Sales Accountability Report

ThisThe is the Sales Accountability Report is used to reconcile server/bartender/employee sales and payments against their “accountable” totals. It ensures all sales, comps, outs/ins, and payments are properly accounted for and shows what each employee is responsible for at the end of the day or across multiple days.

This report is often used by managers or owners to:

-

Confirm that sales, payments, and adjustments balance correctly.

-

Track cash accountability for each employee.

-

Compare employee totals against daily or multi-day store totals.

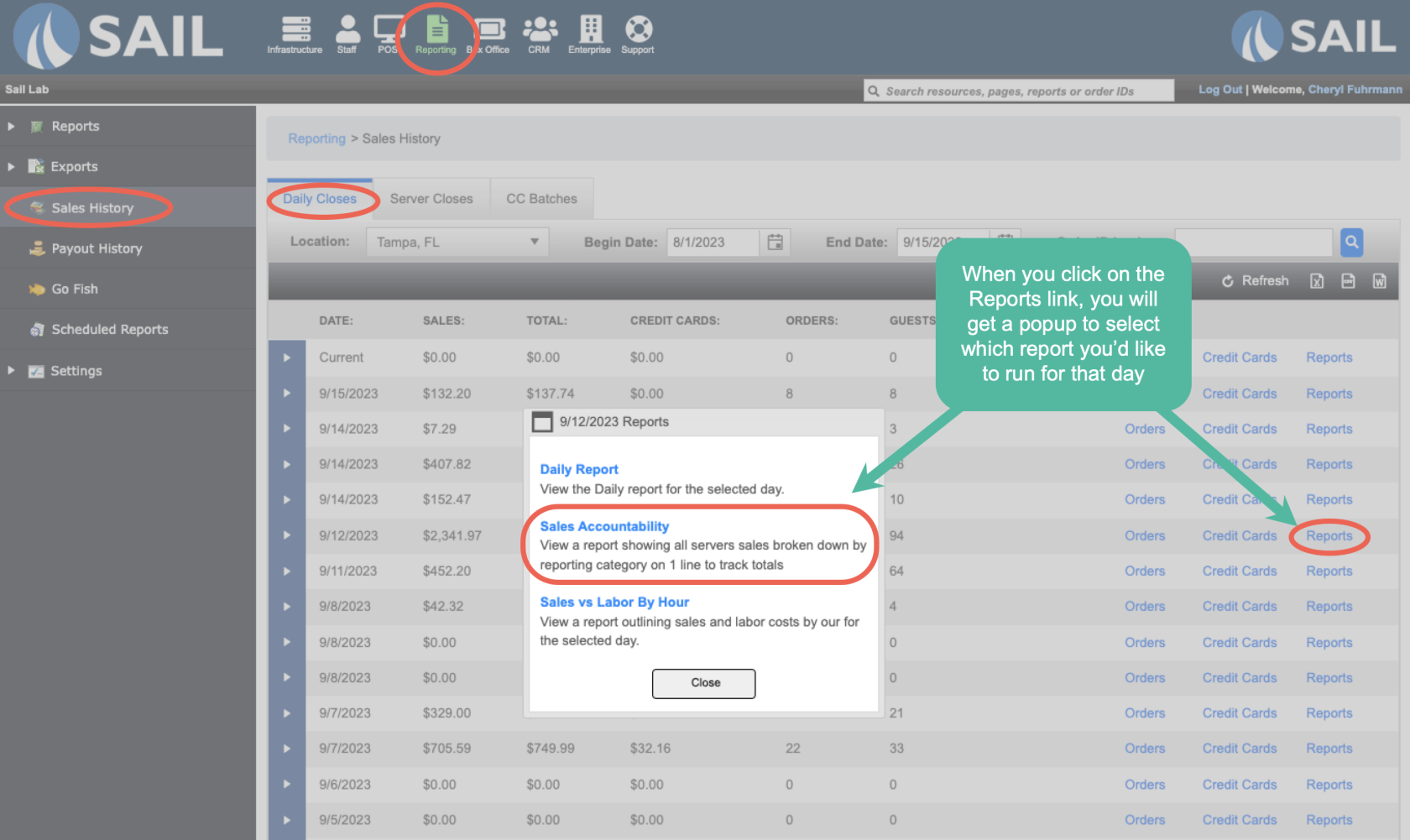

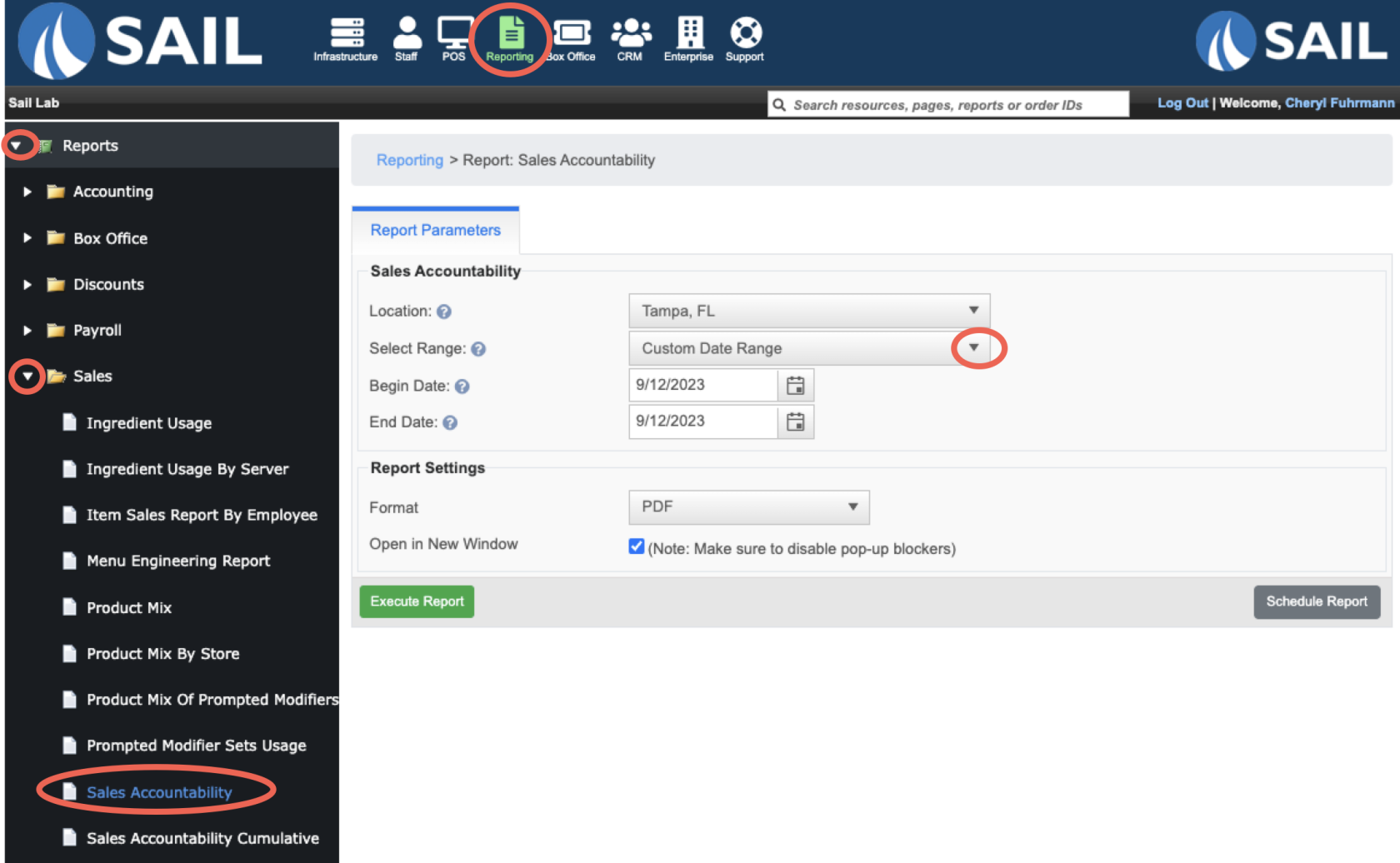

Where to find the report

- There are two ways to find this report:

- Option #1: Backoffice --> Reporting --> Reports --> Sales folder --> Sales Accountability --> Select Date Range --> Execute

