Payroll Details Report

The Payroll Details Report provides the most detailed view of payroll. It lists every employee shift, including clock-in/out times, pay, sales, and a full breakdown of tips. This report combines the depth of the Payroll Report with the added clarity of tip details and payroll summaries, making it ideal for audits and payroll reconciliation.

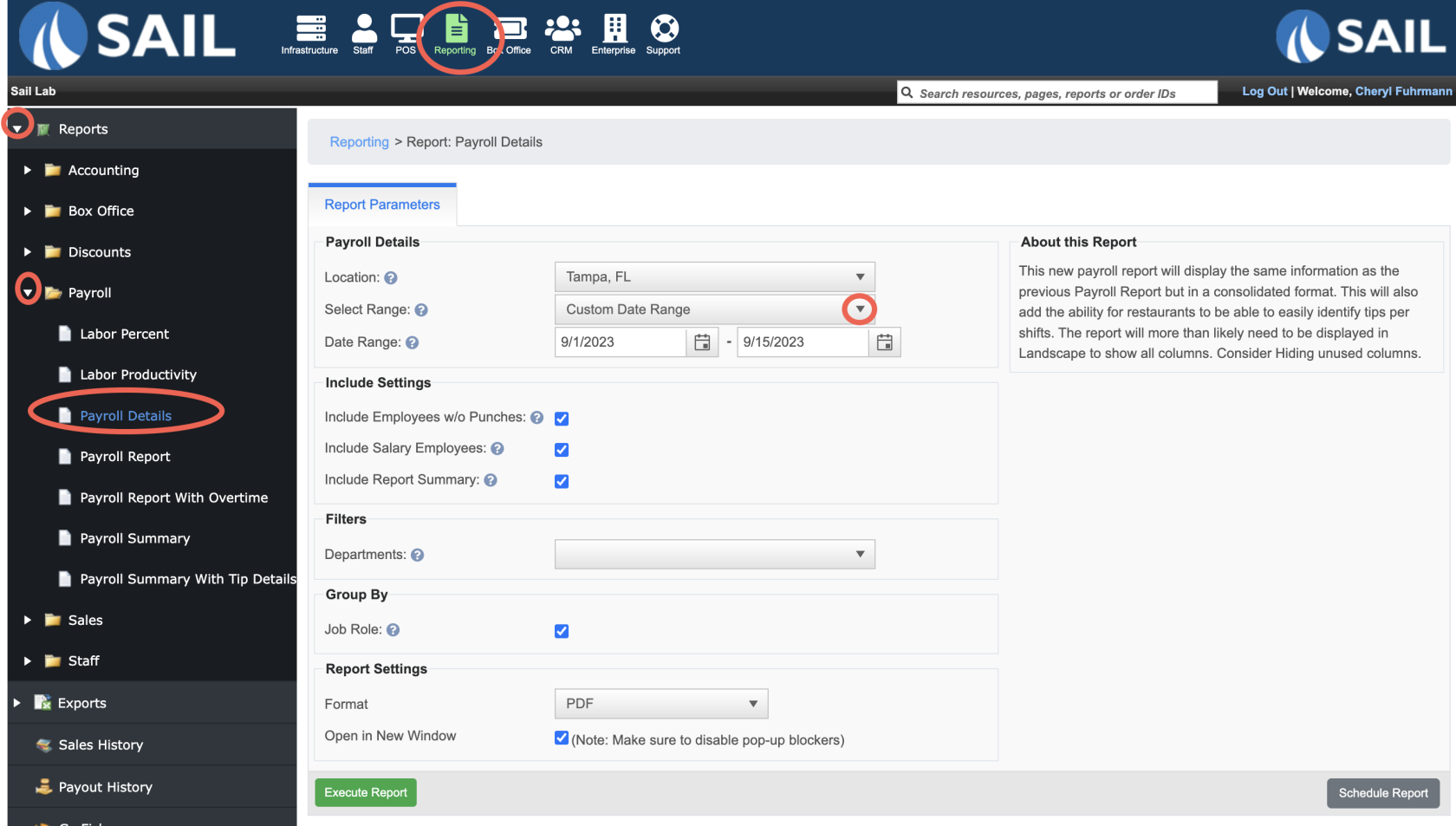

Where to find the report

- Backoffice --> Reporting --> Reports --> Payroll folder --> Payroll

ReportDetails --> Select Date --> Execute

What it looks like

Report Parts

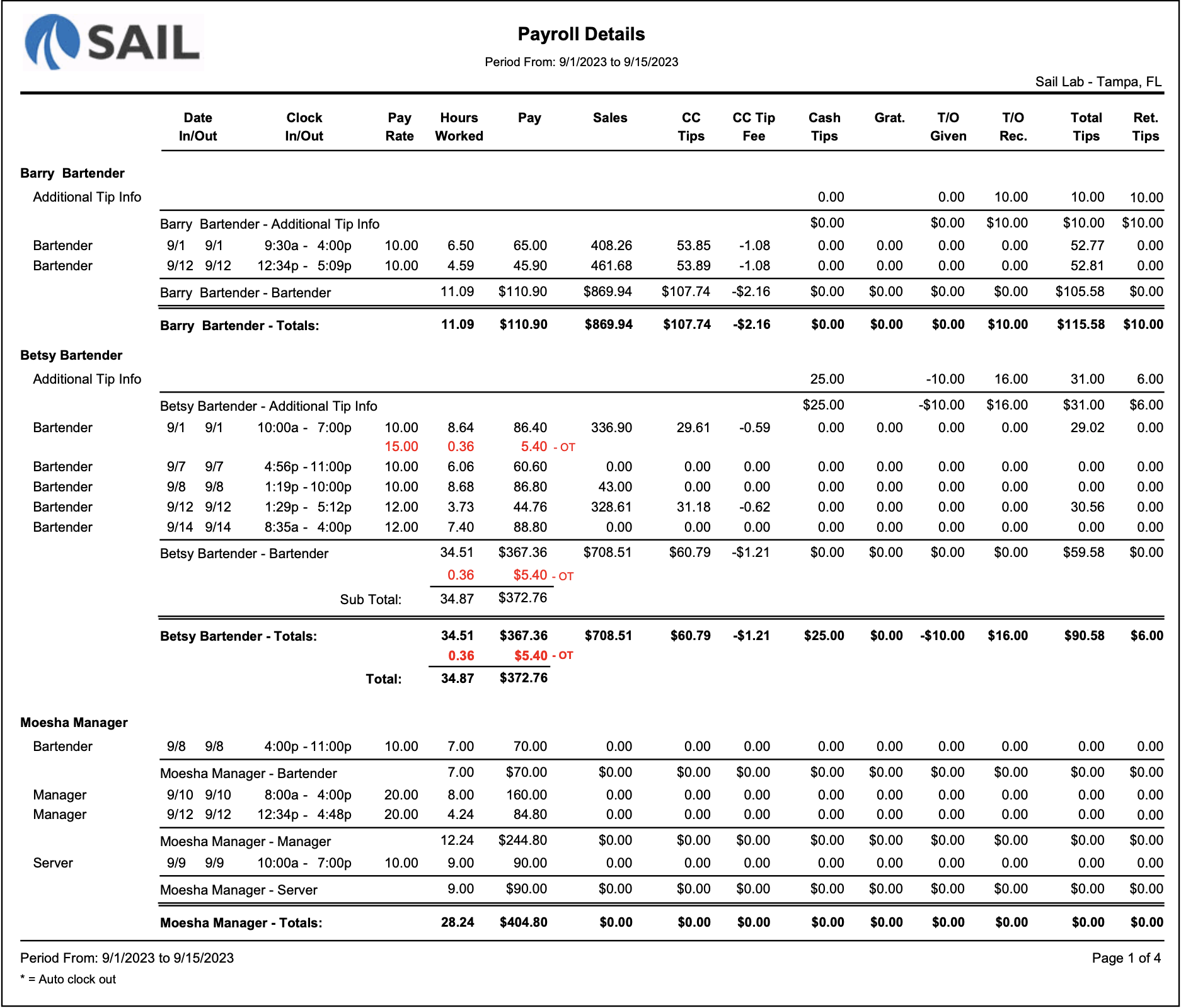

Employee Shift Details

Each employee has their own section showinglists theirshifts hours,worked pay,during andthe tips.period.

-

Clock In/Out

(Date &Time)Time –The exactExact timesthe employee workedfor eachshift.shift worked. -

Job Role – The role worked that shift (e.g., Bartender, Server,

Bartender, Cook, Manager)Cook). -

TotalPayHoursRate – The employee’s hourly wage for that role. -

Hours

workedWorkedduring– Total hours for the shift. -

TotalPay – Wages earned for the shift. -

Job TotalsSales –ASalessubtotalattributedoftohoursthatandemployeepayduringbythejobshift.type -

Tips – Tip breakdown for the shift:

-

CC Tips – Tips left on credit card, gift card, or house account.

-

CC Tip Fee – Processing fees deducted from credit card tips (negative value).

-

Cash Tips – Cash tips reported.

-

Gratuities – Auto-added gratuities (e.g., large party charges).

-

Tipouts Given – Tips paid out to another employee (negative).

-

Tipouts Received – Tips received from another employee.

-

Total Tips – Combined tips for that

employee.shift. -

Retained Tips – Net tips the employee kept after fees and tipouts.

-

Additional Tip Info

