How to Configure Surcharging

This document will show how to configure surcharging in Backoffice

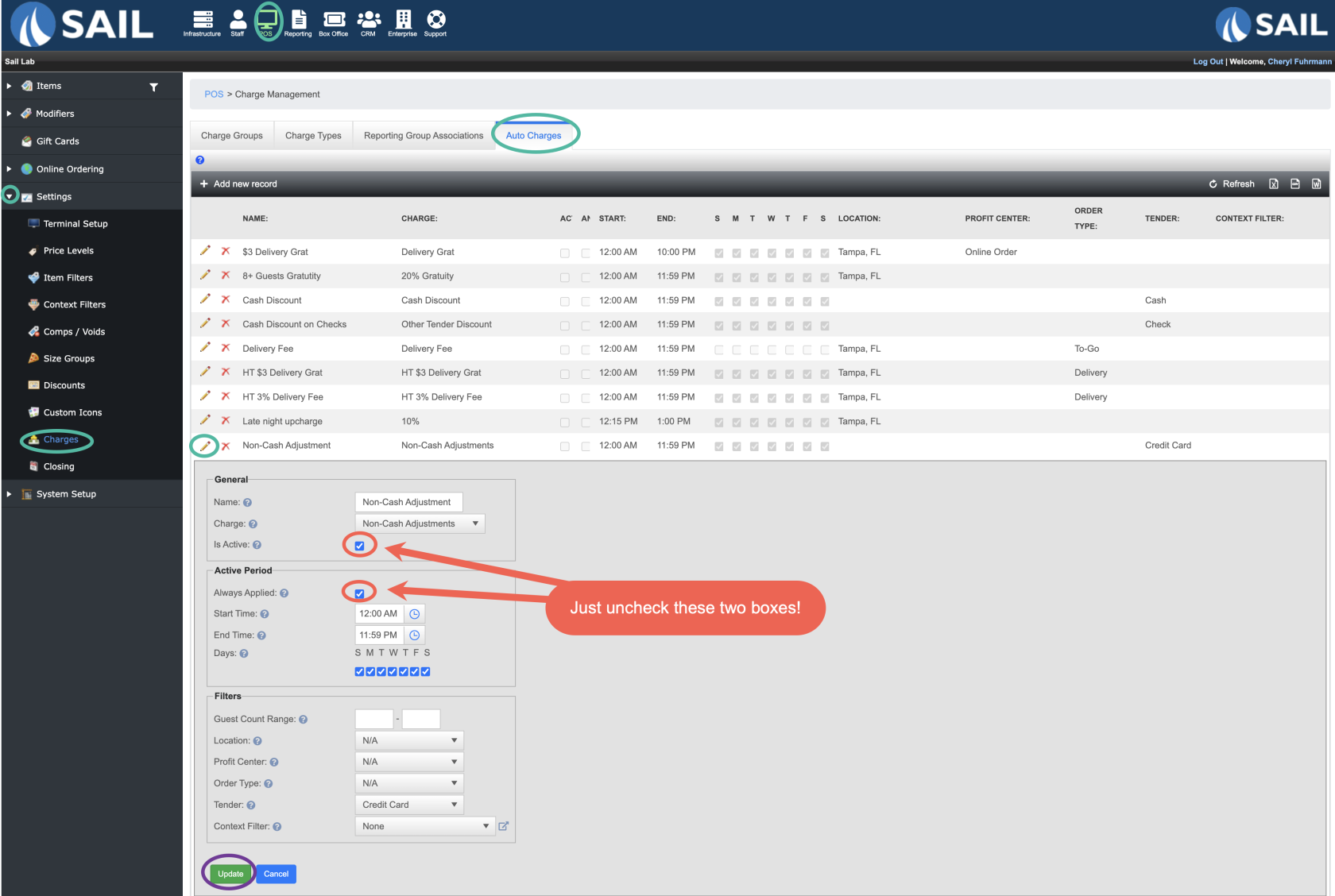

Inactivate NCA or OPF

- POS --> Settings --> Charges --> Auto Charges Tab

- Use the pencil to edit the old offset model (either, NCA or OPF)

