Payroll Report w/Overtime

The Payroll Report with Overtime provides a detailed breakdown of employee hours, wages, tips, and sales for a specific pay period. It is almost identical to the standard Payroll Report, but includes additional columns to break out overtime hours and overtime pay. This makes it easy to see how much of your payroll costs are coming from overtime.

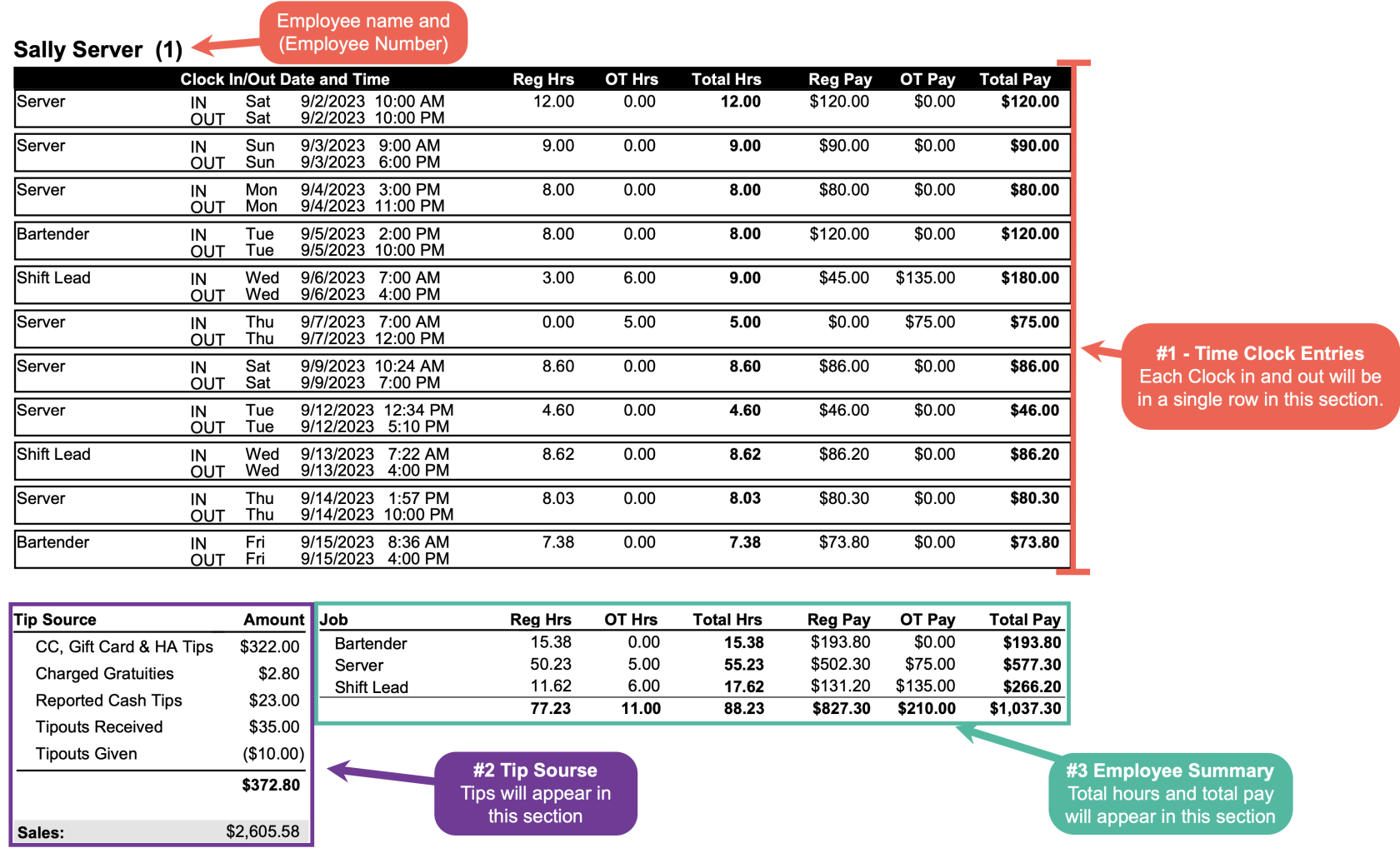

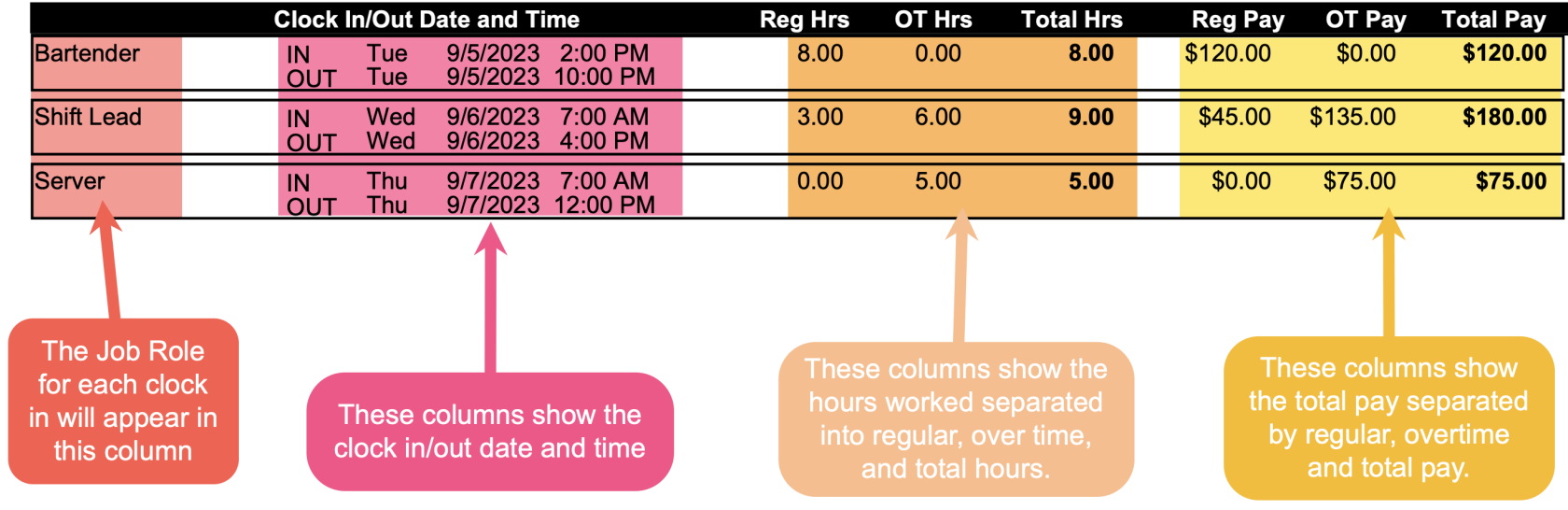

- A payroll report w/overtime will show you each clock in and clock out during the pay period and will have additional columns to show calculated overtime hours and overtime pay

- Here is an example of an employees details on the payroll with overtime report:

