Payroll Summary w/Tip Details

The Payroll Summary w/Report with Tip Details provides a high-level payroll summary by employee, including hours, pay, sales, and a detailed breakdown of tips. It combines payroll, sales, and tip distribution into one report, giving managers a complete picture of labor costs and tip handling for the pay period.

- This report is the same as the Payroll Summary, with only showing summarized hours, But this report has all the Tip source breakdowns

Here

an

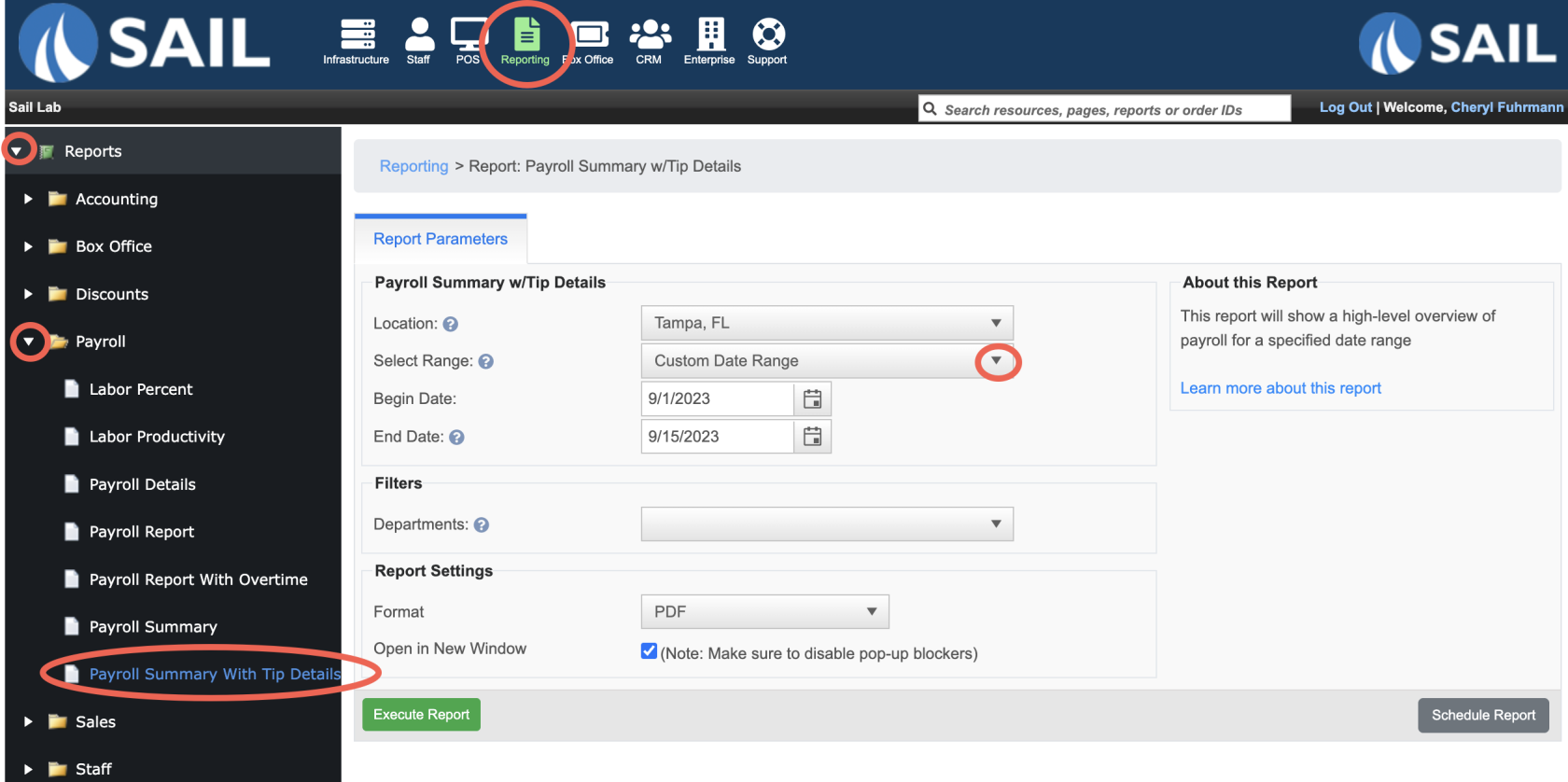

Where ofto find the report:report

- Backoffice --> Reporting --> Reports --> Payroll folder --> Payroll Summary with Tip Details --> Select Date --> Execute