- Uncheck the active and always apply checkboxes

- Click update

- That is all that needs to be done. Do not delete or reuse the old tax type. It needs to stay for past reporting

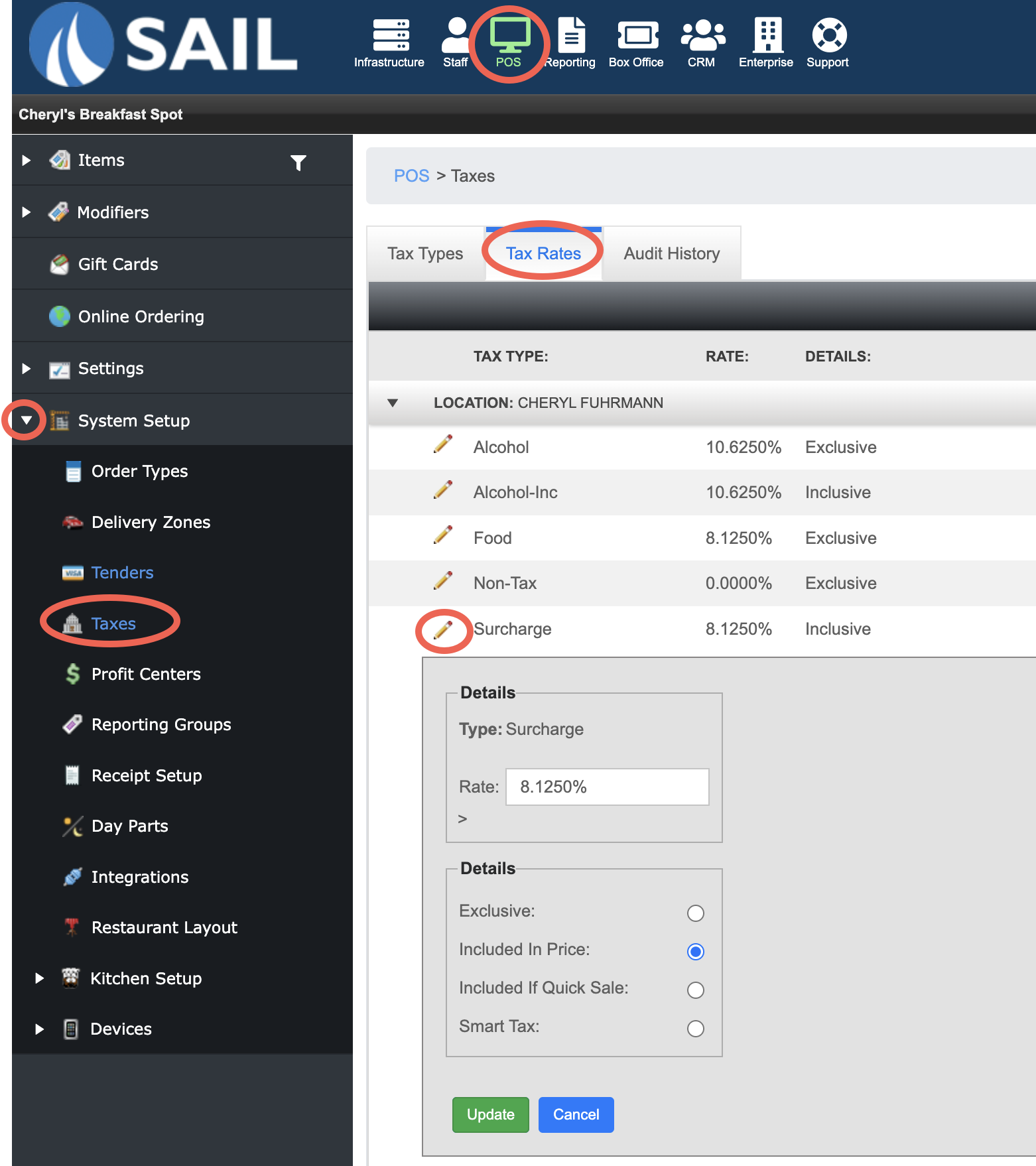

Set up a new tax for Surcharging

- POS --> System Setup --> Taxes

- Create a tax type named "Surcharge"