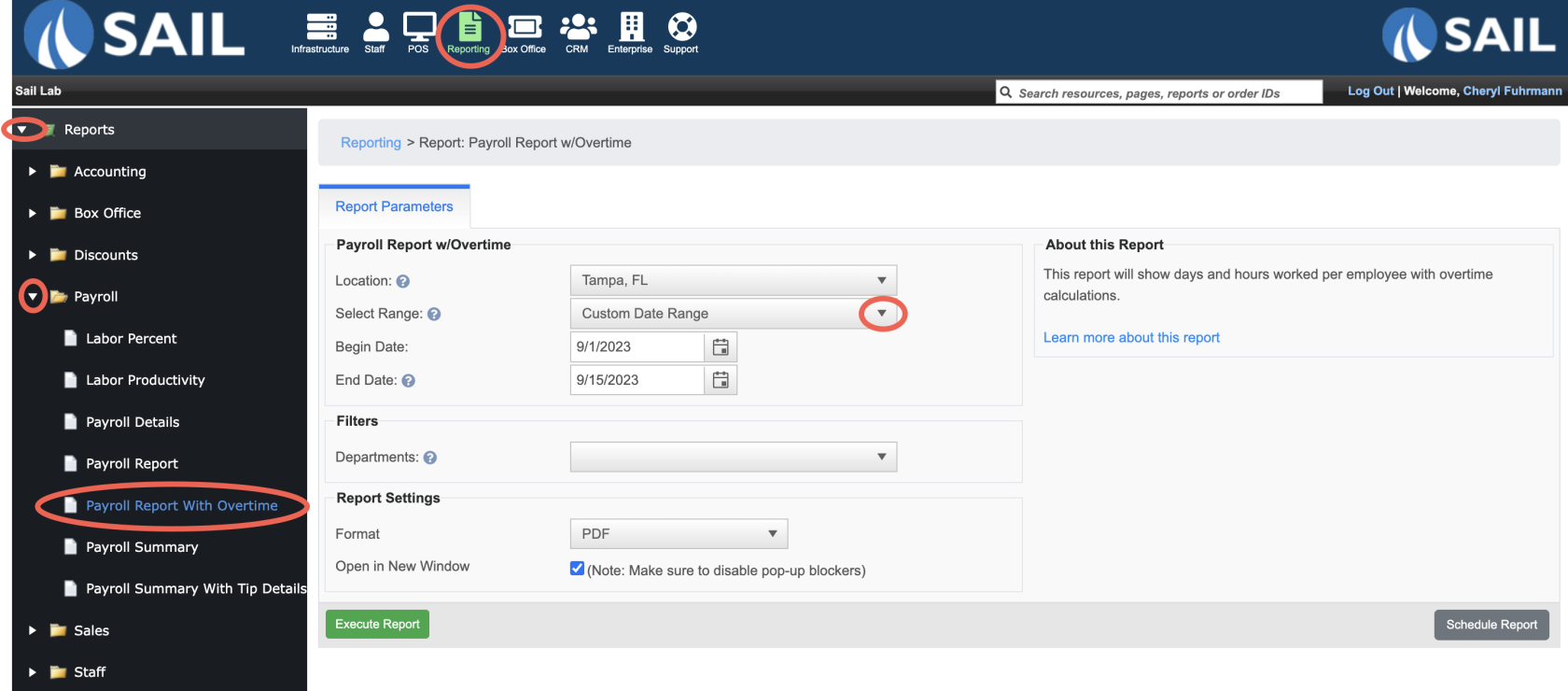

Where to find the report

- Backoffice --> Reporting --> Reports --> Payroll folder --> Payroll Report with Overtime --> Select Date --> Execute

Report Options

Filters

-

Departments – Allows you to run the report for specific departments instead of all employees.

