Exclusive vs Inclusive Tax on reports

This document will show you how exclusive and inclusive taxes report on the Daily sales report and Server Reports.

What is Exclusive Tax?

- Exclusive tax refers to a pricing method where the tax amount is not included in the price of a product or service displayed to the customer. Instead, the tax is calculated and added separately at the time of purchase.

- For example:

- If an item's price is $100 and the tax rate is 10%, the customer will pay $110 (price + tax).

- The displayed price remains $100, and the tax is added during checkout.

- For example:

What is inclusive Tax?

- Inclusive tax refers to a pricing method where the tax amount is already included in the displayed price of a product or service. The customer pays the exact price they see, without any additional tax added at the time of purchase.

- For example:

- If the displayed price is $100 and the tax rate is 10%, the base price (before tax) is calculated as $90.91, and the tax included is $9.09.

- For example:

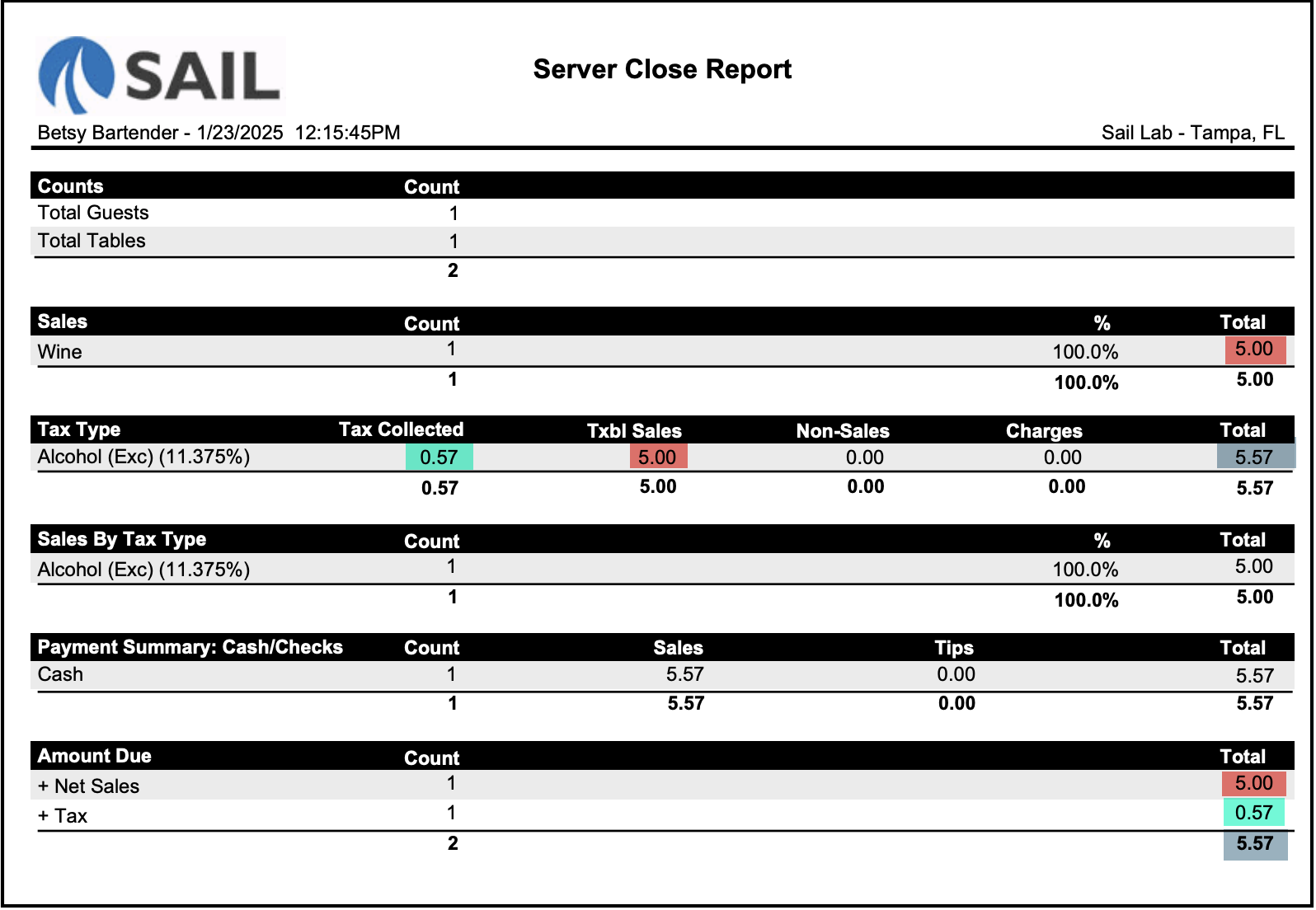

Exclusive Tax on a Server Report

- In this example Betsy rang in one $5 item that has exclusive tax

- $5.00 (Net Sales) + $0.57 (Tax) = $5.57 (Total Sale)

