Exclusive vs Inclusive Tax on reports

This document will show you how exclusive and inclusive taxes report on the Daily sales report and Server Reports.

What is Exclusive Tax?

Exclusive tax refers to a pricing method where the tax amount is not included in the price of a product or service displayed to the customer. Instead, the tax is calculated and added separately at the time of purchase.

For example:

- If an item's price is $100 and the tax rate is 10%, the customer will pay $110 (price + tax).

- The displayed price remains $100, and the tax is added during checkout.

What is inclusive Tax?

Inclusive tax refers to a pricing method where the tax amount is already included in the displayed price of a product or service. The customer pays the exact price they see, without any additional tax added at the time of purchase.

For example:

- If the displayed price is $100 and the tax rate is 10%, the base price (before tax) is calculated as $90.91, and the tax included is $9.09.

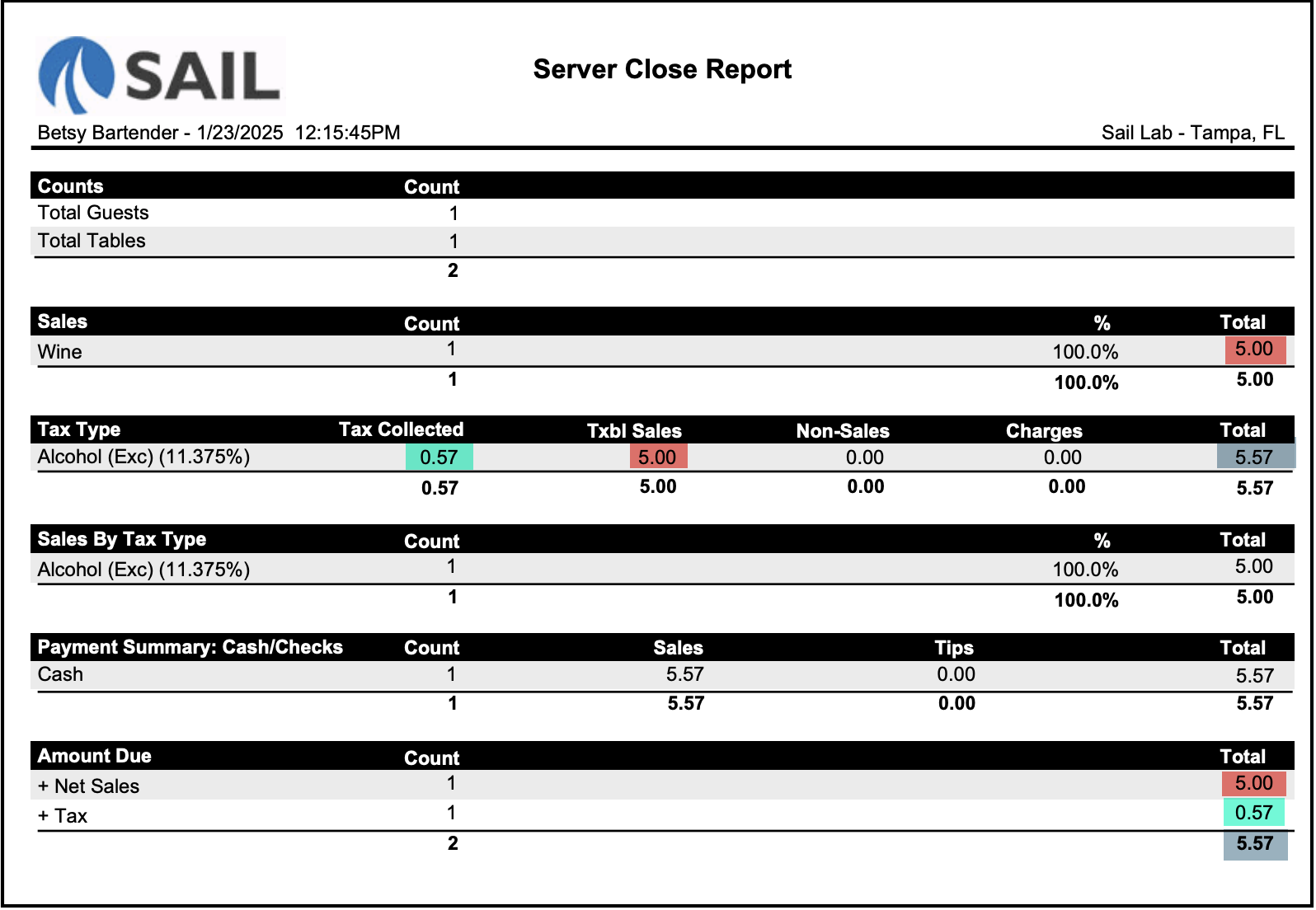

Exclusive Tax on a Server Report

- In this example Betsy rang in one $5 item that has exclusive tax

- $5.00 (Net Sales) + $0.57 (Tax) = $5.57 (Total Sale)

- In this scenario the customer pays the tax

Inclusive tax on a Server Report

- In this example Sally rang in one $5 dollar item that has inclusive tax

- $5.00 (Total Sale) - $0.51 (Tax) = $4.49 (Net Sales)

- In this scenario the restaurant pays the tax

Exclusive and Inclusive tax on a Daily Sales Report

What needs to get reported for tax purposes