Sales Period Report

The Sales Period Report provides a summary of all sales activity for any selected date range.

It is most often used to review monthly sales and prepare tax filings by showing total taxable and non-taxable sales, tips, discounts, and payments.

This report uses the same structure as the Daily Close Report but rolls up multiple days into one consolidated view.

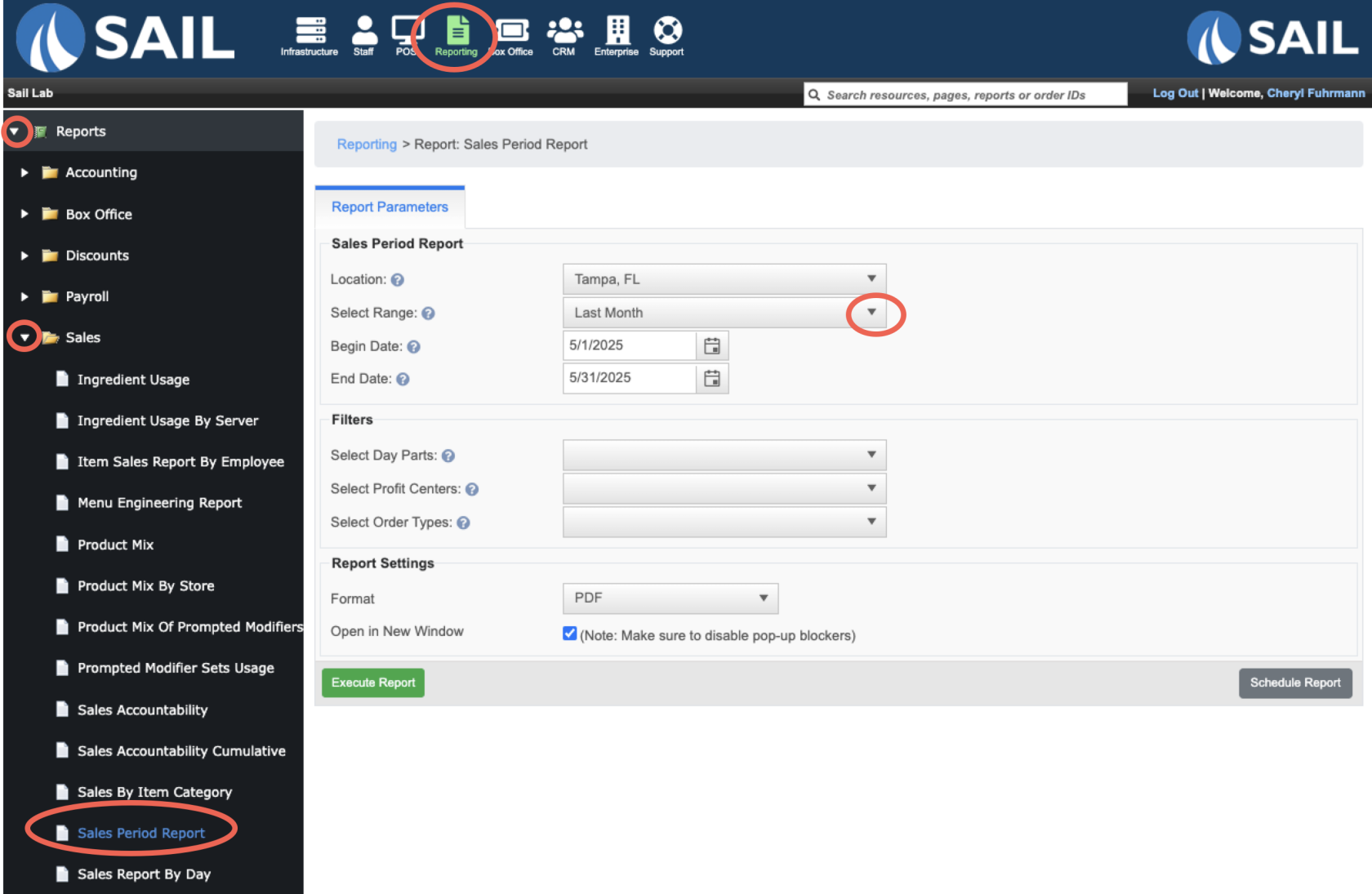

Where to find the report

- Backoffice --> Reporting --> Reports --> Sales folder --> Sales Period Report --> Select Date Range --> Execute

