Sales Accountability Cumulative Report

ThisThe is the Sales Accountability Cumulative Report is used to reconcile sales and payments across a longer date range. Unlike the standard Sales Accountability Report, which shows day-by-day sections, this version adds everything together into one line per employee for the entire period selected.

This is especially useful when:

-

You want a month-to-date or week-to-date accountability summary.

-

You need to see an employee’s total responsibility across multiple shifts.

-

You are preparing for payroll, tip-outs, or high-level audits.

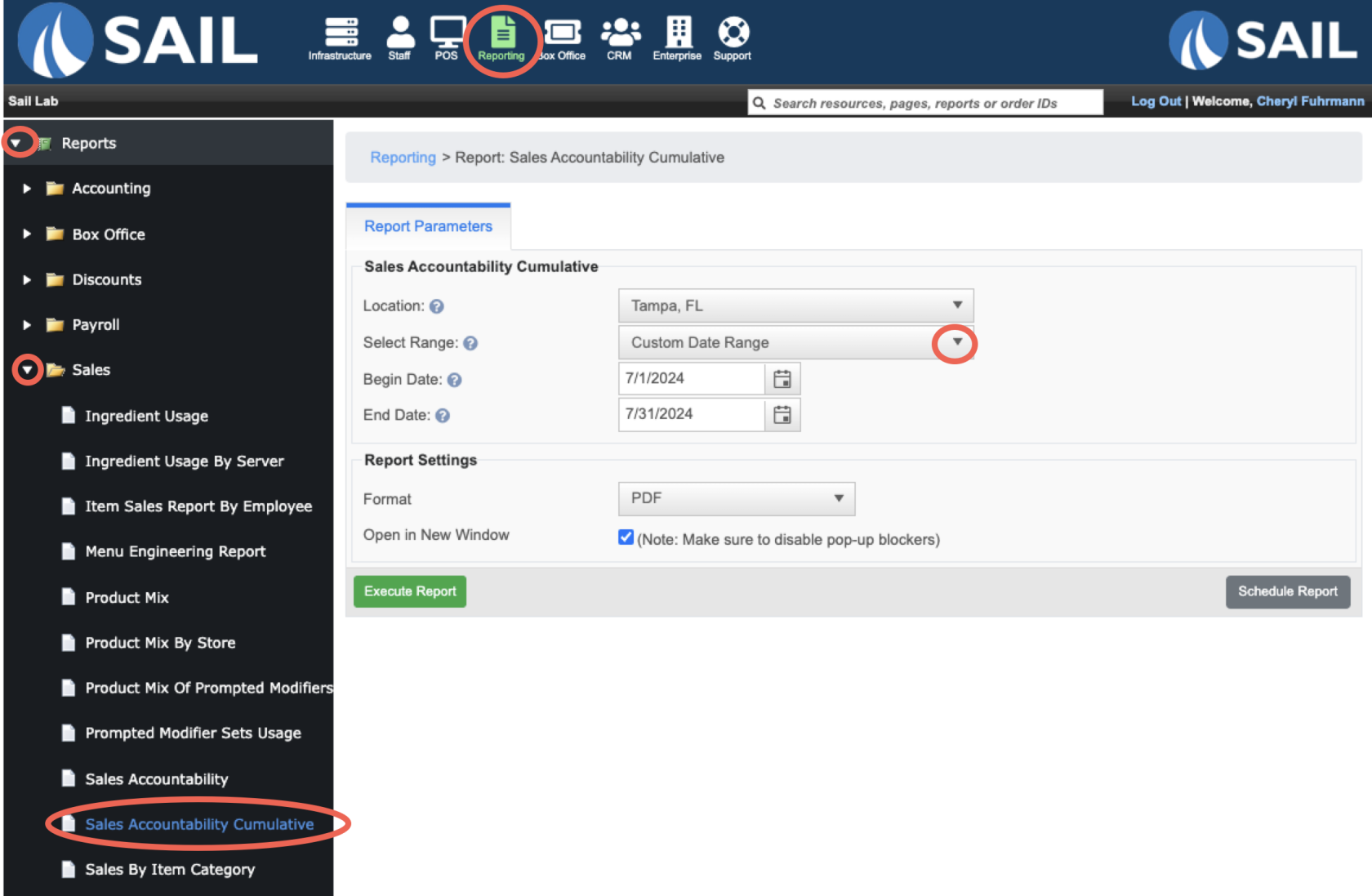

Where to find the report

- Backoffice --> Reporting --> Reports --> Sales folder --> Sales Accountability Cumulative --> Select Date Range --> Execute