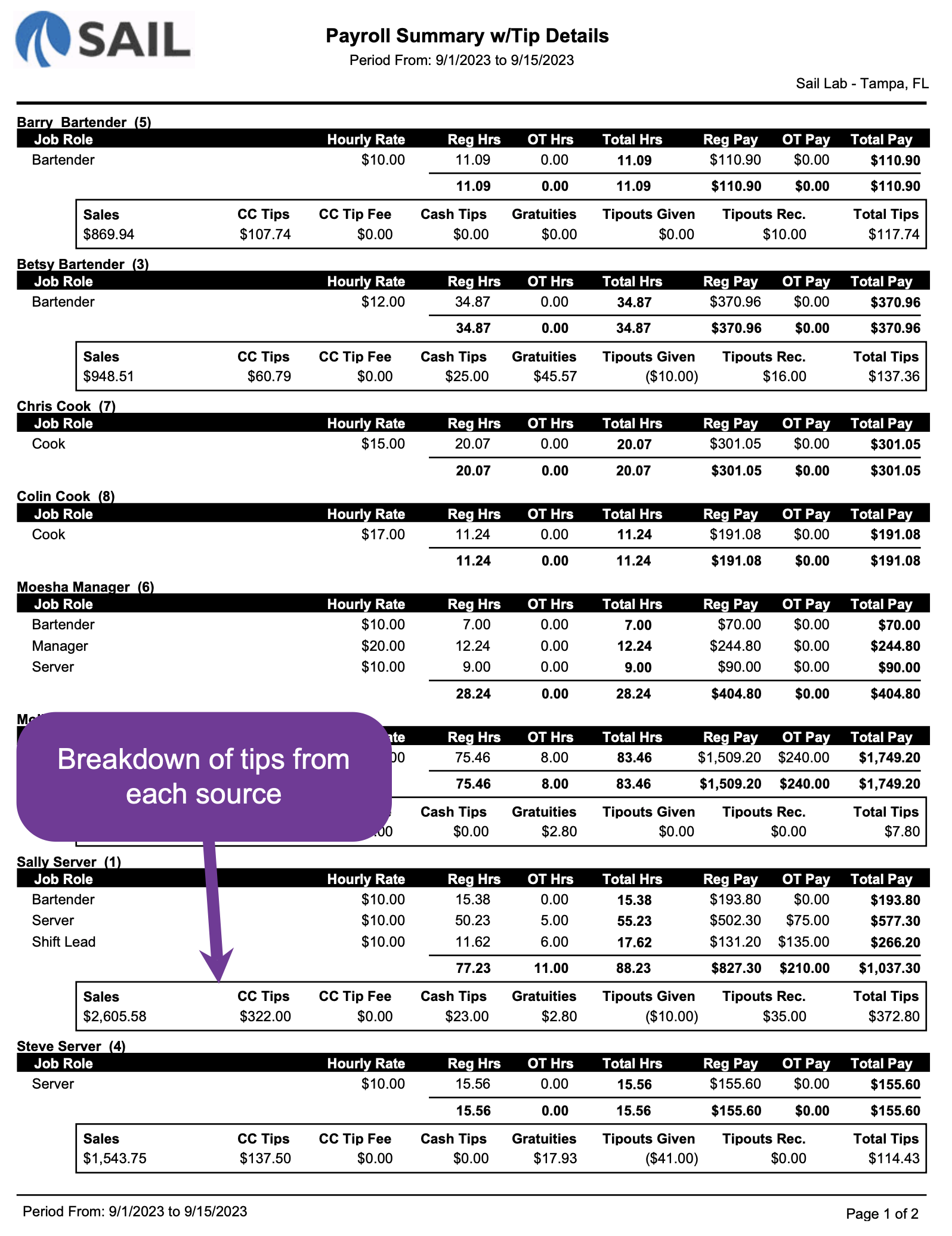

What it looks like

-

CCNametips:/isEmp ID – The employee’s name and ID. -

Job Role – The role worked (e.g., Bartender, Cook, Server, Manager).

-

Hourly Rate – The pay rate for that role.

