Payment Details Report

The Payment Details Report provides a detailed record of all payments received during a selected date range. It breaks down payments by type (cash, check, credit card, gift card, delivery services, etc.) and shows individual transactions processed by employees. This report is essential for reconciling sales, balancing payment methods, and reviewing detailed payment activity.

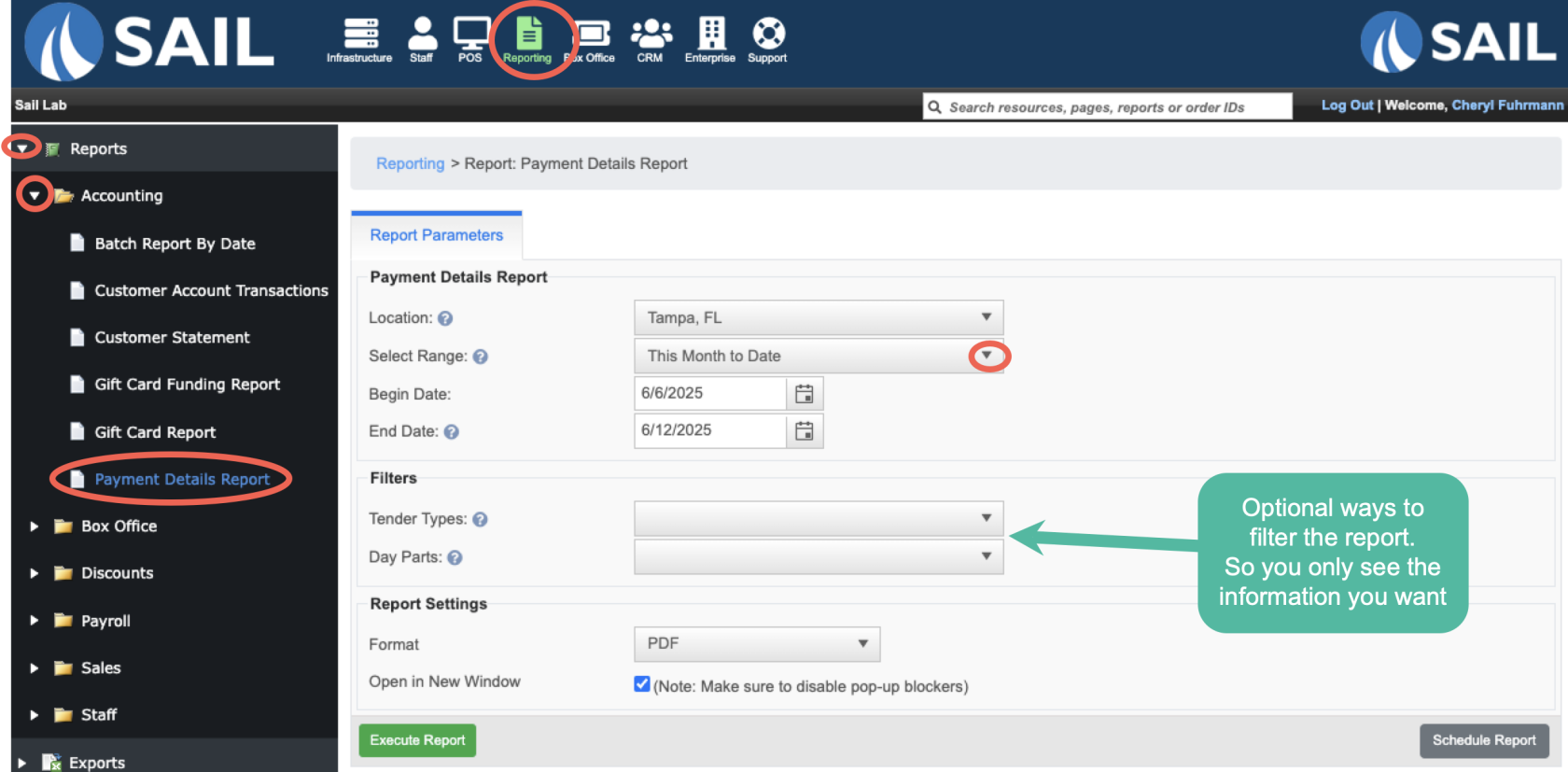

Where to find the report

- Backoffice --> Reporting --> Reports --> Accounting folder --> Payment Details Report --> Select a Date Range --> Execute