What it looks like

Report Parts

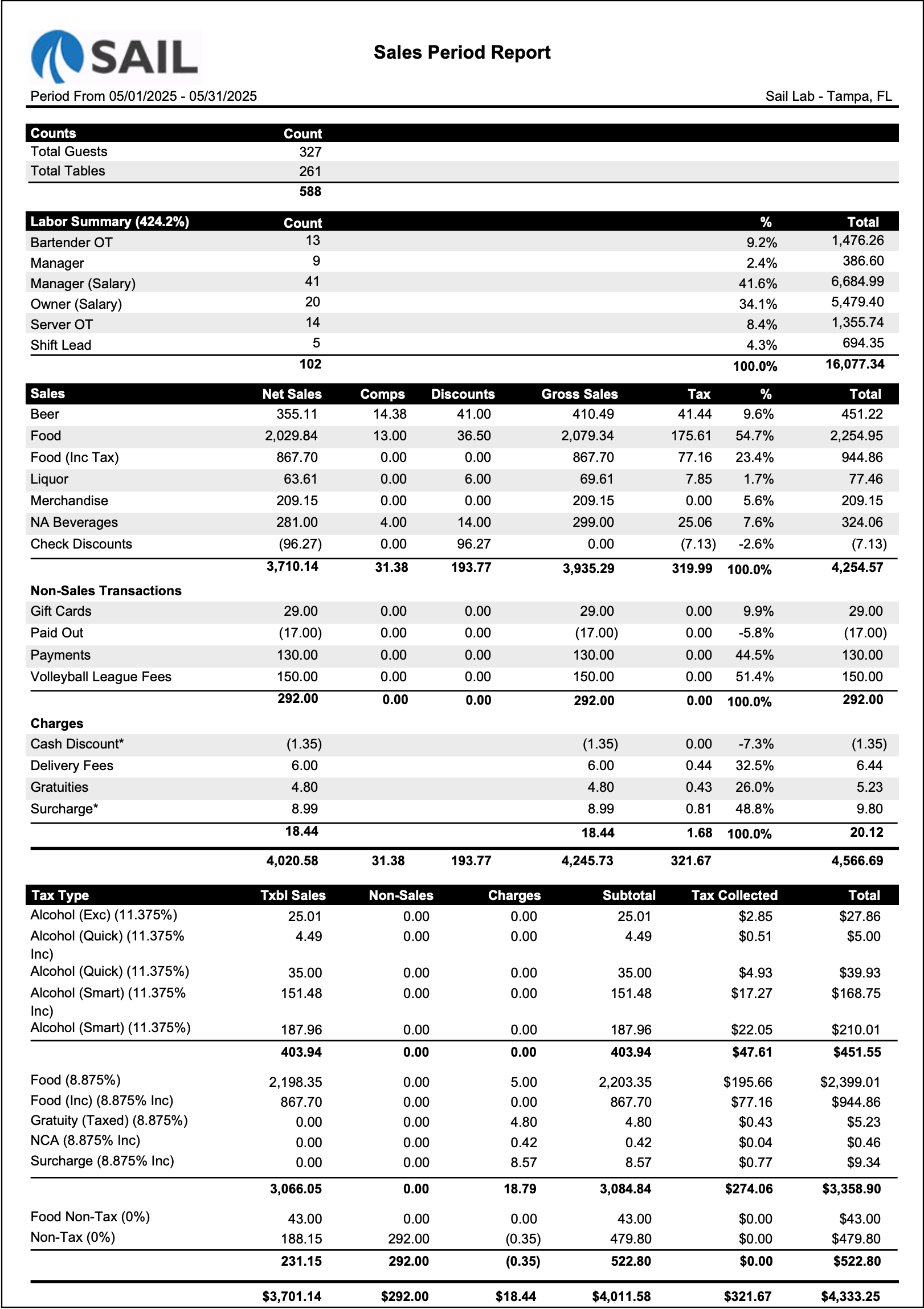

Header

Displays the selected date range and the location name.