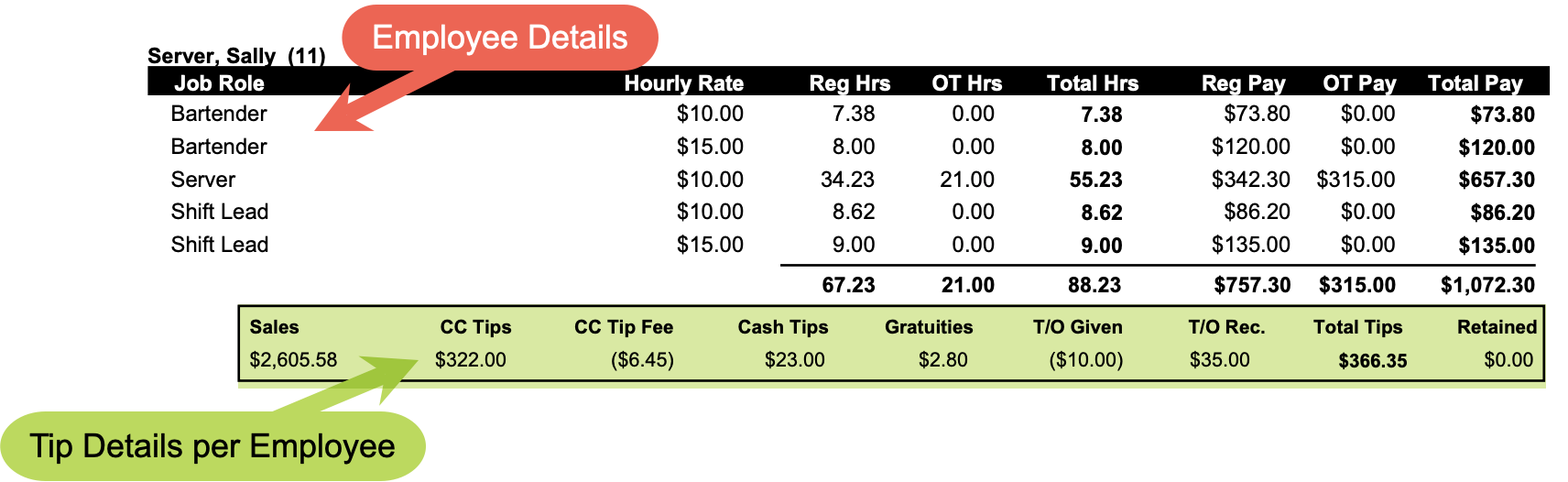

- Note: If the pay rate changed during that pay period, the same

asjob"role will be separated by pay rate.

- Note: If the pay rate changed during that pay period, the same

-

Regular Hours (Reg Hrs) – The number of non-overtime hours worked.

-

OT Hours – The number of overtime hours worked.

-

Total Hours – Combined hours worked.

-

Formula: Reg Hrs + OT Hrs = Total Hours

-

-

Regular Pay (Reg Pay) – Wages earned for regular hours.

-

Overtime Pay (OT Pay) – Wages earned for overtime hours.

-

Total Pay – Combined wages earned.

-

Formula: Reg Pay + OT Pay = Total Pay

-

- Sales – The employee’s total sales for the pay period.

-

CC Tips – Tips left on credit cards, gift cards, or house accounts.

-

CC Tip Fee – Credit card processing fee deducted from tips (negative amount).

-

Charged Gratuities – Auto-added gratuities (e.g., large parties).

-

Reported Cash Tips – Cash tips reported by the employee.

-

Tipouts Given – Tips paid out to another employee (negative amount).

-

Tipouts Received – Tips received from another employee.

-

Total Tips – The combined total of all tips for that employee.

-

Formula: Total Tips = CC, Gift Card & HA

Tips"Tipson+theChargedfullGratuitiesreport.+ Reported Cash Tipsyou+getTipoutsfromReceivedcredit–cards,TipoutsGiftGivenCards,–andCCHouseTipAccountsFees CC Tip Fee:

-

CashRetainedTips:Tips – The net amount of tips retained to be paid on their paycheck.- Formula: Total Tips - Cash

tips that the server manually reports at the end of a shift.Tips Gratuities:

Any automatic gratuity that your location adds. ex… “A party with 8 or more guests will be charged an automatic 15% gratuity.”- Formula: Total Tips - Cash

Tipouts Given: A submitted tip out from you to another employee. (Submit tipout: Allows the ability for a user to submit a tipout to another user for payroll purposes only)Tipouts Received: A submitted tip out from another employee to you. (Submit tipout: Allows the ability for a user to submit a tipout to another user for payroll purposes only)

Report Parts

Employee Details

Each employee has a summary line showing their hours, pay, tips, and sales.