- Options #2: Backoffice --> Reporting --> Sales History --> Daily Closes Tab --> Find the date you're looking for --> Click on the blue Reports Link --> Select Sales Accountability

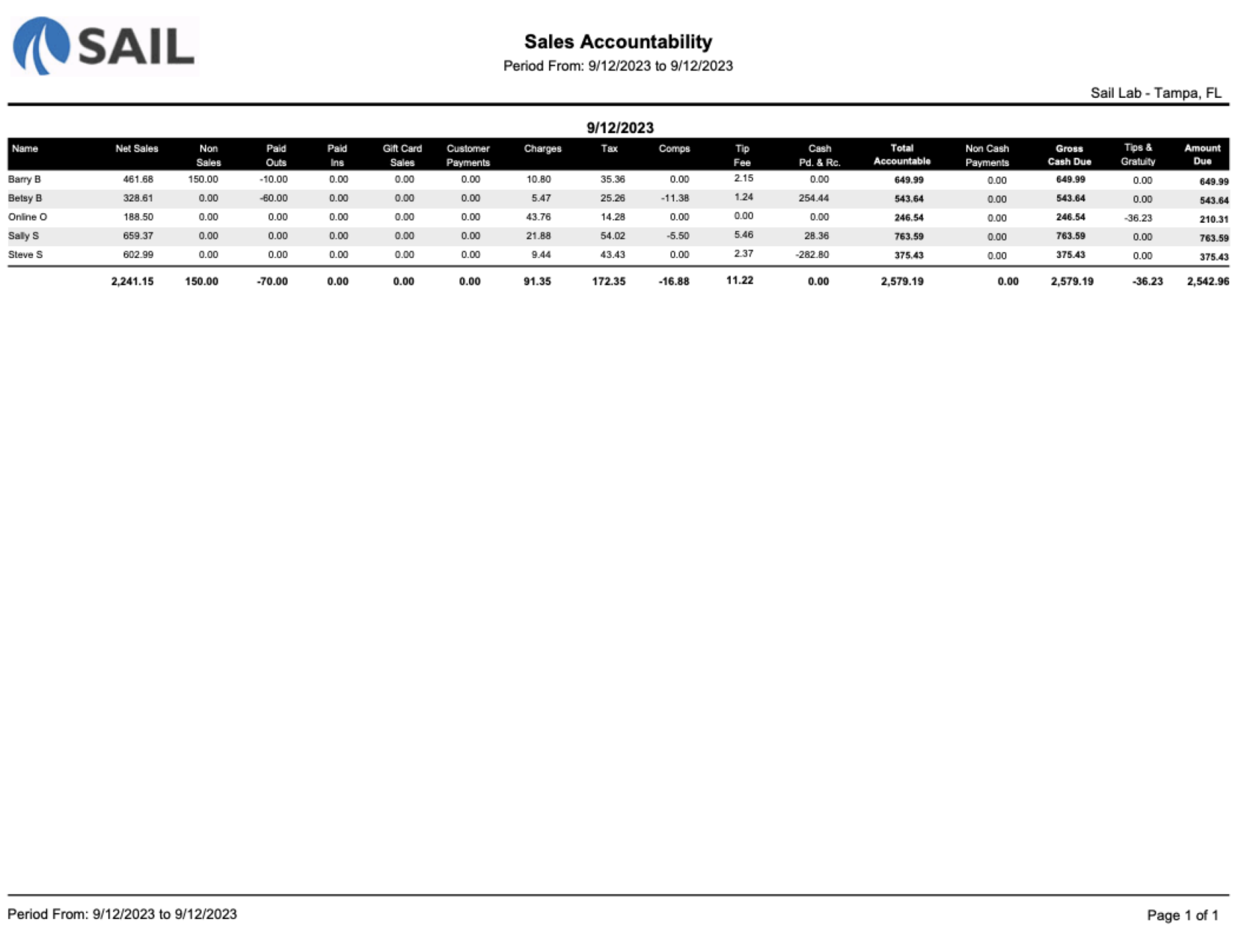

What it looks like

This is a Sales Accountability of 1 day

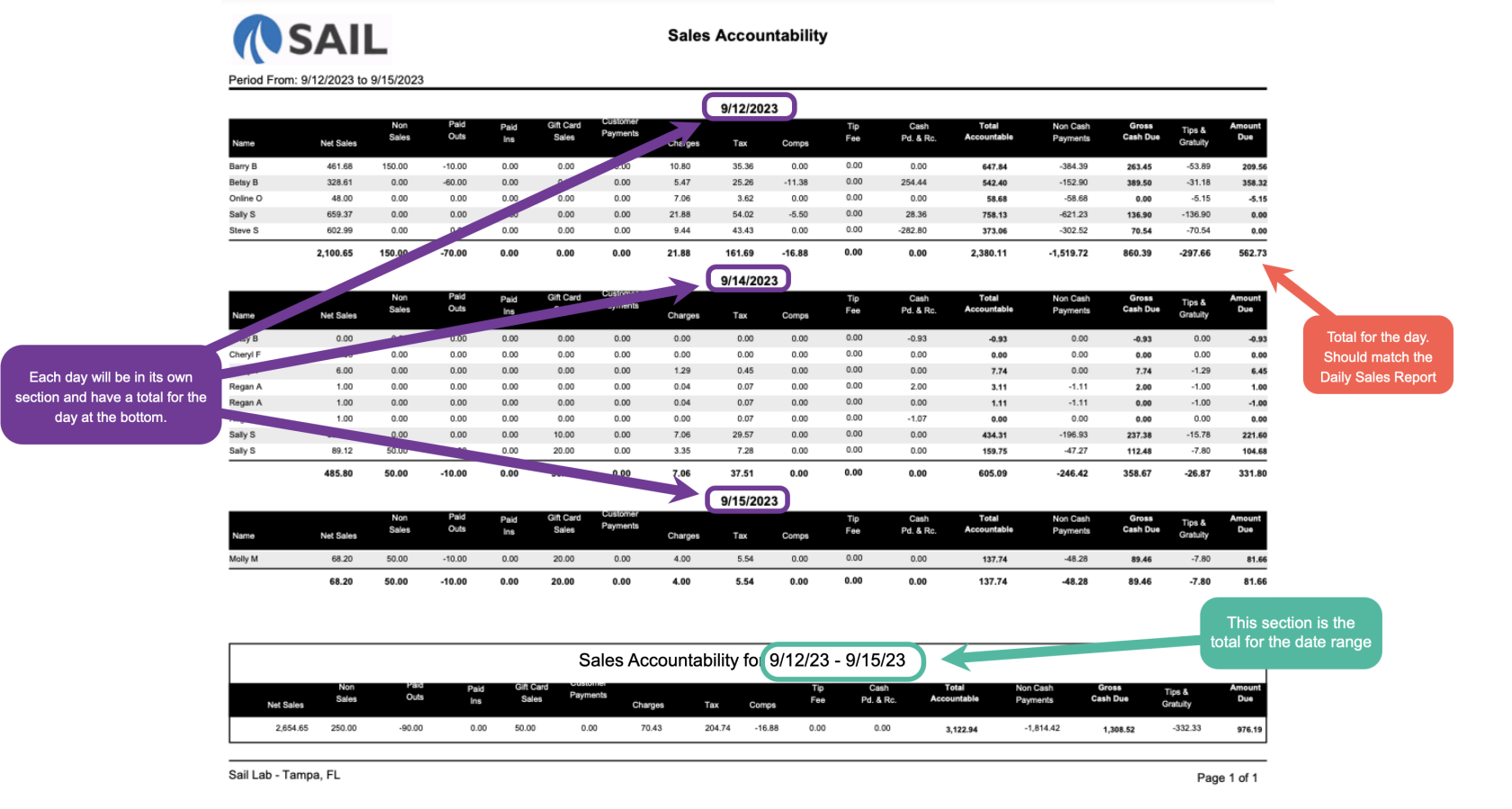

This is a Sales Accountability for a date range

Report Parts

Report Structure

Single-Day View

-

Shows all employees for the selected date.

-

Each employee’s transactions are broken out by column.

-

Totals for all employees appear at the bottom of the page.

Multi-Day View

-

Each day is broken into its own section.

-

A total is provided at the bottom of each day (should match the Daily Sales Report for that date).

-

A date-range total is shown at the very bottom, combining all days included in the report.

