Server Close Report

The Server Close Report shows all sales and payment activity for one employee’s shift close.

It’s used to confirm the total cash that must be turned in, verify all sales and tips, and ensure that each server’s drawer balances correctly before performing the Daily Close.

This report is generated whenever a server performs a Server Close, and is automatically included in the Daily Close once all servers are finished.

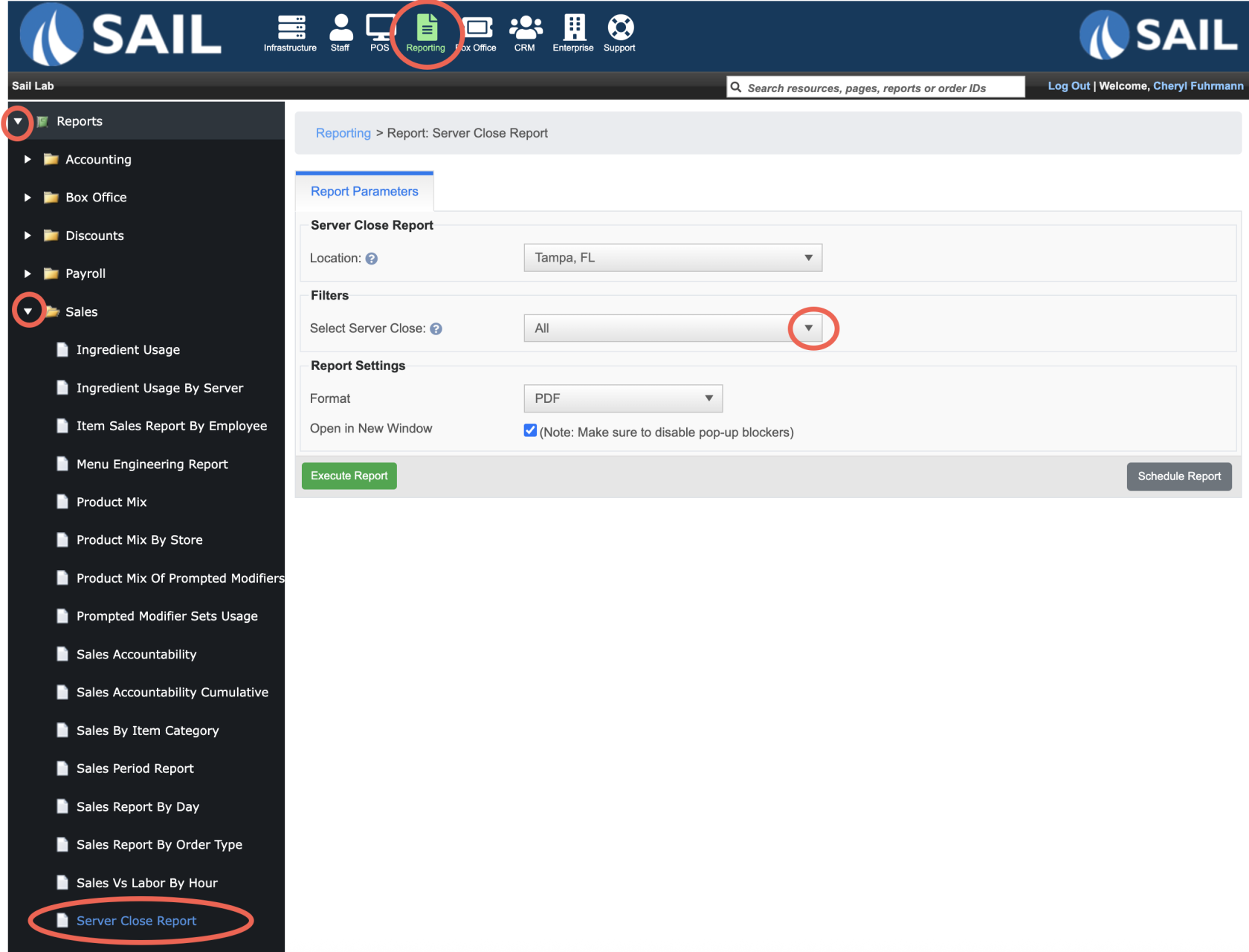

Where to find the report

- Backoffice --> Reporting --> Reports --> Sales folder --> Server Close --> Select Server's Close --> Execute