- In this scenario the customer pays the tax

Inclusive tax on a Server Report

- In this example Sally rang in one $5 dollar item that has inclusive tax

- $5.00 (Total Sale) - $0.51 (Tax) = $4.49 (Net Sales)

- In this scenario the restaurant pays the tax

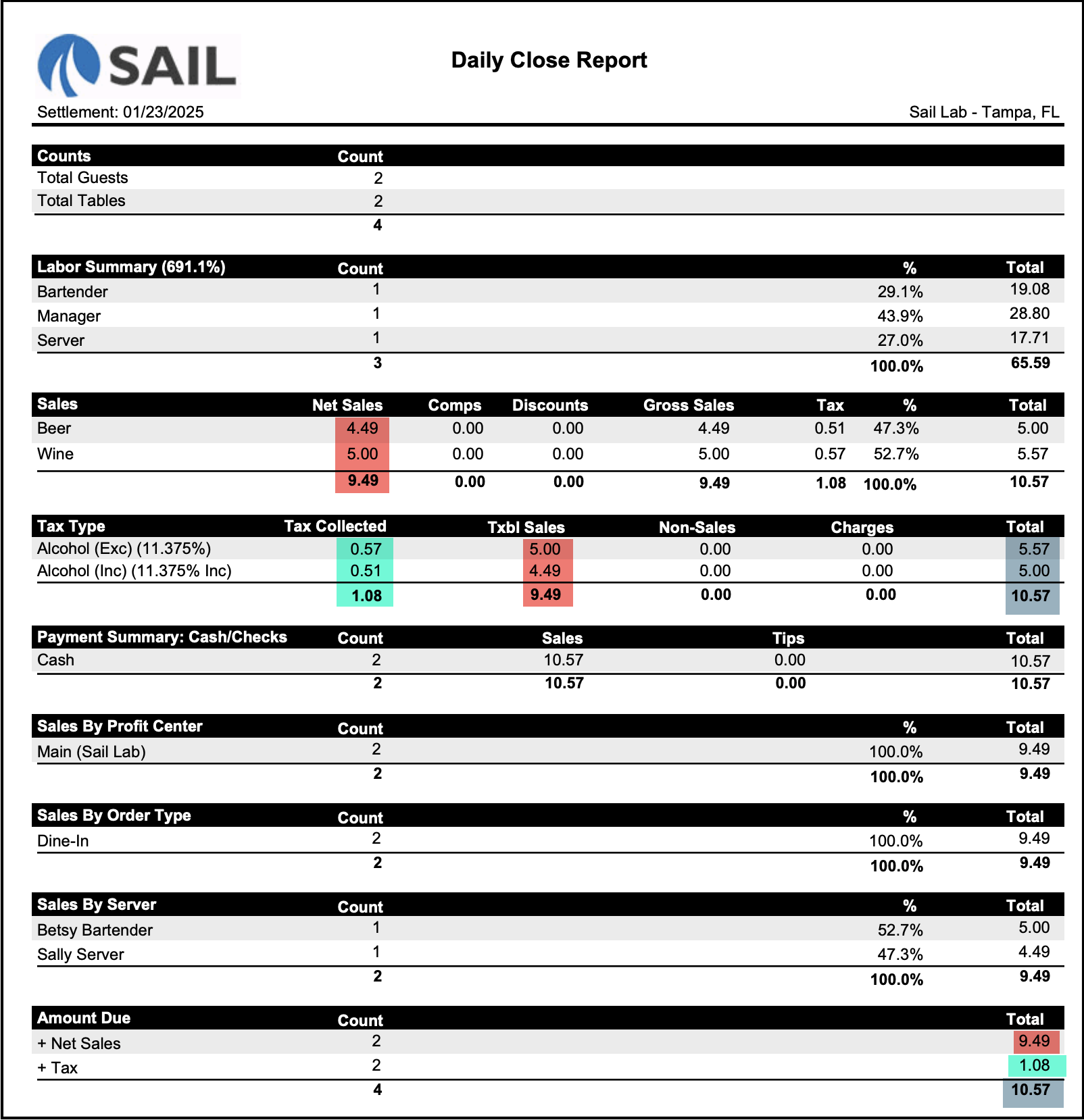

Exclusive and Inclusive tax on a Daily Sales Report

- This is a Daily Sales report

- The first column in the Sales section is the NET SALES

- So you will see the $5.00 for the wine and $4.49 for the Beer, because those are the numbers without taxes

- In the Tax Type Section you will see that the taxable sales column is the same as the Net sales

- In the Tax collected column you will see the tax amount for those items

- In the total column you will see the total sales with taxes included