Payroll Summary

The Payroll Summary Report provides a consolidated overview of employee payroll for a specific pay period. It summarizes regular and overtime hours, pay, tips, and sales for each employee, along with a breakdown by job role. This report is especially useful for high-level payroll review and payroll submission.

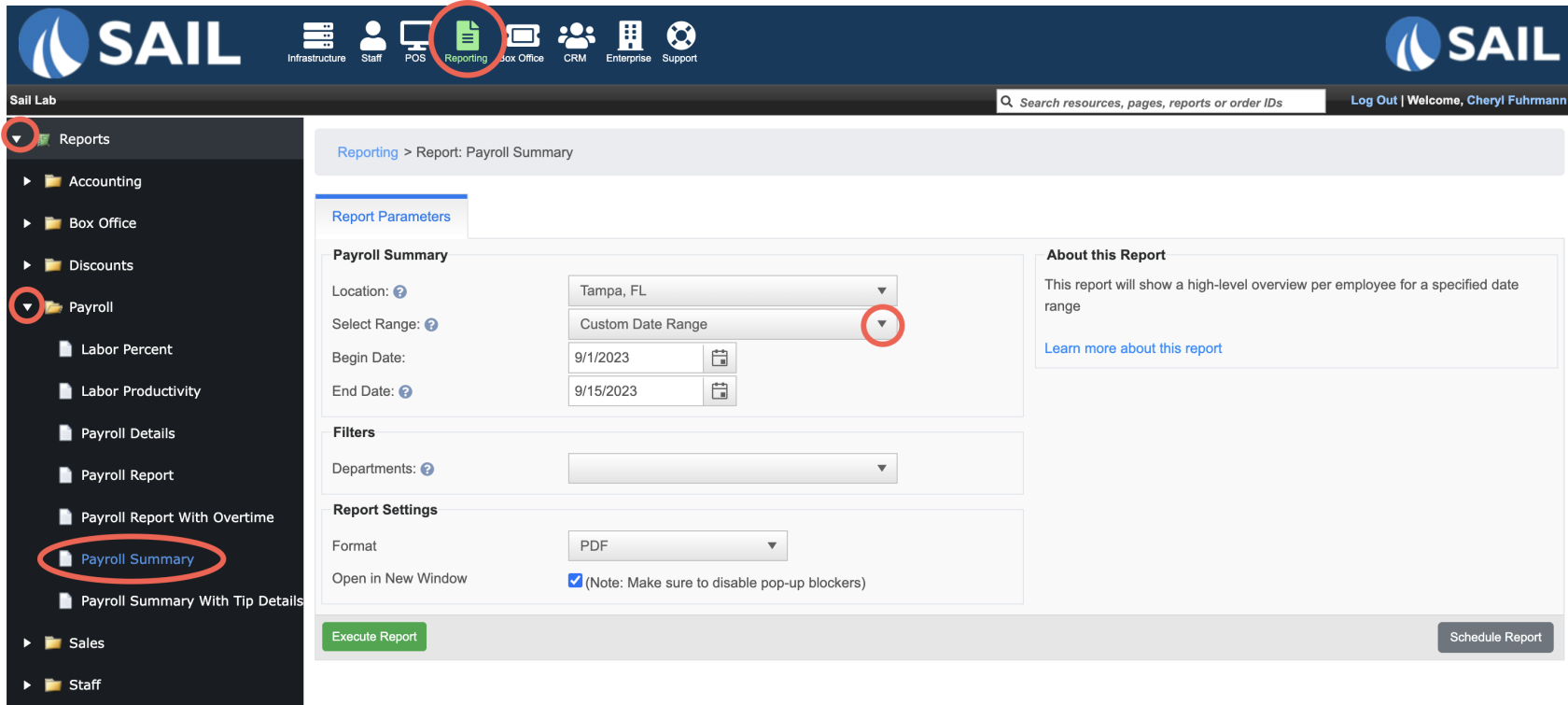

Where to find the report

- Backoffice --> Reporting --> Reports --> Payroll folder --> Payroll Summary --> Select Date --> Execute

Report Options

Filters

-

Departments – Allows you to run the report for specific departments instead of all employees.