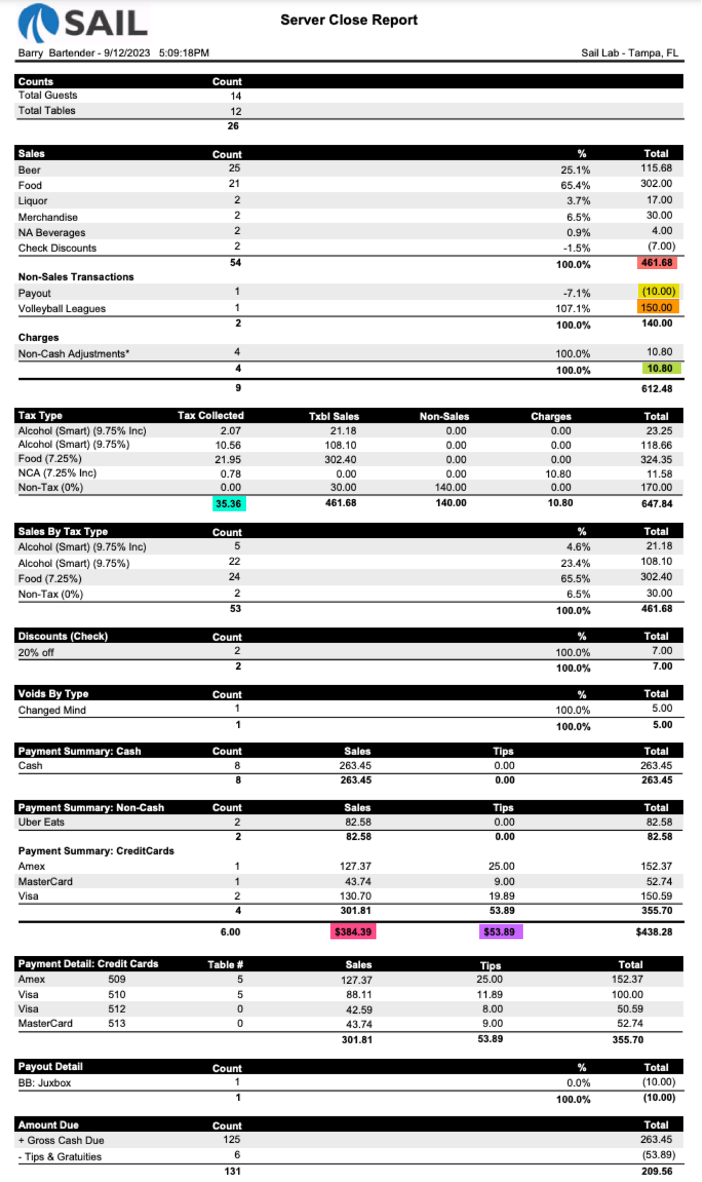

What it looks like

Report Parts

Header

-

Displays the server’s name, date/time of the close, and the location name.

-

Each server close represents one shift. A single server may have multiple closes in a day (e.g., lunch and dinner).

Organization / Sections

-

Sales – Lists Net Sales by Reporting Group (Food, Liquor, Beer, etc.) and the percentage of total sales.

-

Charges – Includes any surcharges or automatic gratuities added to checks.

- Tax Type Summary – Breaks down taxes collected by tax type (Food, Alcohol, Non-Tax, etc.).

-

Discounts / Comps / Voids – Displays employee comps, shift meals, and any voids made during the shift.

-

Payment Summaries – Divided into:

-

Non-Cash Payments (Credit Cards, Gift Cards, House Accounts, ect.)

-

Cash/Checks

-

-

Payment Details - Lists each credit card transaction run during the shift. Use this section to verify that all tips were entered correctly.

-

Amount Due – The final calculation that determines how much cash the server owes the house.

The organization and sections of this report may vary by location.

Each section — such as Sales, Tips, Payments, or Amount Due — is fully configurable in Backoffice using Report Parts.Settings.

Admins can choose which parts appear, the order they display, and which are required for the report to calculate correctly.

For more details on editing report layouts and understanding each available section, see:

To Find Total Accountable

Represents everything the server is responsible for, combining all activity during the shift.

Here is a list of all the possible items that would be in your total accountable number

+ Net Sales

+ Non sales Transaction

+Paid ins

- Payouts

+ Charges

+ Tax

- Comps that were included in sales

- Cash paid (When applicable - On server report only)

+ Cash received (When applicable - On server report only)

+ Tip refund (When applicable)

= Total Accountable

In the example above, from Barry's Report

Total Accountable:

Sales: $461.68

Non Sales Transactions: $150.00

Payouts: -$10.00

Charges: $10.80

Tax: $35.36

Total Accountable = 461.68 + 150 - 10 + 10.80 + 35.36 = $647.84

Gross Cash Due

The amount of physical cash that should exist before removing tips.

You need to take all of their total accountable numbers added up, and subtract all their non cash payments.

Formula: Total Accountable - Non Cash Payments = Gross Cash Due

Uber Eats: $82.58

Credit Cards: $301.81

Non Cash Payments = 82.58 + 301.81 = $384.39

Barry's Gross Cash Due:

Total Accountable: $647.84

Non Cash Payments: $384.39

Gross Cash Due = 647.84 - 384.39 = $263.45

Amount Due

The amount of cash the server must turn in at the end of the shift.

Formula: Gross cash - tips and gratuities.

*Note that Tips can be from any claimed tips, like Credit Cards, Gift cards, House Accounts, and 3rd party vendors like Uber Eats

Gratuities come from the Charges section - These are charged gratuities that are put on the customers bill before they pay out. (for example, you have a table of 10 and you add a 20% gratuity to it)

In this example Barry only has tips from Credit Cards: $53.89

Barry's Amount Due:

Gross Cash: $263.45

Tips & Gratuities: $53.89

Amount Due = 263.45 - 53.89 = $209.56 (this is the total amount of cash that Barry should turn in)

How to Use This Report

- Use this report to verify drawer cash before turning it in.

-

Check that all non-cash payments (credit, gift cards, online orders) match Backoffice totals.

-

Confirm that tips and gratuities were entered and deducted correctly.

-

Ensure that payouts and paid-ins were documented with clear notes.

-

Managers should compare the Amount Due to the actual cash turned in.

-

If a server’s close does not balance, check for missing payments, incorrect comp entries, or unclosed checks.