Tip Details per Employee

For each employee, tip activity is broken down into categories:

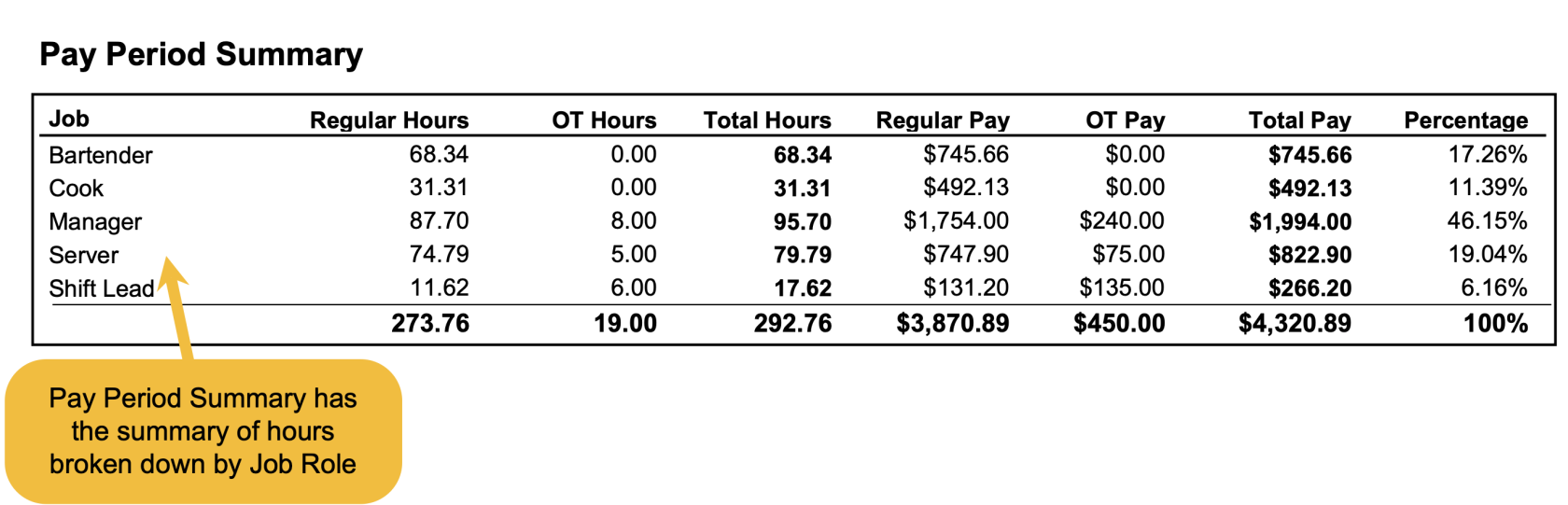

Pay Period Summary

At the

bottomend of thereportreport,willpayrollbeandthetip data are summarized:-

Job Role Totals – Hours and pay grouped by role (e.g., Bartender, Server, Manager).

-

Shows Reg Hours, OT Hours, Total Hours, Reg Pay, OT Pay, and Total Pay.

-

Percentage – The share of total payroll dollars for each role.

-

Formula: Role Total Pay

Period÷SummaryOverall Payroll Total × 100

-

-

ItisGrand

aTotalssummary–ofOverall totals for all hoursbrokenanddownpaybyacrossJobtheRolelocation.

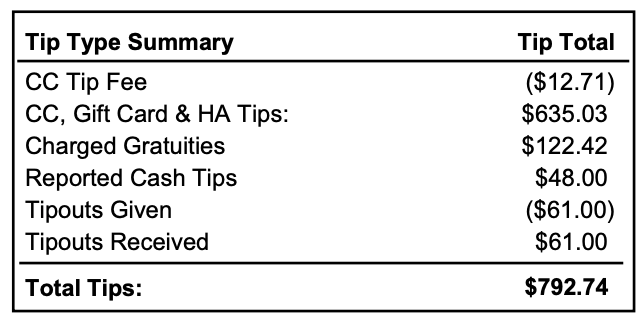

Tip Type Summary

A breakdown of tips across the location:

-

Totoal CC Tip Fee

- Total CC, Gift Card & HA Tips

-

Total Charged Gratuities

-

Total Reported Cash Tips

-

Total Tipouts Given

-

Total Tipouts Received

-

Total Tips (for the location)

How to Use This Report

This report helps you:

-

Verify employee pay, hours, and overtime.

-

Review tip handling in detail (credit, cash, gratuities, tipouts).

-

Confirm credit card tip fees and ensure proper deductions.

-

Monitor payroll distribution by job role.

-

Use the Tip Type Summary to reconcile tips at the store level.

-