- Then on the Tax rates tab put in the same rate as their food or sales tax

- Check the box for "Include in price" to make this an inclusive tax rate

- This tax type can NOT be exclusive or it will leave a balance on the table because the tax will calculate after the payment is made

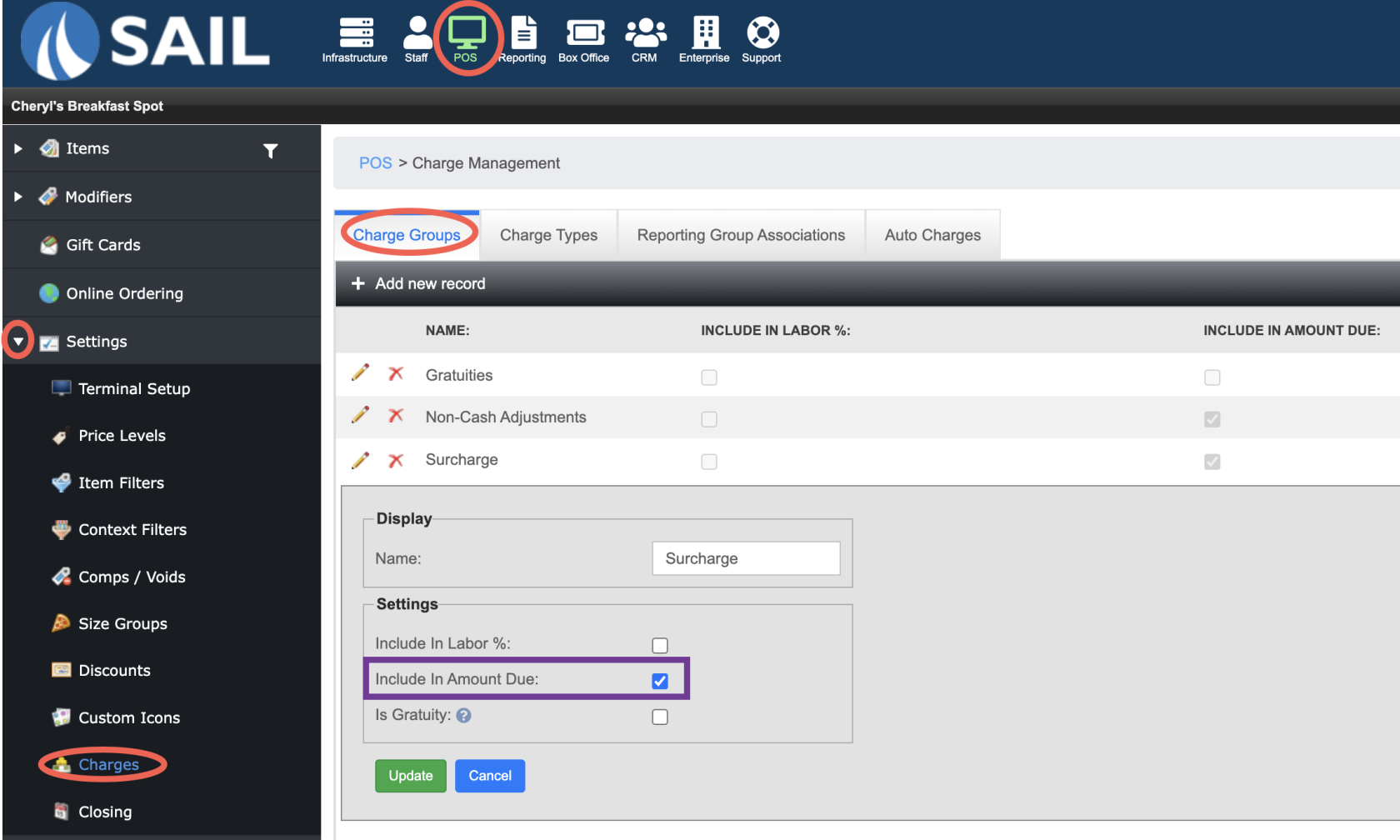

Set up a new Charge Type

- POS --> Settings --> Charges

- On the "Charge Groups" tab, add a new record and name it "Surcharge"

