Payroll Details Report

The Payroll Report provides a detailed breakdown of employee hours, wages, tips, and sales for a specific pay period. It helps managers verify payroll accuracy, review employee performance, and prepare for payroll processing.

- This report will show you each clock in and clock out during the pay period

- It is organized alphabetically by Employees name

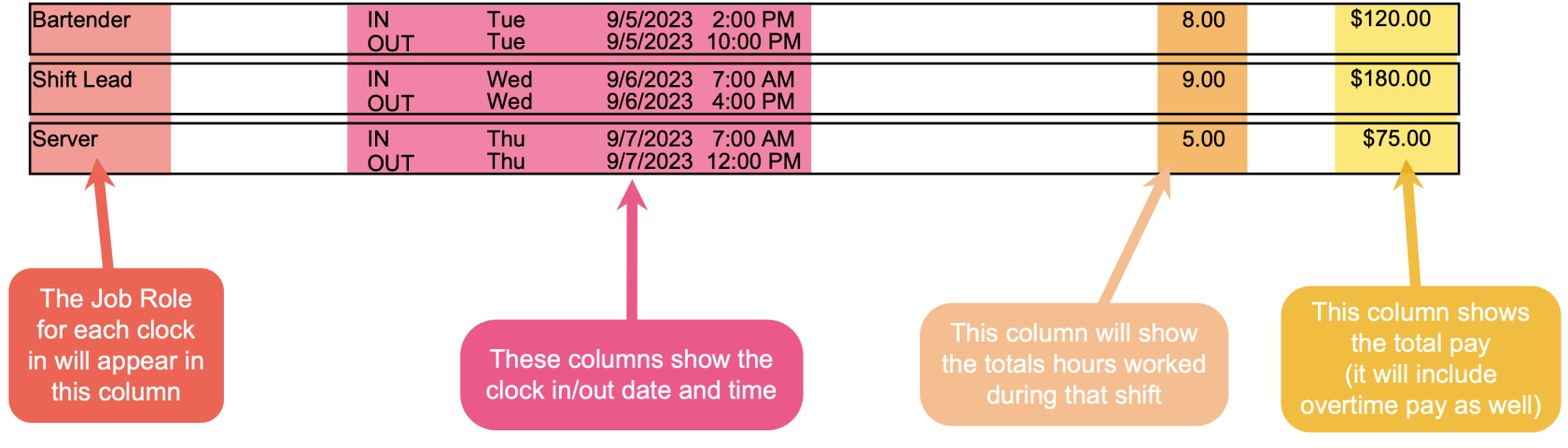

- Note: This report still takes overtime pay into account without breaking it out into additional columns.