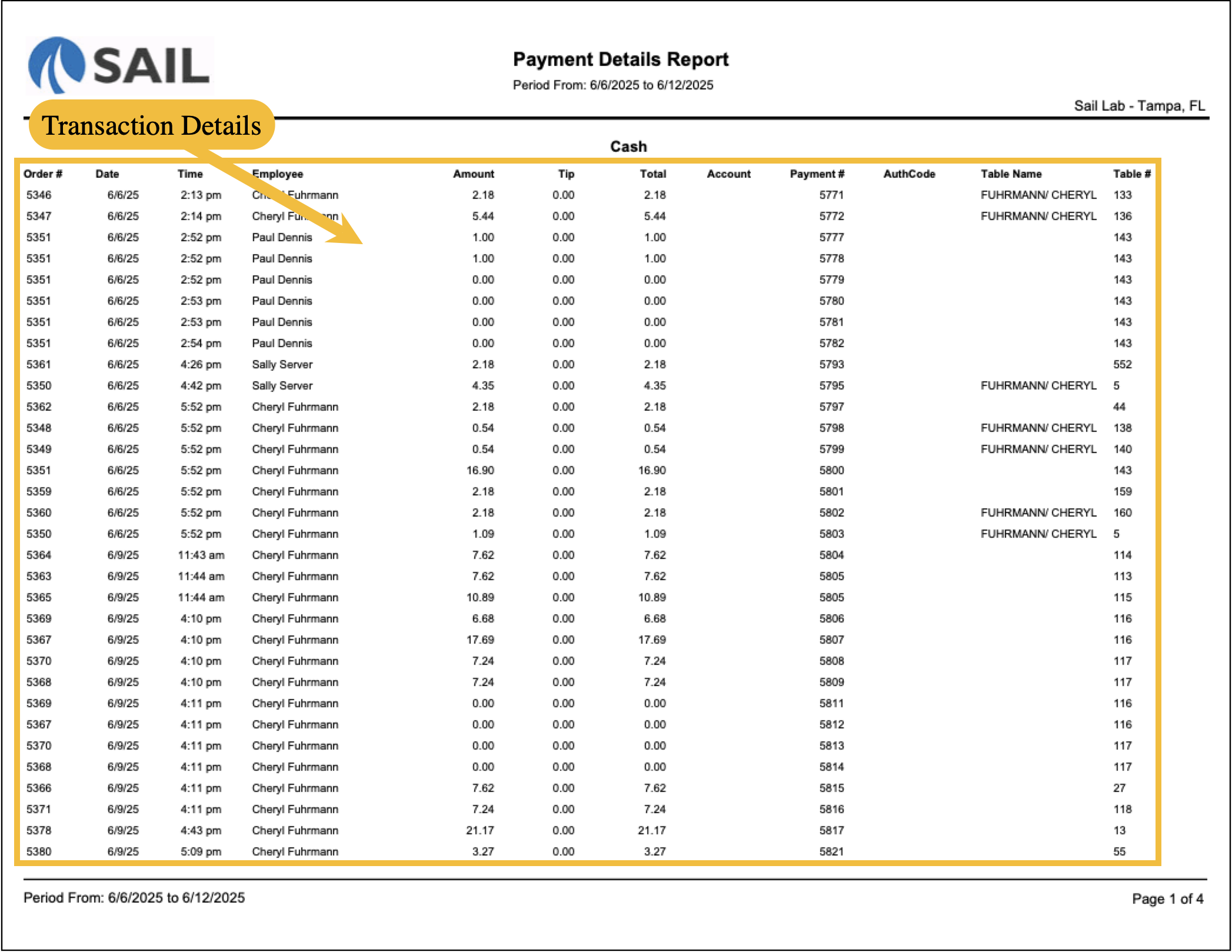

What it looks like

If you'd to see the full 4 page report click here: Accounting.PaymentDetailsReport.pdf