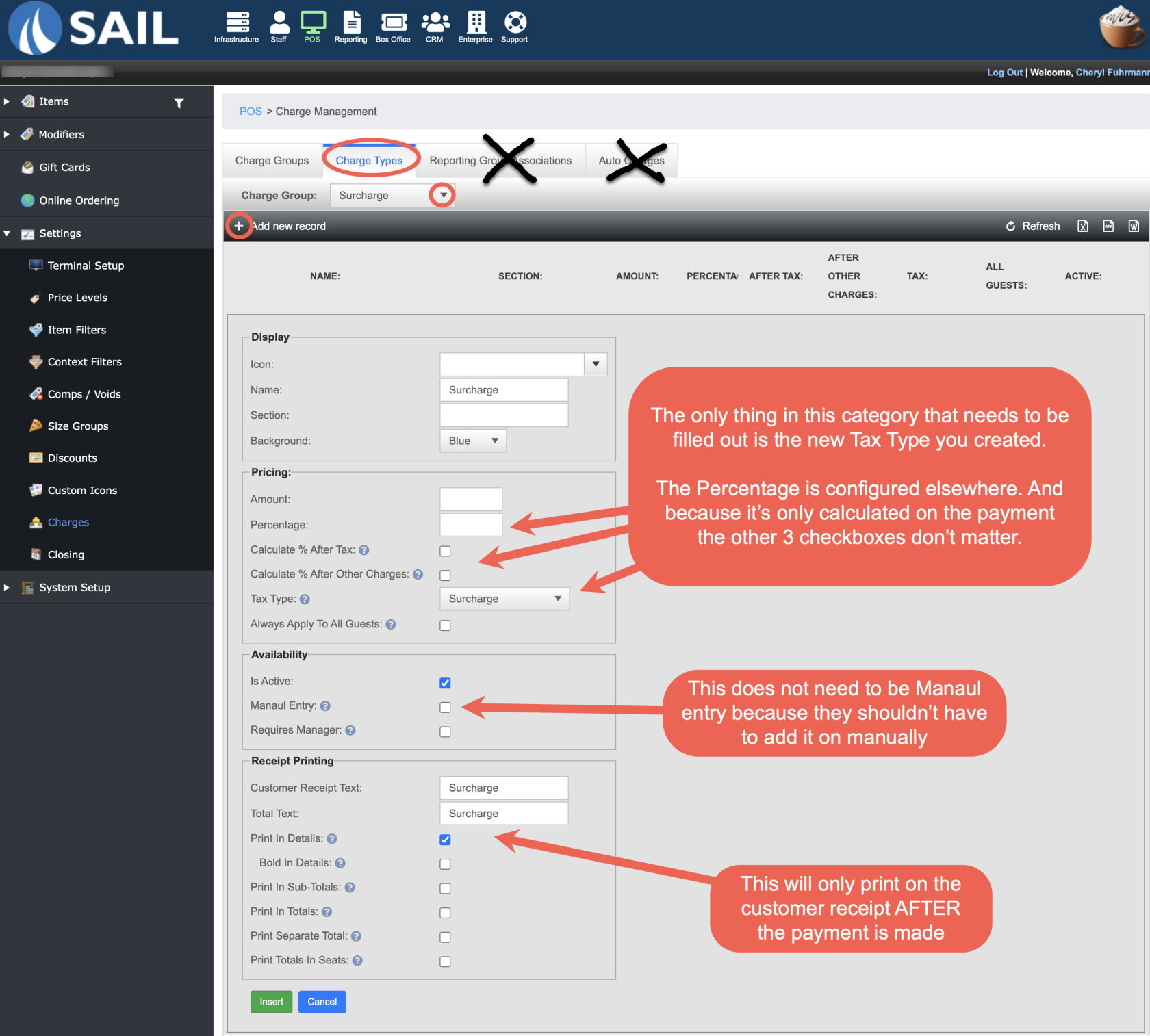

- Charge Types tab

- Reporting group association tab

- You do NOT need to do anything with this tab, because this is a payment related charge it doesn't look at reporting groups.

- You do NOT need to do anything with this tab, because this is a payment related charge it doesn't look at reporting groups.