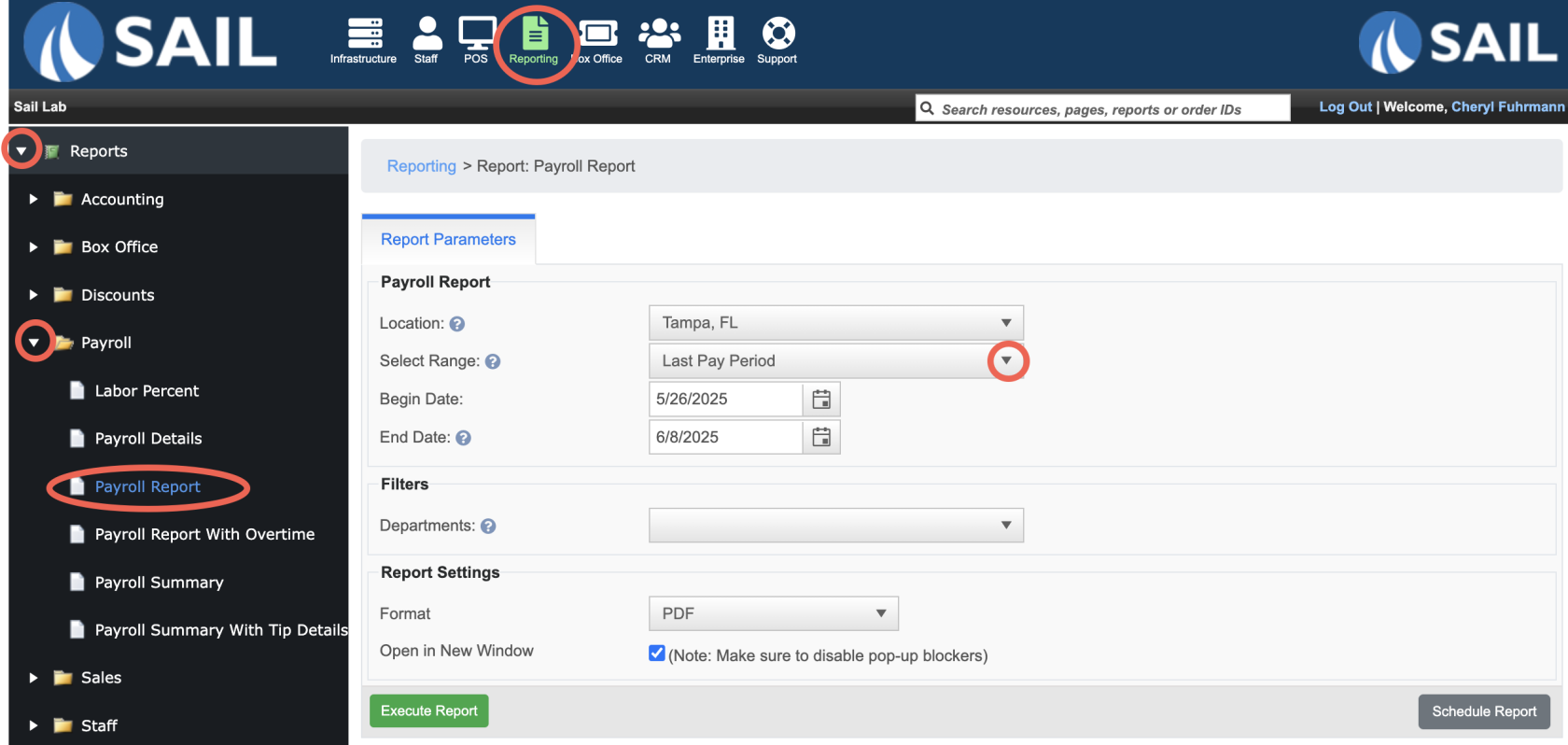

Where to find the report

- Backoffice --> Reporting --> Reports --> Payroll folder --> Payroll Report --> Select Date --> Execute