Some employees will have an Additional Tip Info line showing manual adjustments or carryover tips.

-

Purpose – Used to capture tips not tied to a single shift (e.g., adjustments, corrections, or pooled distributions).

-

Displayed – As separate line items in the employee’s section.

Employee 2. Tip & Sales InformationTotals

BelowAt the end of each employee’s hours and pay,section, the report listsshows:

-

andRegular Hours / OT Hours / Total Hours – Total hours worked in the period.

-

Regular Pay / OT Pay / Total Pay – Total wages earned.

-

Sales – Employee’s total sales.

-

Tips – Combined tips across all shifts.

3. Employee Summary Section

Pay Period Summary

At the end of the report, you’llpayroll seeand overalltips totalsare summarized by job role and then totaled for the entire pay period:period.

-

Job Role Totals –

Combined hours and wages by job roleSummed across allemployees.employees in each role:-

Regular Hours, OT Hours, Total Hours

-

Regular Pay, OT Pay, Total Pay

Period -

– Grand totals of hoursSales and

payTipsfor(bythetype:entireCC,location.cash, gratuities, tipouts, retained)

Summary -

-

Grand Totals – Overall totals for all employees and all roles.

How to Use This Report

This report helps you:

-

VerifyAuditthatemployeeemployees’timecardshourswith clock-in/out detail. -

Reconcile tips, including credit card fees, cash tips, and

wages are calculated correctly.tipouts. -

Review

tipsalesdistribution,byincludingemployeecashalongsidetips,payrollcredit tips, and tipouts.

costs. -

MonitorTrackpayrollovertimebyusagejobandtypeitstoimpactseeonlabor distribution.pay. -

Confirm payroll totals before

submitting payrollsubmission to your provider. -

Investigate discrepancies by drilling down into shift-level detail.