Issuing a Refund in MX Merchant

The process for issuing a refund in MX Merchant.

Quick Pay Refund

Getting to Quick Pay

Step 1 - Login to MXM

Go to www.mxmerchant.com and login using your credentials. If you do not have credentials, request your user account be added to the merchant in question.

Step 2 - Select Location

Verify you are connected to the proper account. You may have to edit your "Location". To do this, select the ![]() in the top right-hand corner. Select "Edit" next to "Location". A pop-up will appear. Search for the correct merchant location by name. Select the checkbox next to the correct location and hit "Save".

in the top right-hand corner. Select "Edit" next to "Location". A pop-up will appear. Search for the correct merchant location by name. Select the checkbox next to the correct location and hit "Save".

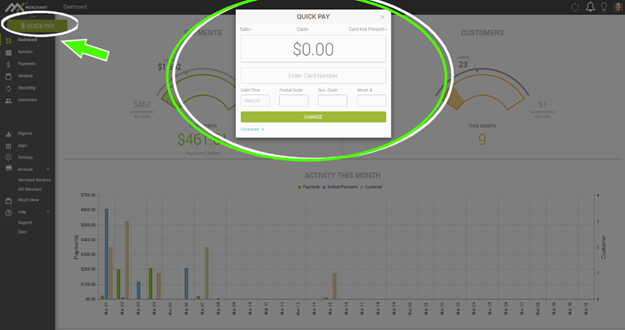

Step 3 - Access Quick Pay

Quick Pay is best for issuing a non-existing payment refund.

Across the top are drop downs with the default selection showing. To change them for the current transaction, click on the down arrows to the right of each word (defaults can be set in payment settings).

- Type of sale: Sale or refund

- Tender type: Card, cash, check or ACH

- Presentment type:

1. For card: card present, card not present, swiped, terminal.

2. For ACH: CCD, PPD, Tel, Web.

The type and presence of tender will determine the fields available to process the payment.

Select "Advanced" in blue at the bottom of the pop-out to access additional data fields that can be added to the payment. Please note all fields under the advanced section are optional.

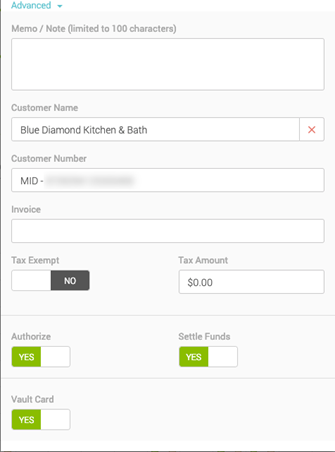

Now you will see the pop-out has expanded with the following fields:

- Memo / Note: a free-form textbox

- Customer Name: you can either search for a customer here or enter a new customer name. If a customer name is entered that does not already exist, a new record will be created for them

- Customer Number: search for an existing customer by customer number or use this field to enter your own unique number

- Invoice: here you can enter your own invoice number for this payment

- Tax Exempt: Yes/No; Defaults to "No"

- Tax Amount: how much of the total above is tax. If nothing is entered the system will default to 7% for reporting purposes only to help you qualify for the best rate

- Authorize: If toggle to no, a field is displayed to enter an offline authorization code. This option is not available to Clerks

- Settle Funds: If toggle to yes, it will add funds to the day’s settlement. If toggled to no, it does not add funds to the day’s settlement. This option is not available to Clerks.

- Vault Card: If toggled to "Yes", card information will be saved. If toggled to "No", card information will not be saved. Card will display with only the last four digits.

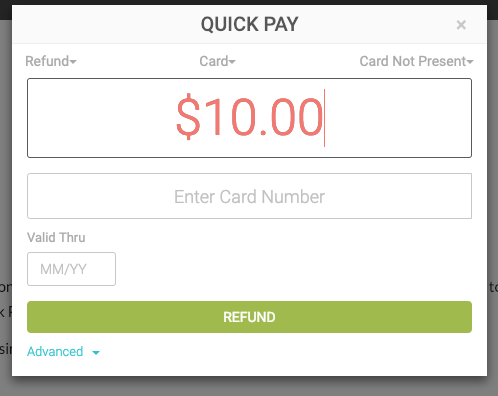

Processing a Refund in Quick Pay

Change the type of sale from default "Sale" to "Refund" in the top left corner. Select payment type from the top-center dropdown (default is card). If you selected either "Card" or "ACH" from those dropdown options, you will need to select the appropriate presentment type/indicator from the far-right dropdown:

In the textbox, enter the amount you wish to refund.

Select the green "Refund" or "Swipe Card" button to finish.

Processing a Previously Existing Payment

Accessing the Payments Tab