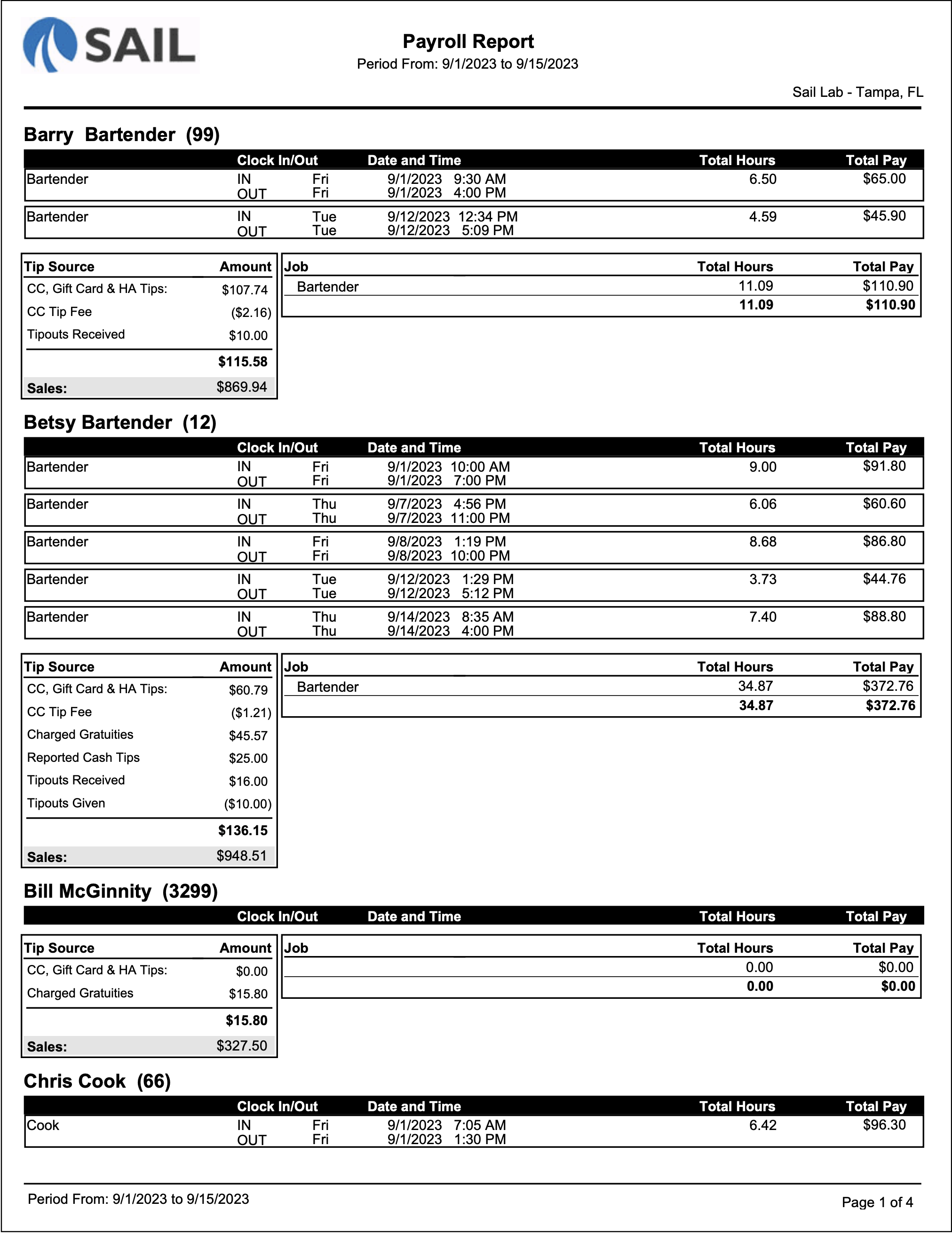

What it looks like

Report Parts

Employee Details

Each employee has their own section showing their hours, pay, and tips.

-

Clock In/Out (Date & Time) – The exact times the employee worked each shift.

-

Job – The role worked (e.g., Server, Bartender, Cook, Manager).

-

Total Hours – Hours worked during the shift.

-

Total Pay – Wages earned for the shift.

