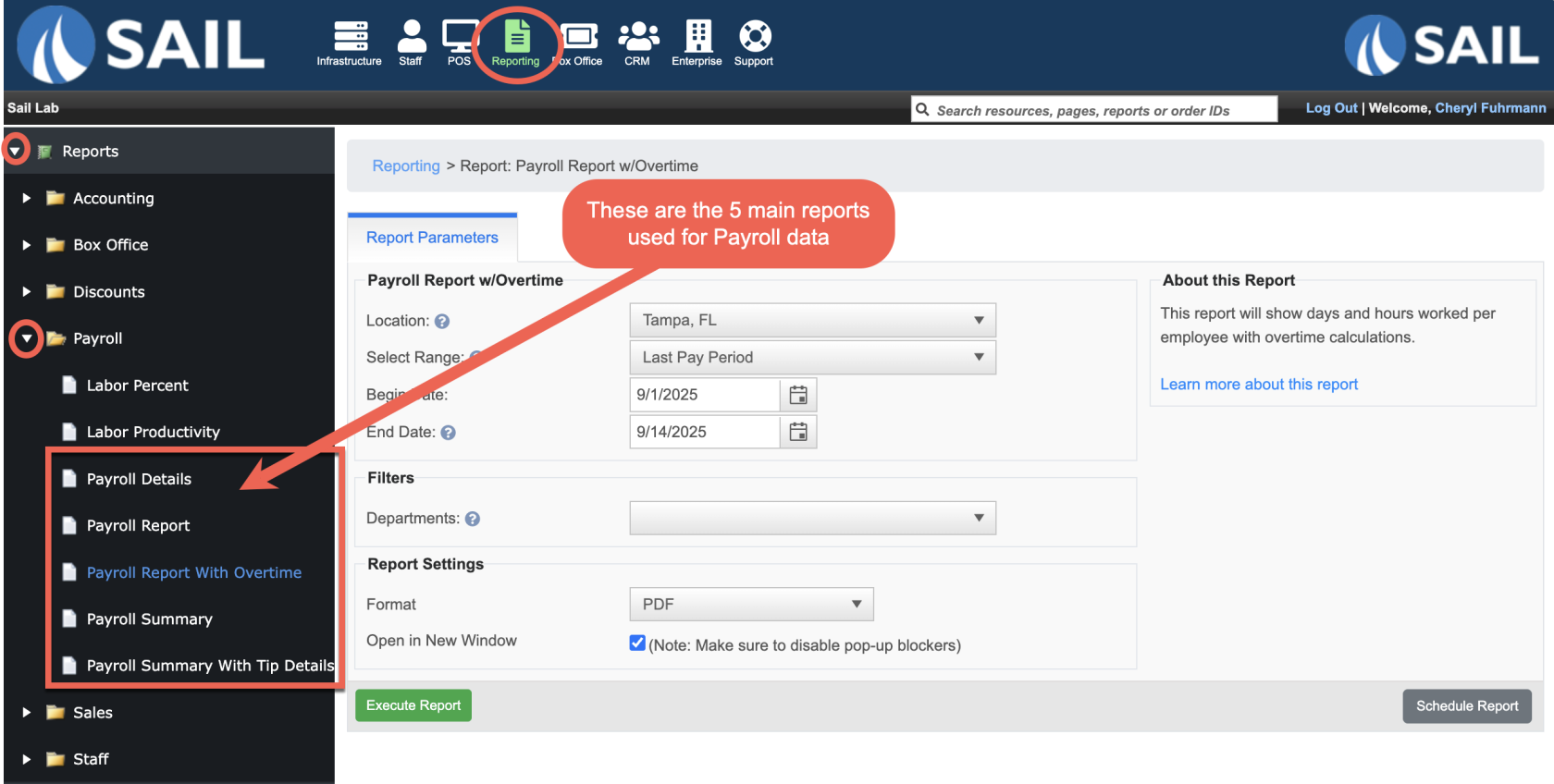

Which Payroll Report is right for me?

Our system offers four different payroll reports. Each one has a slightly different purpose. Use this guide to choose the right report for your needs.

How to run a payroll report

Which Payroll Report is Right for Me?

Our system offers five different payroll reports. Each one serves a slightly different purpose. Use this guide to choose the right report for your needs.

1. Payroll Details Report

Best for: Full audits and in-depth reconciliation.

-

The most detailed payroll report.

-

Shows each shift with clock in/out times, pay, sales, and a full tip breakdown.

-

Overtime hours appear in red on a separate line, and then again in the employee totals section.

-

Can be grouped by Job Role (with subtotals for each role and then a grand total) or by Day (chronological with one totals line).

-

Optional Report Summary at the end gives payroll and tip totals by role and pay period.

👉 Run this when you need the most complete payroll and tip picture for auditing, reconciliation, or compliance.

2. Payroll Report

Best for: Auditing shifts and verifying detailed hours.

-

Shows employee hours, pay, tips, and sales shift by shift.

-

Includes clock in/out times.

-

Helps troubleshoot timecard issues or verify individual shift details.

👉 Run this when you want the most detailed, shift-level payroll data.

3. Payroll Report with Overtime

Best for: Tracking and managing overtime.

-

Same as the Payroll Report, but adds Overtime Hours (OT Hrs) and Overtime Pay (OT Pay) columns.

-

Lets you monitor compliance with labor laws and manage labor costs more effectively.

👉 Run this when you need to break out overtime separately.

4. Payroll Summary Report

Best for: A clean, high-level payroll snapshot.

-

Summarizes each employee’s total hours, pay, tips, and sales.

-

Groups payroll by job role, showing totals and percentages for each role.

-

Great for quick payroll checks before submission.

👉 Run this when you want a concise payroll overview.

5. Payroll Summary with Tip Details

Best for: Reconciling tips and ensuring accuracy.

-

Includes everything in the Payroll Summary Report.

-

Adds a detailed tip breakdown (credit, cash, gratuities, tipouts, and fees).

-

Includes a location-wide Tip Type Summary.

👉 Run this when you need to confirm tip distribution or reconcile tips.

Quick Comparison Guide

| Report | What It Shows | Unique Features | When to Use It |

|---|---|---|---|

| Payroll Report | Detailed breakdown of hours, pay, tips, and sales by employee/shift. | Includes clock in/out times. | When auditing timecards or verifying shift details. |

| Payroll Report with Overtime | Same as Payroll Report but breaks out overtime. | Adds OT Hours and OT Pay columns. | When tracking overtime costs and compliance. |

| Payroll Summary Report | High-level totals by employee and job role. | Groups by role with percentages of payroll. | When you want a quick payroll snapshot. |

| Payroll Summary w/ Tip Details | Same as Payroll Summary plus detailed tip tracking. | Adds per-employee tip details and location-wide Tip Type Summary. | When reconciling tips or reviewing fee/tipout handling. |

| Payroll Details Report | Most detailed, shift-level payroll + full tip breakdown. | Overtime in red, grouping by Job Role vs. Day, optional summary at end. | When auditing or reconciling payroll and tips in detail. |

Decision Guide

-

Do you need shift-level detail?

→ Run Payroll Report (or Payroll Report w/ Overtime if OT is important). -

Do you just need totals for payroll submission?

→ Run Payroll Summary Report. -

Do you need to reconcile tips?

→ Run Payroll Summary w/ Tip Details. -

Do you need the deepest level of detail (shifts, roles, tips, OT, and optional summary)?

→ Run Payroll Details Report.