- Auto Charge Tab

- You do NOT need to set up an auto charge, because the charge is determined from the processor not Sail

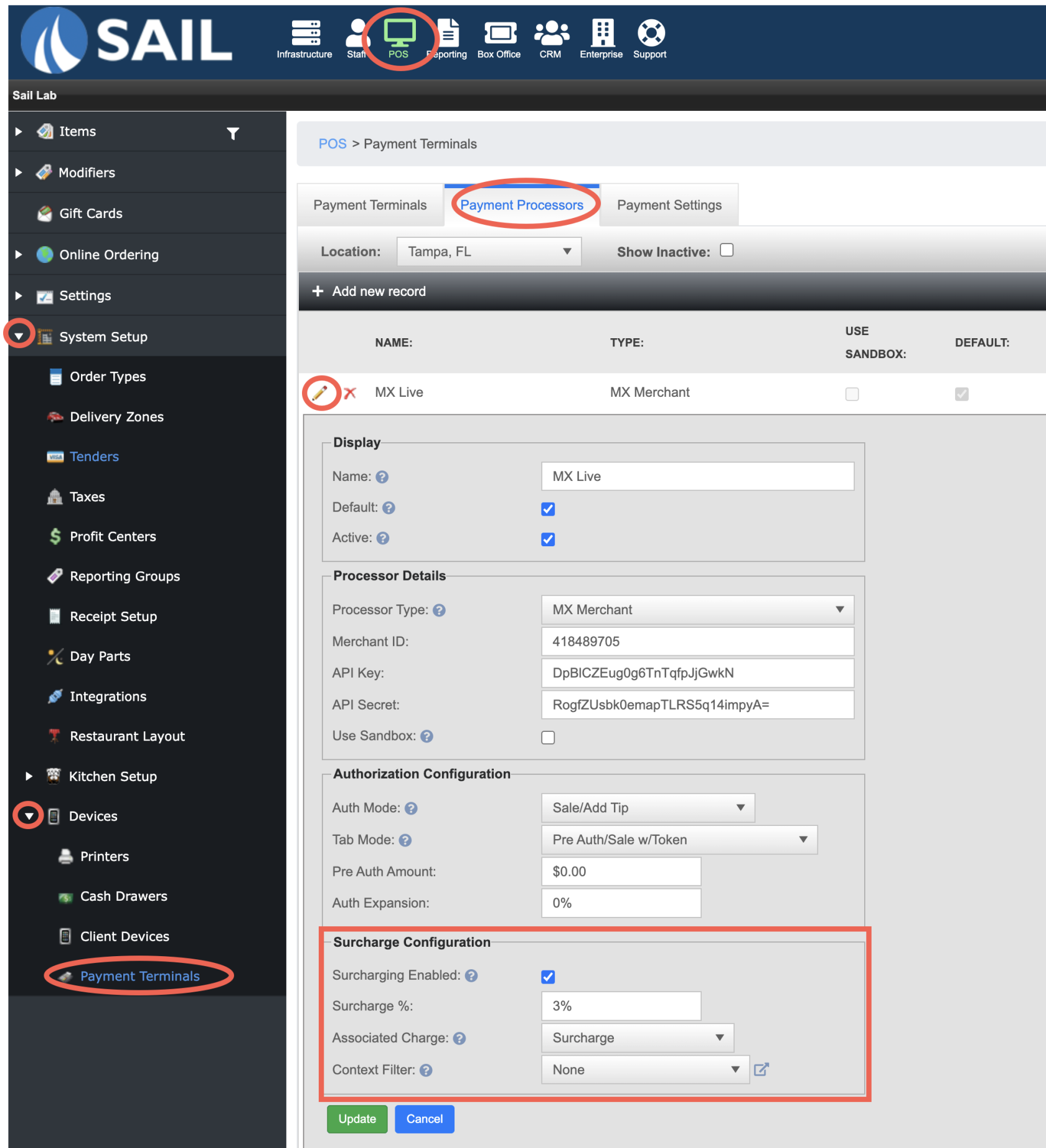

Set up the Payment Terminal

- POS --> System Setup --> Devices --> Payment Terminals --> "Payment Processors" tab