-

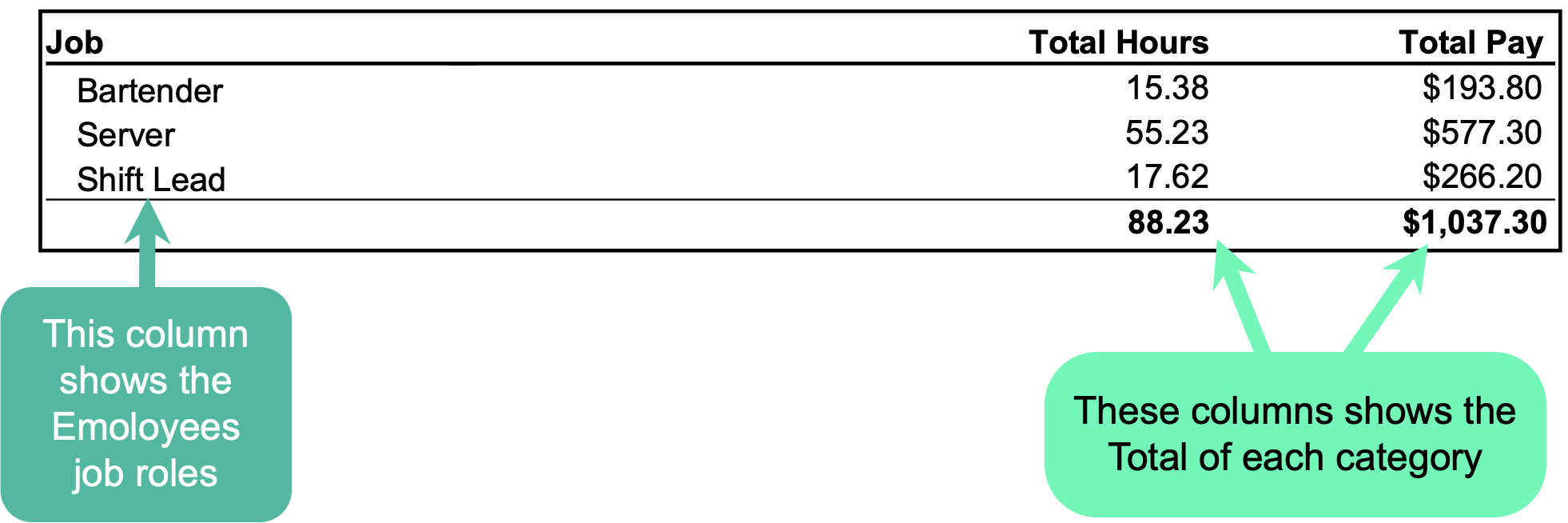

Job Totals – A subtotal of hours and pay by job type for that employee.