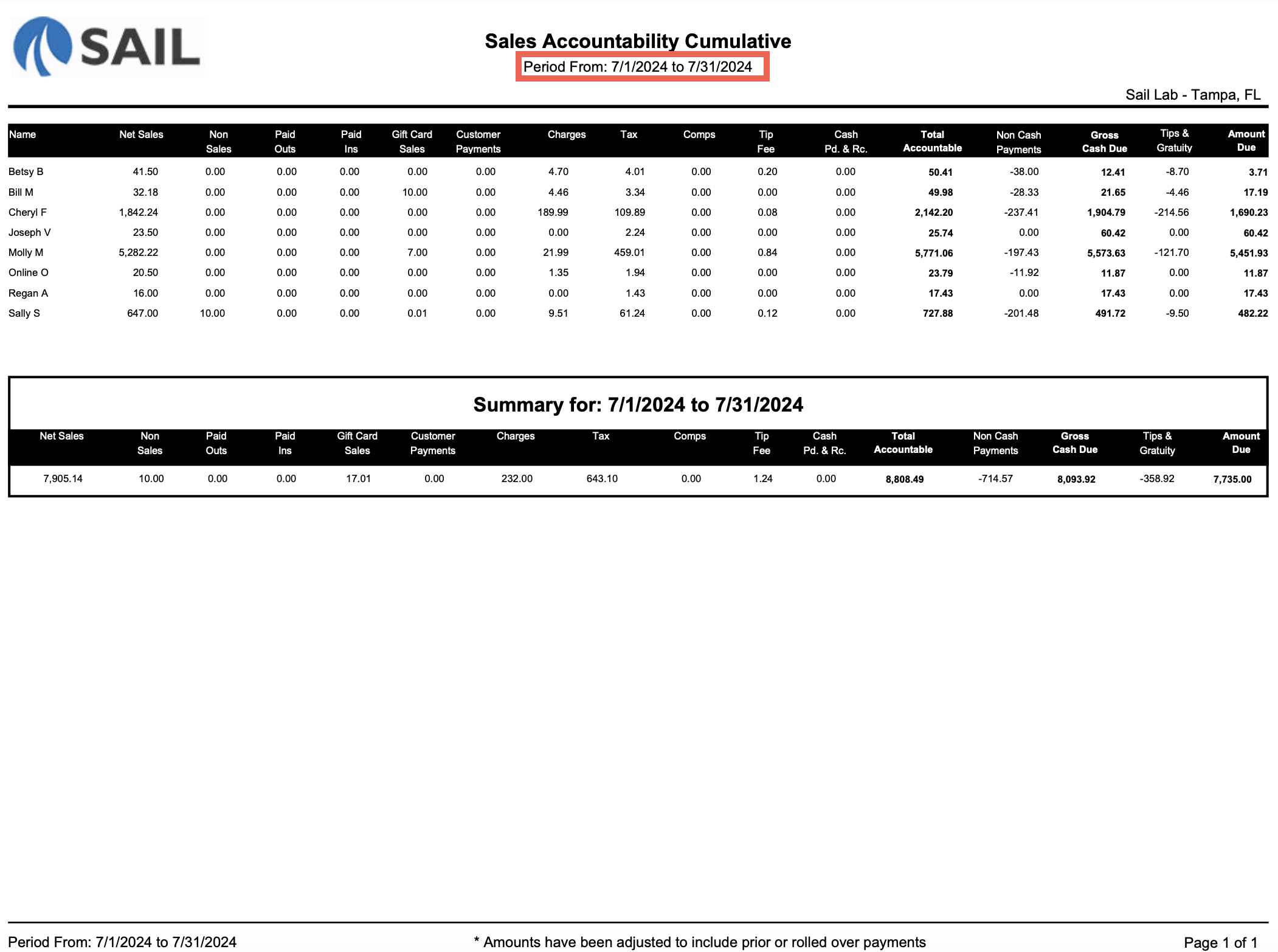

What it looks like

Report Parts

Report Structure

WehavePer

aEmployeenewTotalsreport–thatEachcanemployeetakeappearsyouronce,SaleswithAccountabilityallReportactivityandfromadd athe date rangetogethercombined.onFor1 reportSoexample, if an employee worked5fivetimesshifts,duringtheirthatNet Sales, Charges, Tax, Comps, etc. are rolled up into a single line.-

Summary Row – At the bottom, the report includes a grand total for all employees for the selected date

rangerange.it would add all 5 days together and put them on 1 line

-

No Daily Breakouts – Unlike the standard report, there are no separate sections per day.

Column Explanations

- Name - Employees name

-

Net Sales – The sales amount after discounts and comps.

-

Non Sales – Transactions not tied to food/beverage sales (e.g., retail items, non-revenue entries).

-

Paid Outs – Cash removed from the drawer (e.g., buying supplies, payouts).

-

Paid Ins – Cash added back into the drawer.

-

Gift Card Sales – Total sales of gift cards.

-

Customer Payments – House account or customer account payments.

-

Charges – Additional charges tied to an order (e.g., service fees, gratuity).

-

Tax – Total sales tax collected.

-

Comps – The dollar value of complimentary items.

-

Tip Fee – The fee the employee pays on their credit card tips

-

Cash Pd. & Rec. – Cash paid and received between employees.

Calculated Totals

-

Total Accountable – The sum of all numbers highlighted in red above (Net Sales, Non Sales, Paid Outs, Paid Ins, Gift Card Sales, Customer Payments, Charges, Tax, Comps, Tip Fee, Cash Pd. & Rec.). This is what the employee is responsible for.

-

Non Cash Payments – Payments made by card, gift, or other non-cash methods.

-

Gross Cash Due – This shows the net cash amount the employee should have

Formula: Total Accountable - Non Cash Payments -

Tips & Gratuity – All tips recorded for the employee.

-

Amount Due – this is the final amount the employee owes or is owed

Formula: Gross Cash Due - Tips & Gratuities

How to Use This Report

-

Employee Totals Over Time – Instead of checking shift-by-shift accountability, use this report to see an employee’s overall accountability for the week or month.

-

Payroll Prep – Use the cumulative view when preparing payroll or reconciling cash deposits to employee totals.

-

Audit Trends – Spot patterns, such as frequent comps or large variances, without digging through each individual day.

-

Compare Against Standard Report – If something looks off, you can always drill down by running the Sales Accountability Report for individual days and cross-check totals.