirming you are integrating your compliance into your online portal will appear. Select "Allow". You will be redirected back to the "Apps" page of your MX Merchant account.

Like before, hover over the Sysnet app with your mouse. Click  .

.

Step 5 - Complete Your Compliance

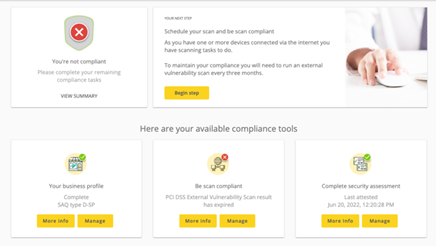

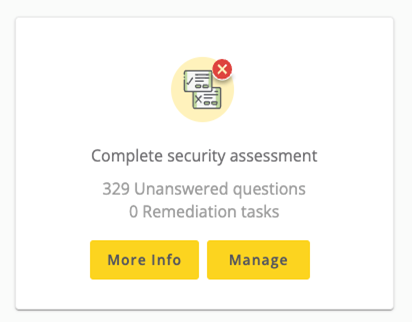

Your dashboard will show “Not compliant” and three boxes for:

- Your Business Profile

- Be Scan Compliant

- Complete Security Assessment

You'll start with the business profile. Correctly answering the business profile is critical – if the wrong profile is selected, your security assessment or “questionnaire” will not be accurate to your business.

Step 6 - Business Profile

Under "Your business profile", select "Manage".

Follow the prompts. If you are using the integrated point-of-sale, complete the following:

Q: PLEASE READ: PCI DSS 4.0 update

A: I understand

Q. Select Your Processing Method

A: POS Terminal

Q. Your Point-To-Point Encryption system: Is your Point-of-Sale system a PCI SSC Point-to-Point Encryption (P2PE) hardware solution? elect Your Processing Method

A: No

Q: Does your business electronically store credit card numbers? Do not keep credit card information in electronic files unless you have a compelling business reason to store the information. In most cases, you will reduce the level of effort required to comply with the PCI standard if you do not electronically store credit card numbers after authorization.

A: Yes

Q: Third Party Managed System Service Providers: Do you have relationships with one or more third-party service providers that manage system components included in the scope of this assessment, for example, via network security control services, anti-malware services, security incident and event management (SIEM), contact and call centers, web-hosting services, and IaaS, PaaS, SaaS, and FaaS cloud provider?

A: Yes

Q: Managed system component providers: Your service providers. You can add a new one or remove if the existing one is incorrect.

A: INGAGE LLC

Q: Other Third Party Service Providers that may impact cardholder data security: Do you have relationships with one or more third-party service providers that could impact the security of the merchant’s cardholder data environment (CDE)? For example, vendors providing support via remote access, and/or bespoke software developers.

A: Yes

Q: Other third party service providers: Your other third party service providers. You can add a new one or remove if the existing one is incorrect.

A: INGAGE LLC

Q: Does your business use or allow any remote administrative access?

A: Yes

Q: Does your company have a wireless network connected to the cardholder data environment?

A: Yes

Q: Do you agree with the above statements?

A: Yes

Q: Your company policy for information security

A: I already have an Information Security Policy in place that covers ALL of the relevant clauses of the Payment Card Industry Data Security Standard (PCI DSS)

Q: Password Policy: Do you enforce a minimum password length of seven characters, containing both numeric and alphabetic characters, for user accounts on all POS devices, computers and systems in your business?

A: Yes

Your profile result should be "SAQ-D".

If the resulting SAQ bullet points do not match your business, please email us to review together: support@ingageipayments.com

Move on to the next step. Select the logo or "Home" button if needed.

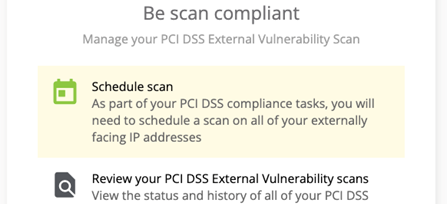

Step 7 - PCI Scan

Under the "Be scan compliant" section, select "Manage".

Select "Schedule scan".

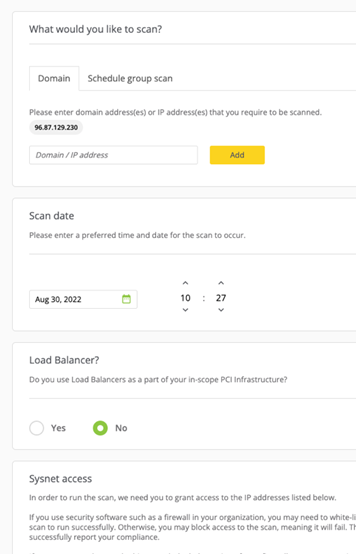

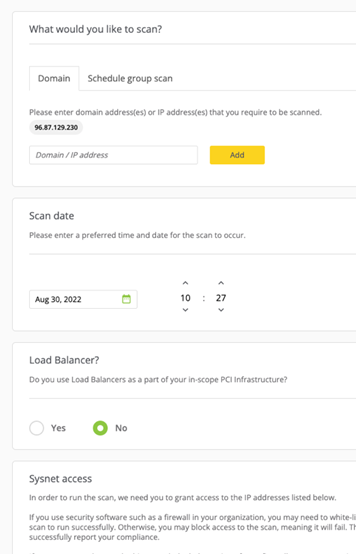

Your IP address will populate in the gray bubble. If you are at the location of the business, this is the business' IP address.

If you are not at the business, you must get the local IP address from the business. This can be done via Google and searching, "What is my IP address".

For "Scan Date", enter today'tomorrow's date.date Youat can3 alsoAM. set it

for any time in the near future.

Scans canare takebest 24-72run hourswhen tothe run.business is not operating, hence, the 3 AM time.

Set "Load Balancer?" to "No".

Under "Sysnet access", check the box at the bottom and select "Schedule Scan".

Step 8 - Finish Questionnaire

Under "Complete security assessment", select "Manage".

Follow the prompts. Select "Click to start your questionnaire".

The last question requires our scan to be done and passed.

All other questions are the responsibility of the merchant and must be answered according to the business’ unique handling of processing and policies. You will receive an opportunity to change your answers at the end. Once passed, you will have a copy of your certificate available for download.

Merchants will be required to answer "yes" to all questions in order to pass! This is to certify that the questions regarding compliance and security are true for your business. Please answer honestly.

There is a toggle at the top of the page that allows you to sort your “yes” and “no” answers. This is to allow you to look through those questions that you answered “no” to, to update your business processes or policies and return to the page to mark them as “yes”.

You will not be allowed to submit your questionnaire if all answers are not marked as “yes”.

Additional help resources are available on the Sysnet website. Additionally, the phone number for Sysnet support is located on the website screen in the upper right hand corner and is available for your use. A PCI compliance expert can assist you with questionnaire answers.

Unfortunately, as your Qualified Integrator Reseller (QIR) we cannot answer these questions for you and we encourage all businesses to answer the questions thoroughly and honestly.

Step 9 - Confirm Scan and Finish Questionnaire

Sysnet will send you an email confirming your scan PASS or FAIL. It will go to the email on file (used earlier). Please check junk/spam as these emails are automated.

If your scan is a FAIL – call our support team at (612)-861-5277 or email us at support@ingageit.com. Our I.T. support group will need to review your network and scan results to assist you. You will need to follow their direction and proceed with another scan.

If your scan is a PASS – log back into Sysnet and complete the final question of the questionnaire. This is the last step for compliance for the year. You can download a copy of your compliance for your records. Congratulations on your compliance and savings.

. A grid layout will appear.

. A grid layout will appear.  .

.