How to Edit a Comp & Voids

This document will show you how to edit your current Comps & Voids in the system

Whats the difference between Comps & Voids?

- Void is for an item that was never made and no longer needs to be made.

- Example: A customer changed their mind and does not want the item, or a server mistakenly entered the item.

- Comp removes the need for the customer to pay for the order.

- Example: A customer had an issue and the cost of the meal was covered.

- The main difference is that a void says this was not made so the system does not need to reflect it, whereas a comp is saying the meal was made and needs to be accounted for but the cost of the meal was paid by the store.

- Voids and comps are always 100% of the item selected (if you want to do a partial amount that would be a discount)

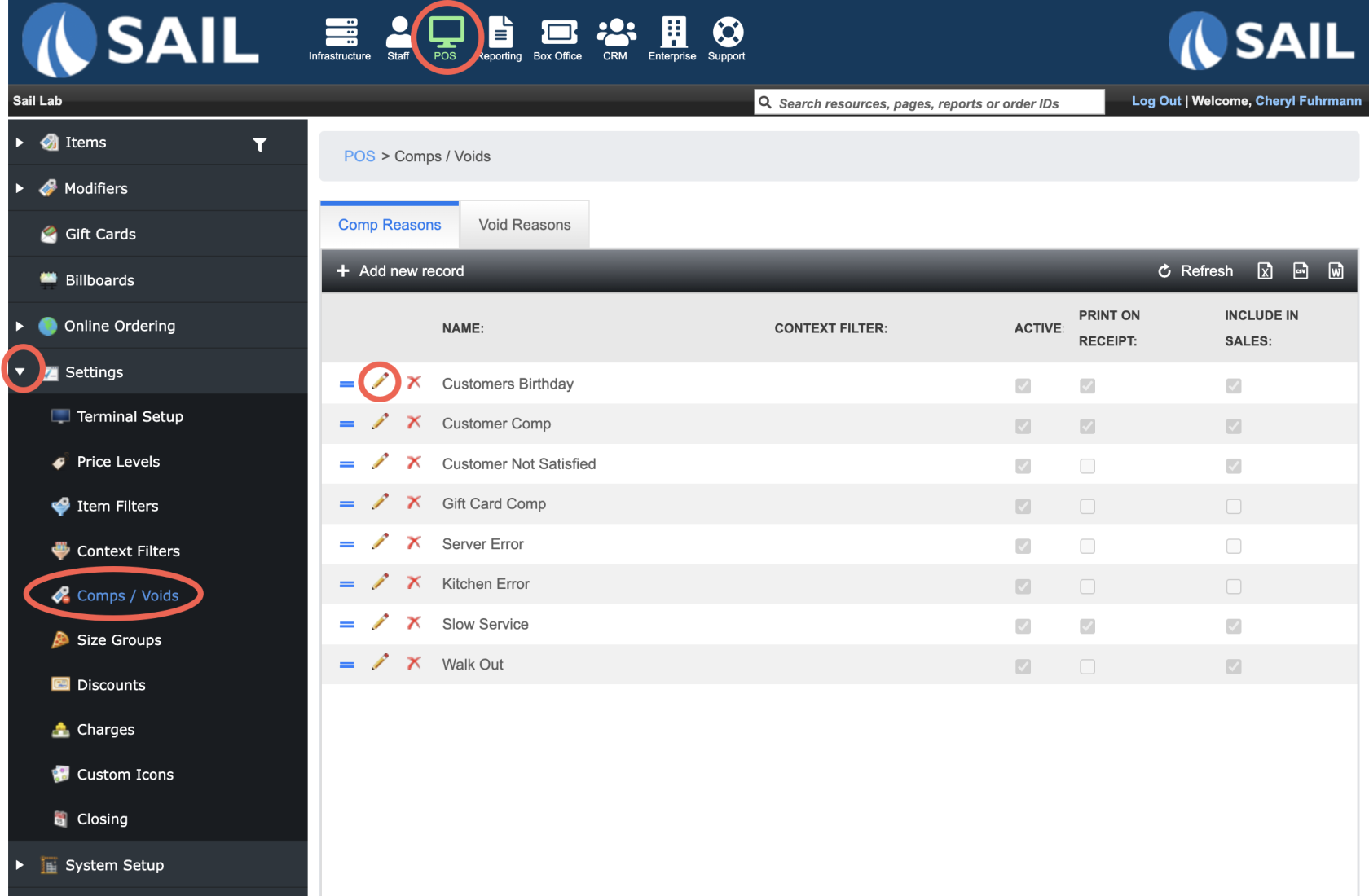

Where to edit them

- Backoffice --> POS --> Settings --> Comps/Voids

- Use the Comp or Void tab depending on which one you're editing

- Click the Pencil next to the one you'd like to edit

How to edit a Comp

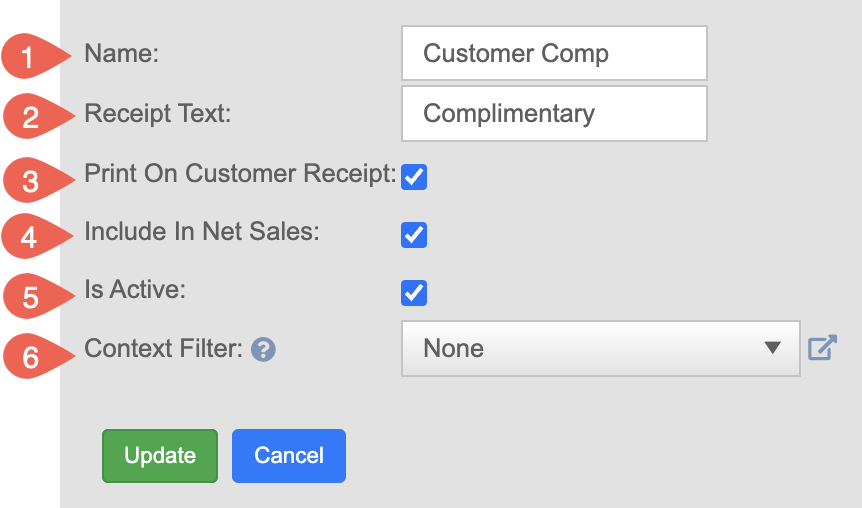

- Once you click on the pencil you will have these options to edit

- Name: Edit the name that will appear in the list when you click the Comp button.

- This is how staff will identify the comp reason during use.

- Receipt Text: If you choose to print the comp on the customer's receipt, you can optionally add a custom message that will appear below the item.

- Example: For a birthday comp, you might display: “Happy Birthday!”