You can run this report for any time span — a single day, a week, a pay period, or a full month.

Organization / Sections

- Counts – Lists the total guests, tables, and checks for the period.

- Labor Summary – Shows total labor dollars and hours by job role for the selected range.

- Sales – Breaks down Net Sales by Reporting Group (Food, Liquor, Beer, etc.), with Comps, Discounts, Tax, and Gross Sales shown per group.

- Non-Sales Transactions – Displays additional sales or adjustments not tied to menu items (Gift Card sales, Paid Outs, or Fees).

- Charges – Includes surcharges, gratuities, delivery fees, or cash discounts added during the period.

- Tax Type Summary – Shows the total taxable sales and tax collected for each configured tax type (e.g., Alcohol, Food, Non-Tax).

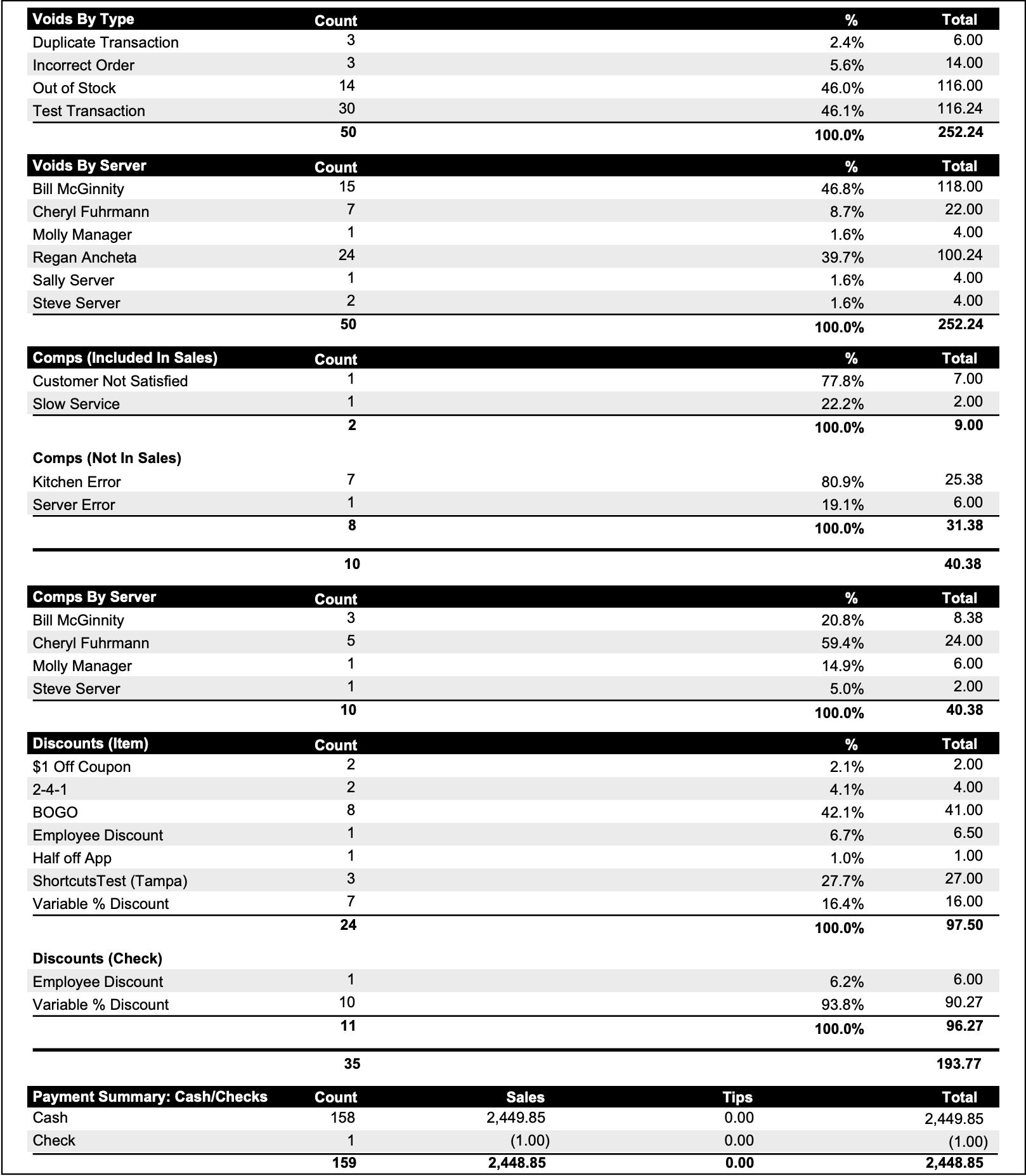

- Voids, Comps, and Discounts – Lists totals by type and by employee, to help identify trends or training needs.