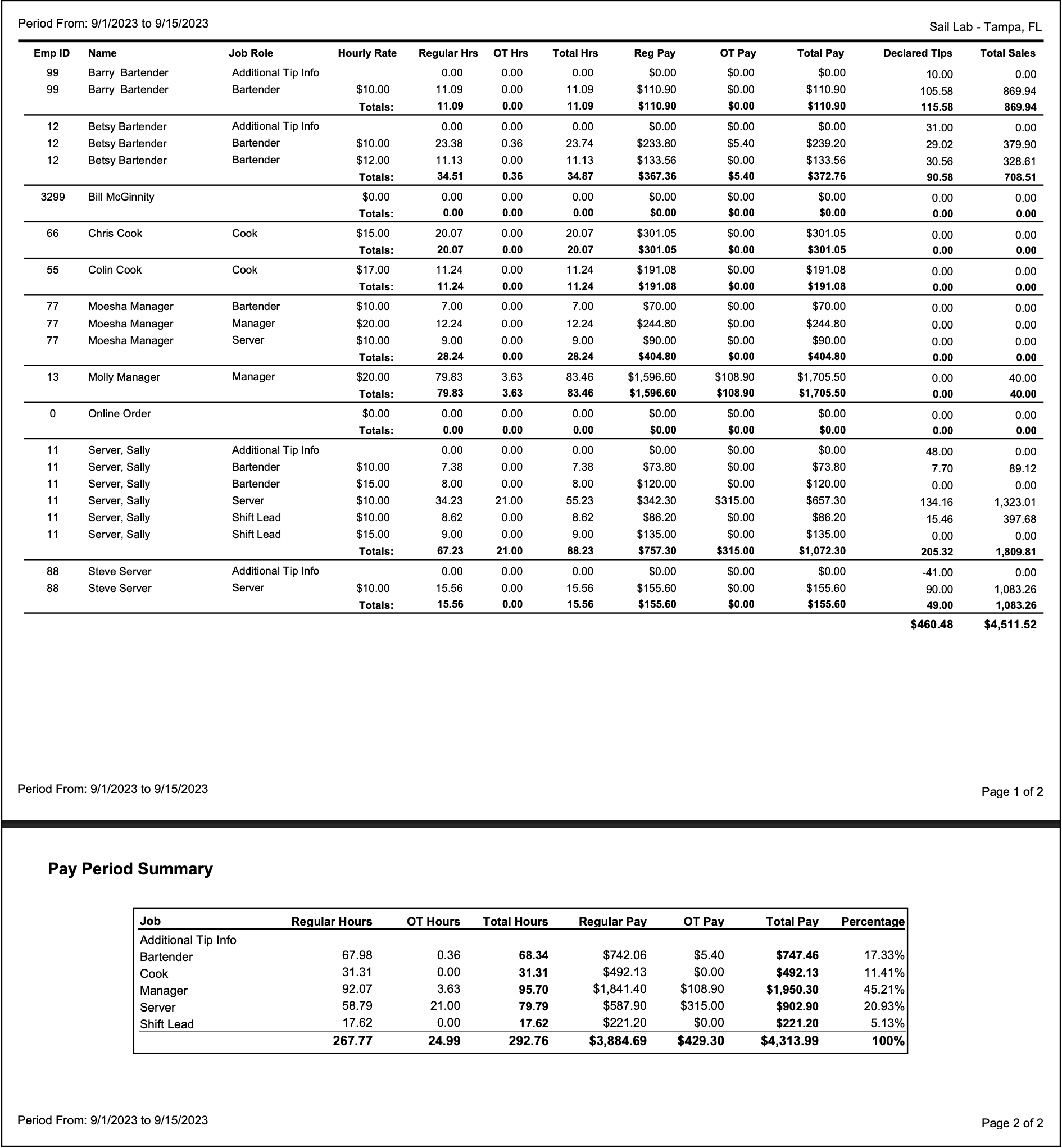

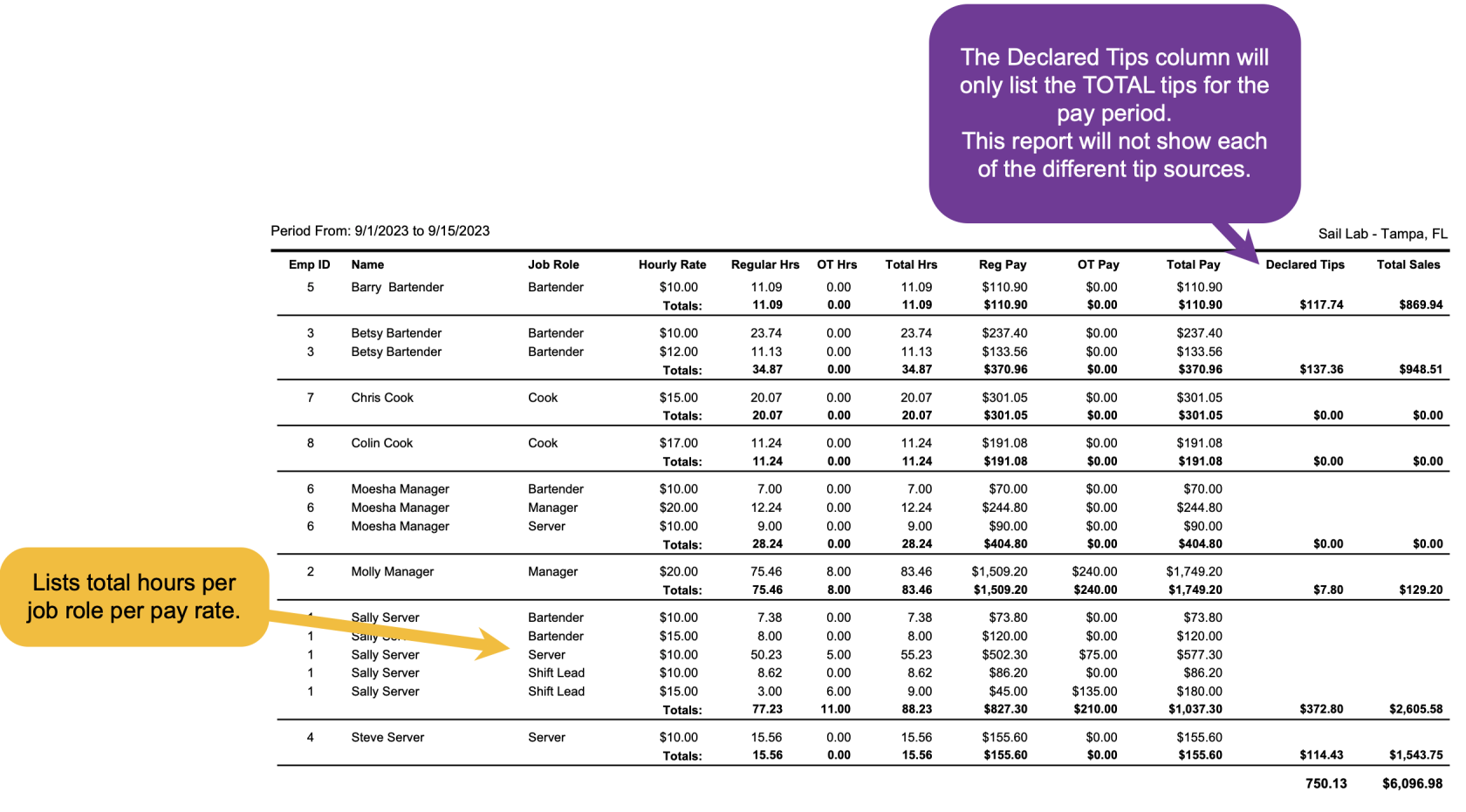

What it looks like

Report Parts

Employee Details

Each employee has their own summary line showing hours, pay, tips, and sales.

Here’s what each column means

-

Name / Emp ID – The employee’s name and unique ID.

-

Job Role – The role worked during the period (e.g., Bartender, Cook, Server, Manager).

-

Hourly Rate – The pay rate for that role.

-

Regular Hours (Reg Hrs) – The number of non-overtime hours worked.

-

OT Hours – The number of overtime hours worked.

-

Total Hours – Combined hours worked.

-

Formula: Regular Hours + OT Hours = Total Hours

-

-

Regular Pay (Reg Pay) – Wages earned for regular hours.