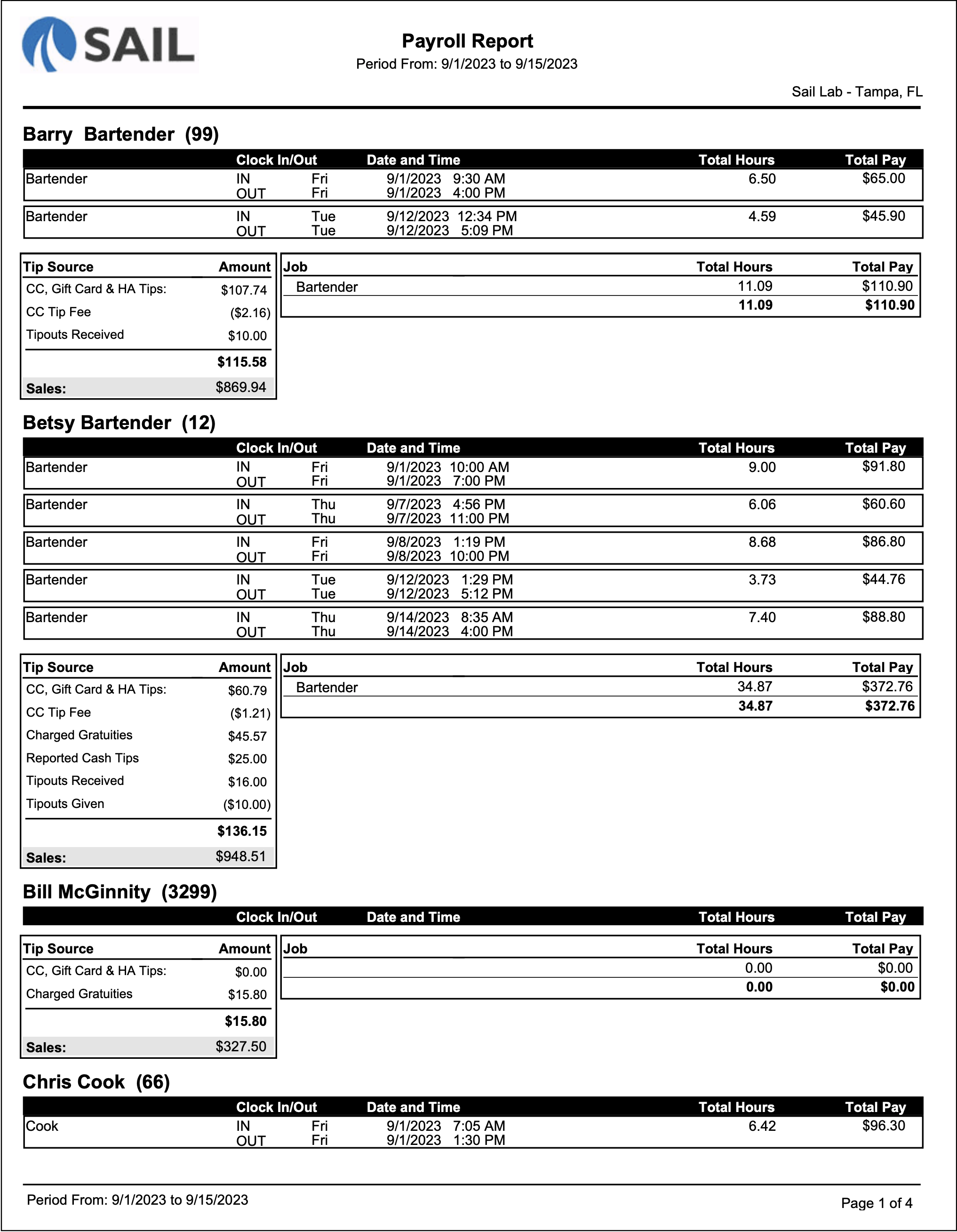

What it looks like

Report Parts

Employee Details

Each employee has their own section showing their hours, pay, and tips

1. Time Clock Entries section:

-

Job Roll – The role worked (e.g., Server, Bartender, Cook, Manager).

- Clock In/Out (Date & Time) – The exact times the employee worked each shift.

-

Reg Hours – The number of regular hours worked.

-

OT Hours – The number of overtime hours worked.

-

Total Hours – The combined hours worked.

-

Formula: Reg Hours + OT Hours = Total Hours

-

-

Reg Pay – Wages earned for regular hours.

-

OT Pay – Wages earned for overtime hours (typically at an overtime rate such as 1.5x).

-

Total Pay – The total wages earned.