Report Parts

Report Sections

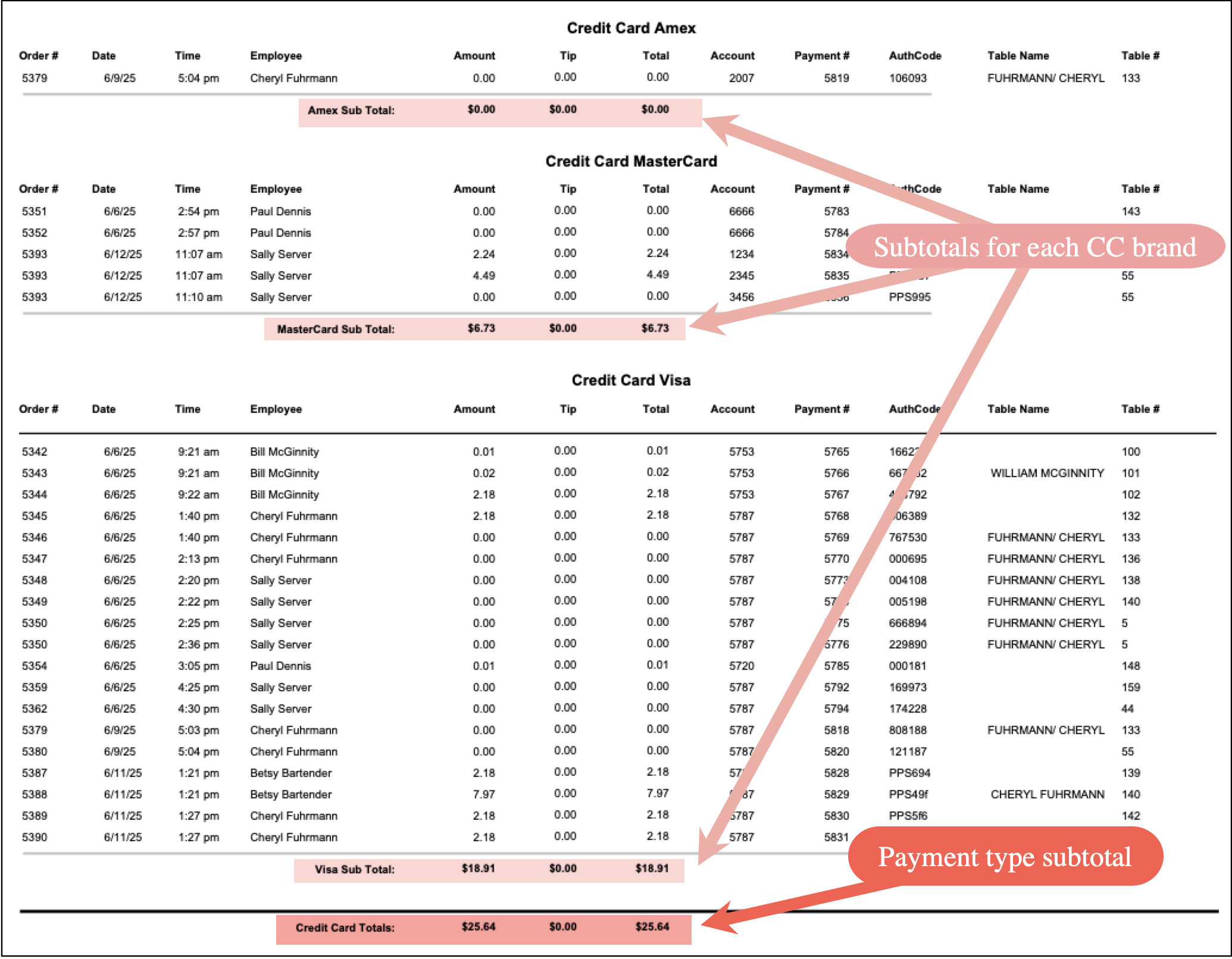

The report is organized by payment type, with each type grouped into its own section. Examples include:

-

Cash

-

Check

-

Credit Card (Amex, MasterCard, Visa, etc.)

-

Customer Payment (house account payments)

-

Door Dash

-

Gift Cards

Each payment method has its own subtotal.

For credit cards, the report goes one step further:

-

Each card brand (Amex, MasterCard, Visa, etc.) has its own sub total.

-

These brand subtotals are then added together into an overall Credit Card subtotal.

At the very end of the report, you’ll see the Grand Total, which combines all subtotals (Cash, Check, Credit Card, Gift Card, etc.) into one overall figure.

Transaction Details

Each row within a payment type represents one payment transaction.

-

Order # – The POS order tied to the payment.

-

Date / Time – When the payment was processed.

-

Employee – The staff member who processed the payment.

-

Amount – The payment amount entered.

-

Tip – Any gratuity applied to the payment.

- Total – The final payment including tips (if applicable).

- Account – The last 4 digits of the credit card or gift card. Or the check number when used.

-

Payment # – The unique payment identifier in the system.

-

Auth Code – For credit cards, the authorization code from the processor.

-

Table Name / # – The table name or number associated with the order.

How to Use This Report

This report helps you:

-

Reconcile daily deposits by comparing subtotals for each payment type with processor/bank statements.

-

Monitor cash, check, and card payments separately for easier balancing.

-

Track third-party delivery service payments (e.g., Door Dash).

-

Audit gift card usage, both standard and promotional.

-

Review employee-level activity to confirm which staff processed specific payments.