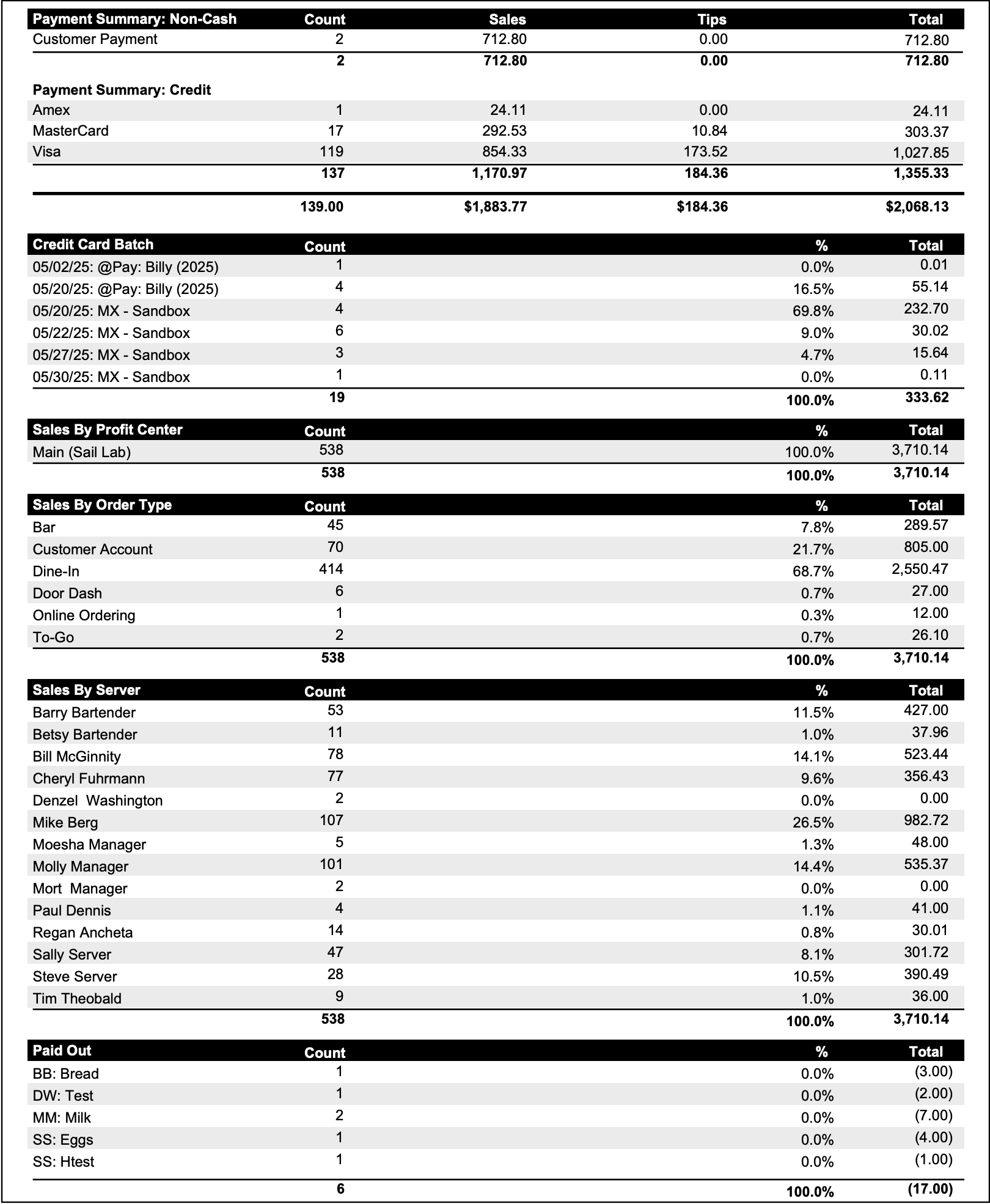

- Payment Summaries – Divided into:

- Cash/Checks

- Non-Cash Payments (Credit Cards, Gift Cards, Online Orders)

- Sales by Profit Center – Splits sales by configured profit centers (e.g., Main, Bar, Patio, Online).

- Sales by Order Type – Shows dine-in, to-go, pick-up, and third-party delivery totals.

- Sales by Server – Summarizes each employee’s contribution to total sales.