-

Formula: Reg Pay + OT Pay = Total Pay

-

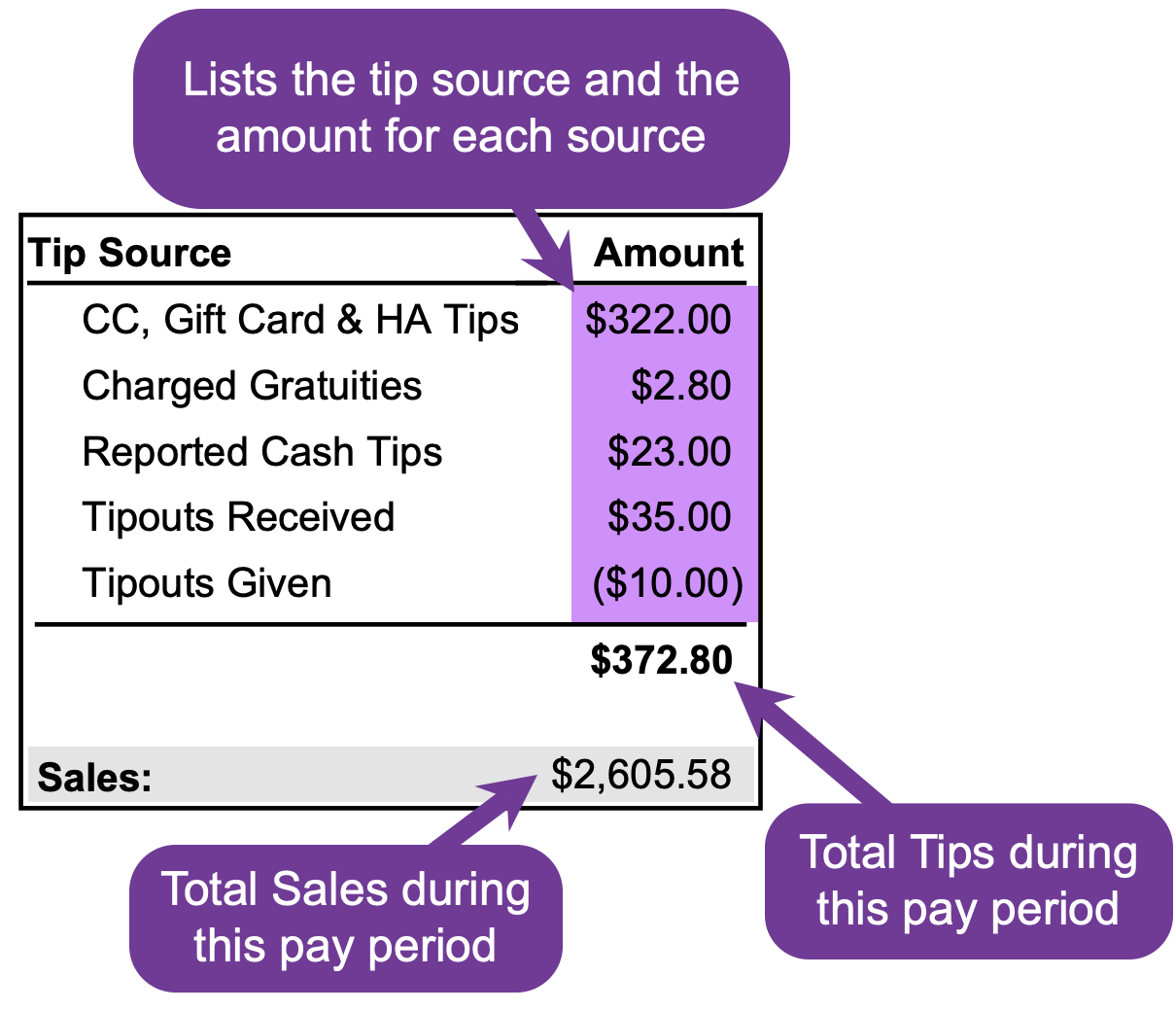

2. Tip & Sales Information

Below each employee’s hours and pay, the report lists their tips and sales.

-

Tip Source Amount – Breaks down tips into categories:

-

CC, Gift Card & HA Tips – Tips left on credit cards, gift cards, or house accounts.

-

CC Tip Fee – Credit card processing fee deducted from tips.

-

Charged Gratuities – Auto-gratuities (e.g., large parties).

-

Reported Cash Tips – Cash tips reported by the employee.

-

Tipouts Received – Tips received from another employee.

-

Tipouts Given – Tips shared with another employee (negative value).

-

-

Total Tips – Net tips after fees, tipouts, and adjustments.

-

Sales – The total sales attributed to the employee for the period.