- Print on customer receipt: Check this box if you want the comp to show on the guest's receipt

- Use this when: The comp is a positive gesture (e.g., a free appetizer, birthday drink, or a manager’s treat) and you want the customer to know they’re not being charged.

- Leave unchecked when: The comp is due to an internal issue (e.g., server or kitchen error) and you prefer not to draw attention to it on the guest’s receipt.

- Include in Net Sales: Do you want this item to appear on reports in your Net Sales?

- Include in Net Sales when: The item was prepared and given to the customer (even if it was complimentary). Example: A birthday drink that was comped but still consumed—usage tax is still owed.

- Exclude from Net Sales when: The item was never served (e.g., dropped, burned, or misrung), and thus not consumed by the customer. No usage tax is owed.

- Is Active: Indicates whether this comp reason is active and available for staff to select.

- Context Filter: Optionally apply a context filter to limit where or by whom this comp reason can be used—such as specific locations or job roles.

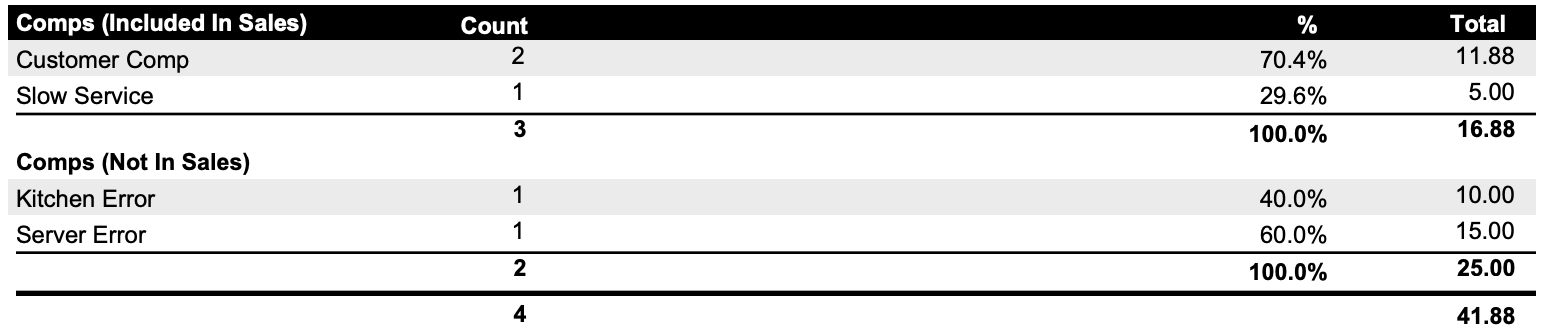

Comps in Reporting

This section show which comps were used this day.

It breaks it down by:

Comps Included in sales - These will still be in your sales numbers for the day and taken out later in the amount due section

Comps Not included in sales - These will not be included in your sales numbers and will show in the comp column in the sales with details section