Column Explanations

- Name - Employees name

-

Net Sales – The sales amount after discounts and comps.

-

Non Sales – Transactions not tied to food/beverage sales (e.g., retail items, non-revenue entries).

-

Paid Outs – Cash removed from the drawer (e.g., buying supplies, payouts).

-

Paid Ins – Cash added back into the drawer.

-

Gift Card Sales – Total sales of gift cards.

-

Customer Payments – House account or customer account payments.

-

Charges – Additional charges tied to an order (e.g., service fees, gratuity).

-

Tax – Total sales tax collected.

-

Comps – The dollar value of complimentary items.

-

Tip Fee – The fee the employee pays on their credit card tips

-

Cash Pd. & Rec. – Cash paid and received between employees.

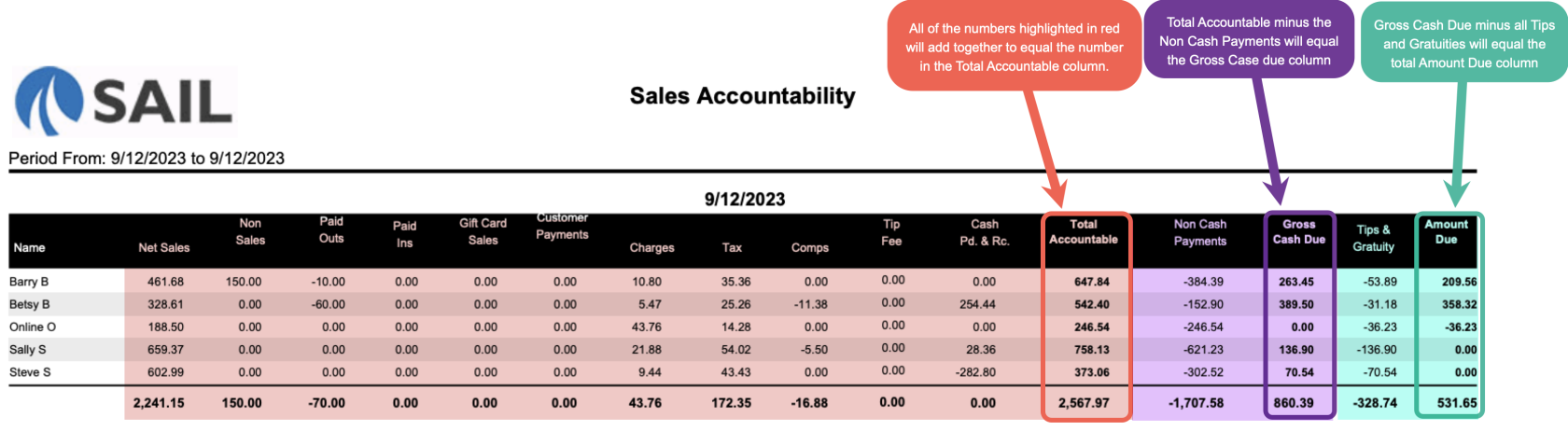

Calculated Totals

-

Total Accountable – The sum of all numbers highlighted in red above (Net Sales, Non Sales, Paid Outs, Paid Ins, Gift Card Sales, Customer Payments, Charges, Tax, Comps, Tip Fee, Cash Pd. & Rec.). This is what the employee is responsible for.

-

Non Cash Payments – Payments made by card, gift, or other non-cash methods.

-

Gross Cash Due – This shows the net cash amount the employee should have

Formula: Total Accountable - Non Cash Payments -

Tips & Gratuity – All tips recorded for the employee.

-

Amount Due – this is the final amount the employee owes or is owed

Formula: Gross Cash Due - Tips & Gratuities

How to Use This Report

-

Daily Review: Run for one day to confirm each employee’s sales and payments balance. The total at the bottom should reconcile with the Daily Sales Report.

-

Multi-Day Review: Run for multiple days to see accountability per day and an overall total. This is helpful for weekly or payroll-level reconciliation.

-

Check Variances: If the Amount Due seems off, trace back through the Total Accountable formula to spot errors in Paid Outs, Comps, or Payments.

-

Audit Cash Handling: Use Gross Cash Due and Amount Due to confirm each employee turned in the correct amount of cash after tips are applied.