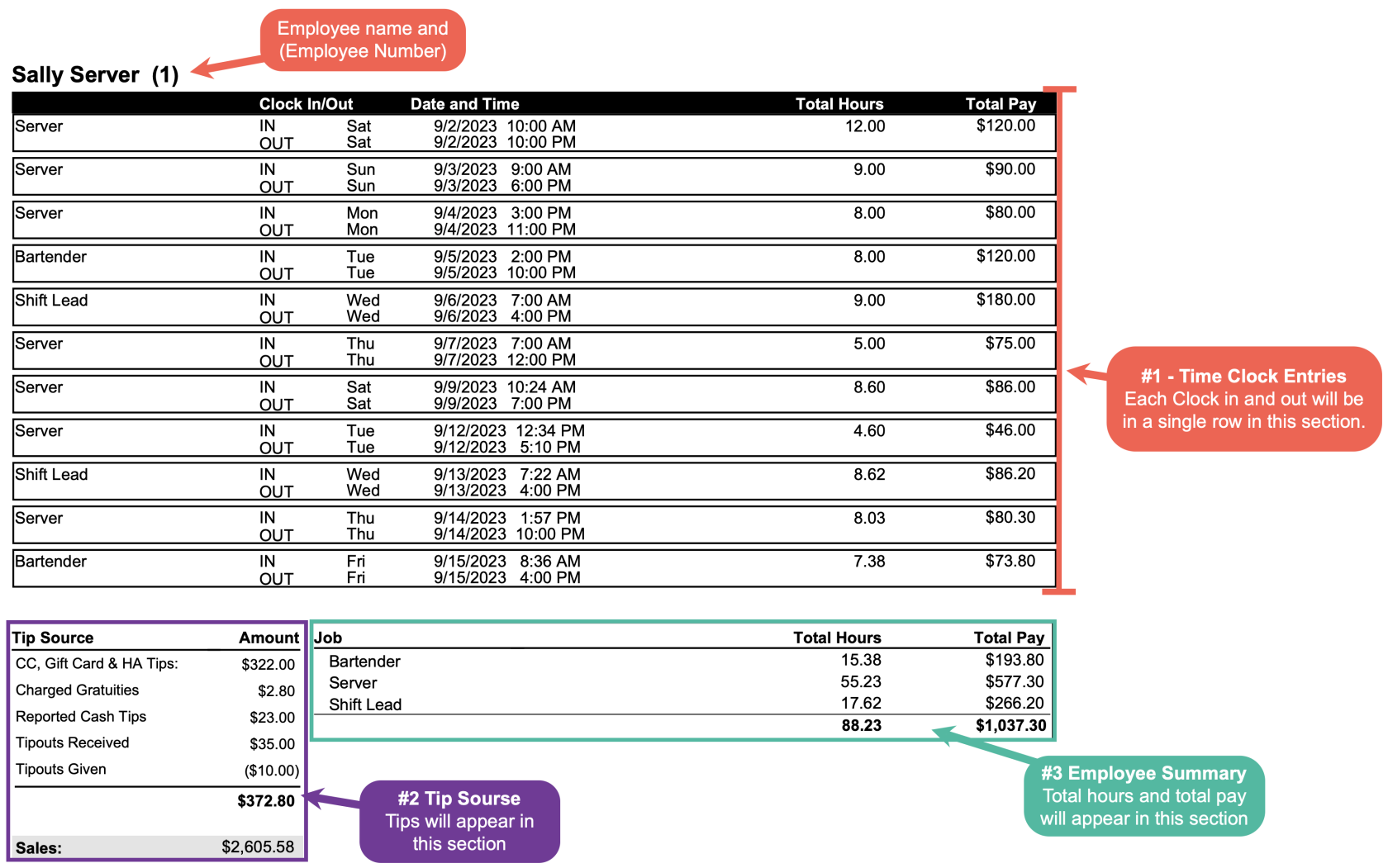

1. Time Clock Entries Section

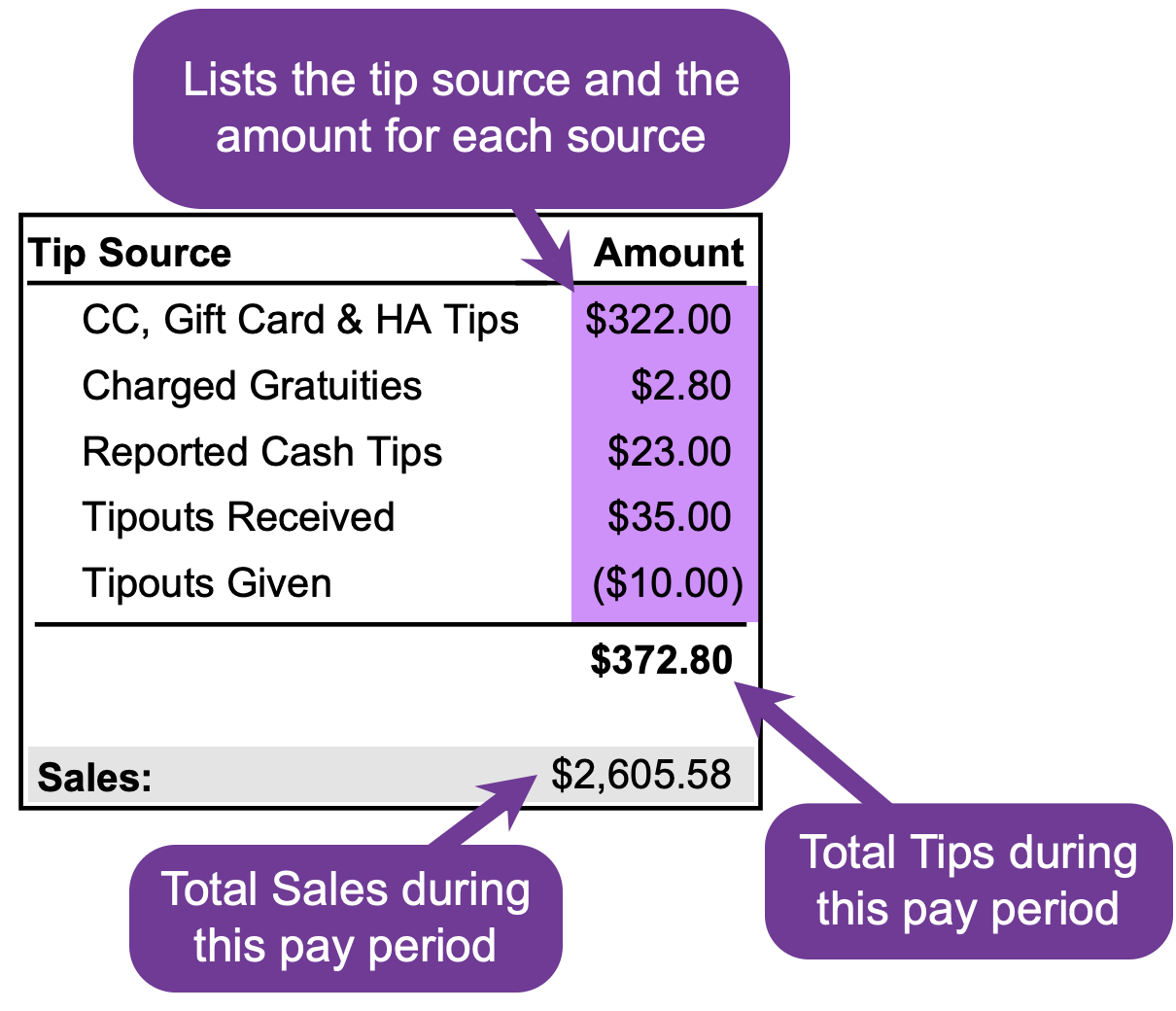

2. Tip & Sales Information

Below each employee’s hours and pay, the report lists their tips and sales.