-

Overtime Pay (OT Pay) – Wages earned for overtime hours.

-

Total Pay – Combined wages earned.

-

Formula: Reg Pay + OT Pay = Total Pay

-

-

Declared Tips – Total amount of tips during that pay period. (Includes, cash, CC, fees and tipouts)

-

Total Sales – Total sales attributed to the employee during the period.

At the end of each employee’s section, the report shows Totals for their combined hours, pay, tips, and sales.

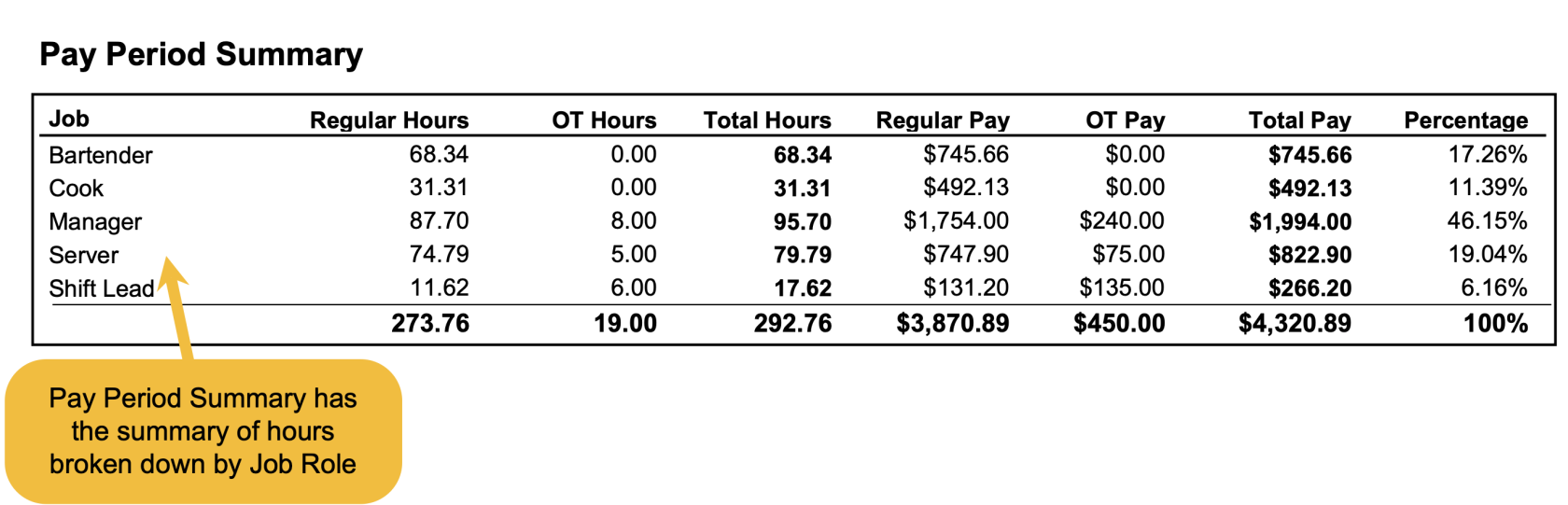

Pay Period Summary

At the end of the report, payroll information is grouped by job role and also shows grand totals for the entire pay period.

-

Job – Each role (Bartender, Cook, Manager, Server, Shift Lead, etc.).

-

Regular Hours / OT Hours / Total Hours – Summed across all employees in that role.

-

Regular Pay / OT Pay / Total Pay – Summed across all employees in that role.

-

Percentage – The share of overall payroll dollars that role represents.

-

Formula: Role Total Pay ÷ Overall Payroll Total × 100

-

Example: If Servers earned $902.90 out of $4,313.99 total, then $902.90 ÷ $4,313.99 = 20.93%.

-

-

Grand Totals (Bottom Row) – Overall totals for all hours and pay across all roles in the pay period.

How to Use This Report

This report helps you:

-

Confirm payroll totals for each employee before submission.

-

Monitor overtime costs by employee and by role.

-

Review tip and sales attribution by employee.

-

Track payroll distribution across job roles to spot labor imbalances.

-

Validate compliance with pay rates and overtime rules.