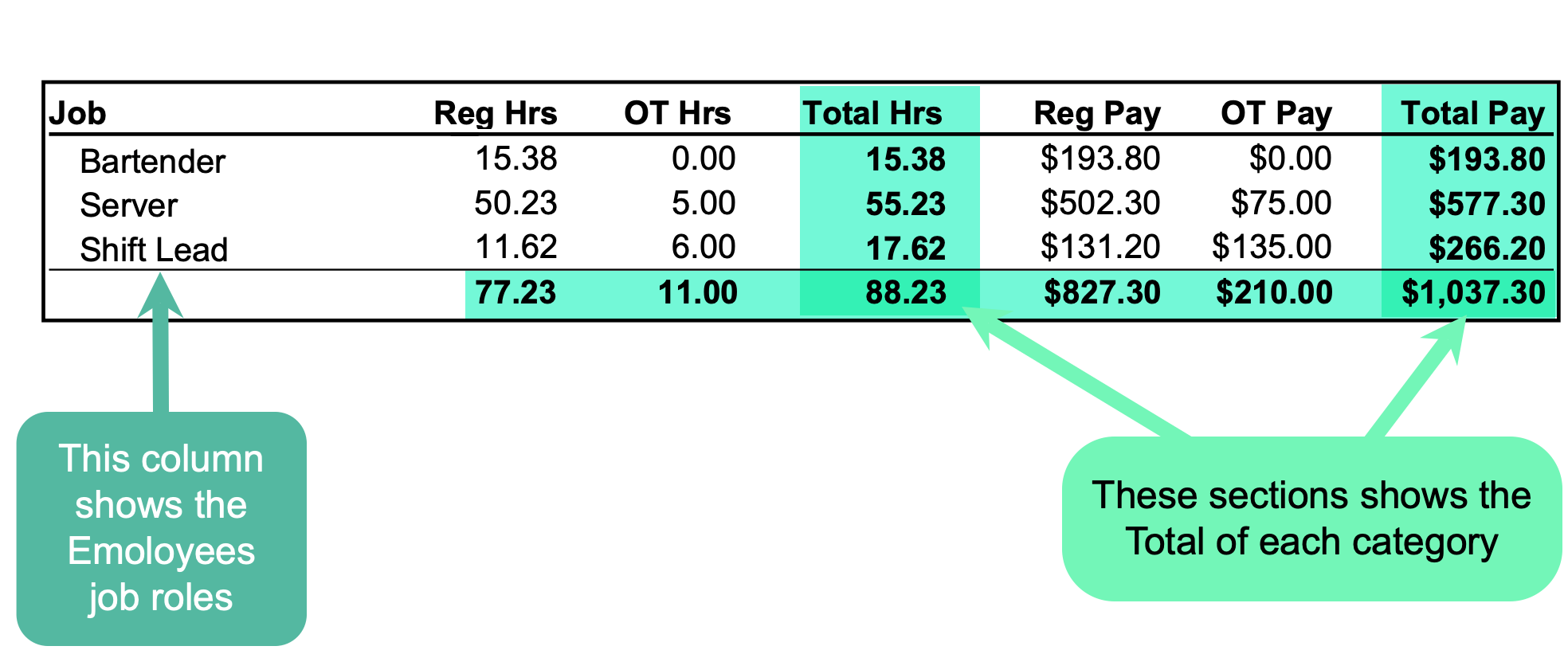

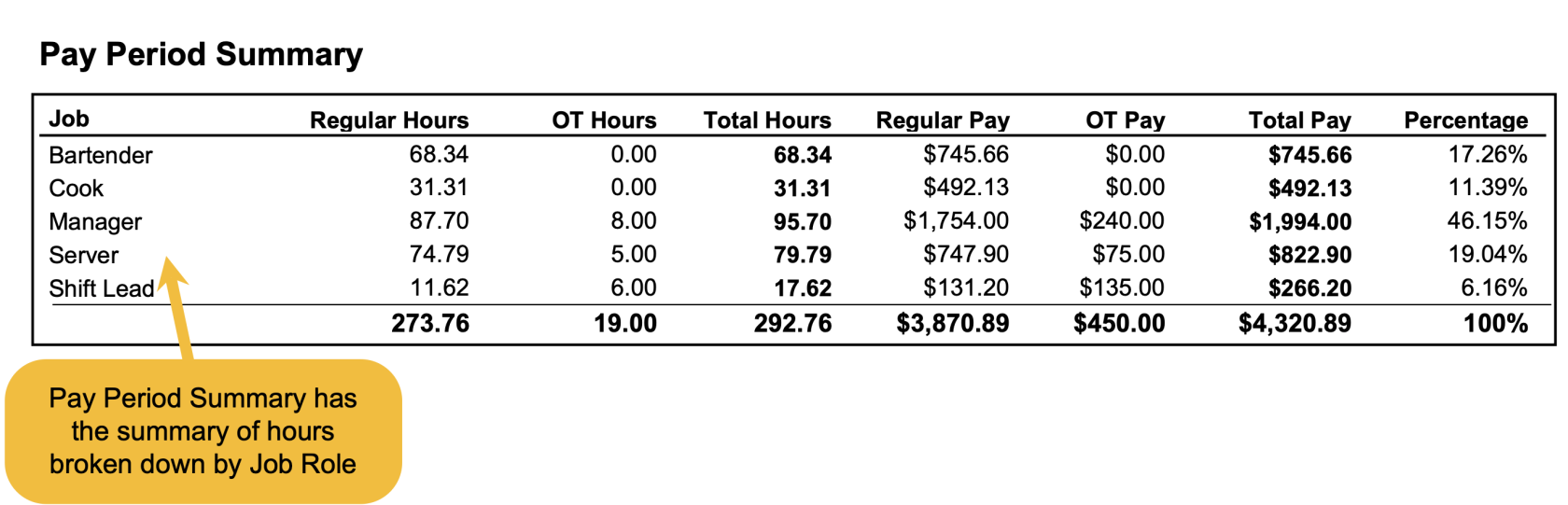

3. Employee Summary Section: (Job totals)

Pay Period Summary

At the end of the report, you’ll see overall totals for the entire pay period:

-

Job Totals – Combined hours and wages by job role across all employees.

-

Pay Period Summary – Grand totals of hours and pay for the entire location.

How to Use This Report

This report helps you:

-

Verify that employee hours and wages (including overtime) are calculated correctly.

-

Monitor overtime usage and identify opportunities to reduce extra labor costs.

-

Review tip distribution, including cash tips, credit tips, and tipouts.

-

Monitor payroll by job type to see labor distribution and overtime impact.

-

Confirm totals before submitting payroll to your provider.

No Comments