-

Tip Source Amount – Breaks down tips into categories:

-

CC, Gift Card & HA Tips – Tips left on credit cards, gift cards, or house accounts.

-

CC Tip Fee – Credit card processing fee deducted from tips.

-

Charged Gratuities – Auto-gratuities (e.g., large parties).

-

Reported Cash Tips – Cash tips reported by the employee.

-

Tipouts Received – Tips received from another employee.

-

Tipouts Given – Tips shared with another employee (negative value).

-

-

Total Tips – Net tips after fees, tipouts, and adjustments.

-

Sales – The total sales attributed to the employee for the period.

3. Employee Summary Section

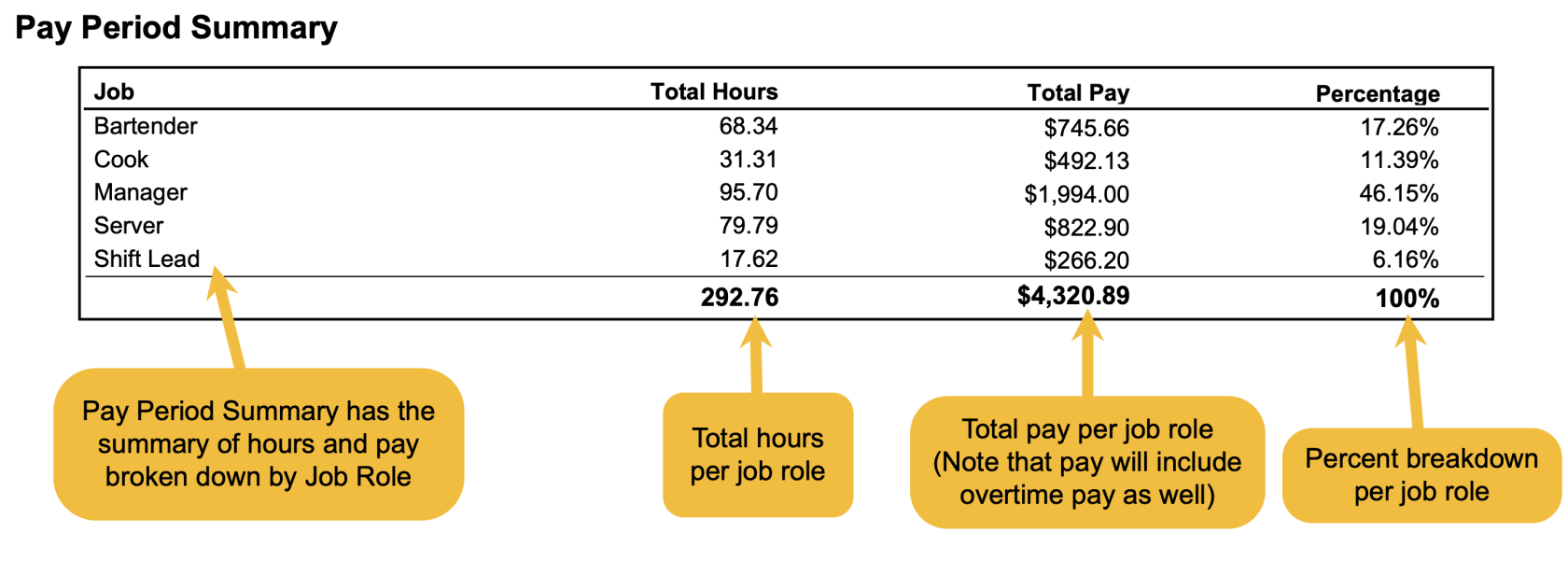

Pay Period Summary

At the end of the report, you’ll see overall totals for the entire pay period:

-

Job Totals – Combined hours and wages by job role across all employees.

-

Pay Period Summary – Grand totals of hours and pay for the entire location.

How to Use This Report

This report helps you:

-

Verify that employees’ hours and wages are calculated correctly.

-

Review tip distribution, including cash tips, credit tips, and tipouts.

-

Monitor payroll by job type to see labor distribution.

-

Confirm totals before submitting payroll to your provider.