- Paid Outs – Lists all payout details with initials and notes from the reporting period.

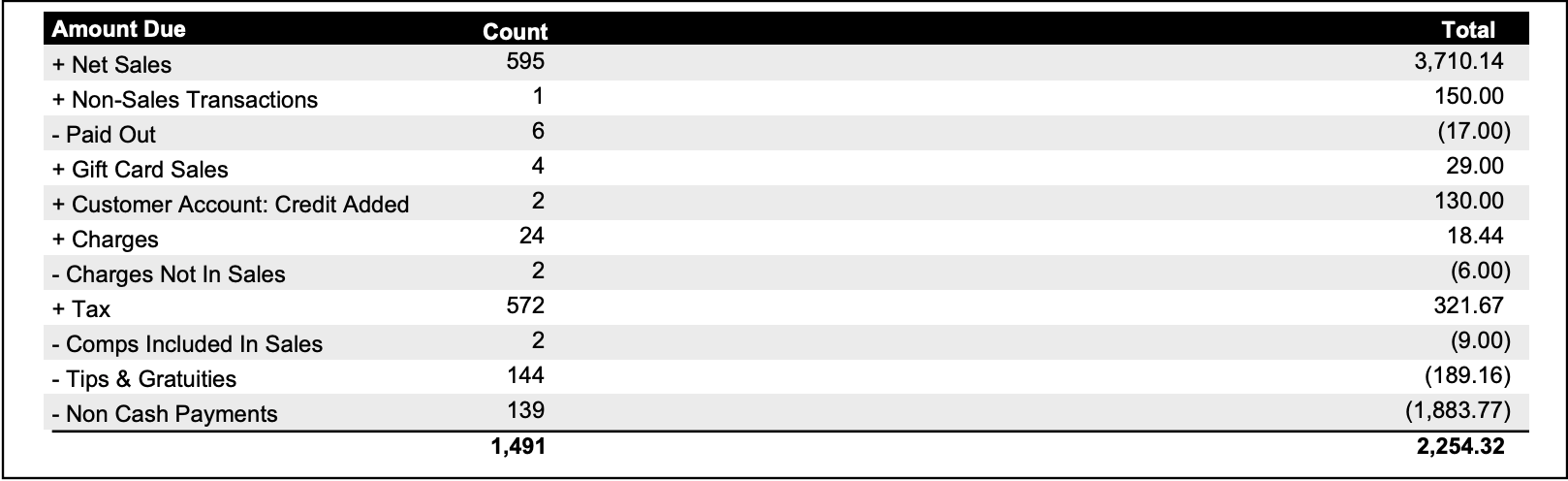

- Amount Due – The final section that calculates the Total Amount Due (Net Cash) across all days in the range.

The organization and sections of this report may vary by location.

Each section — such as Sales, Tips, Payments, or Amount Due — is fully configurable in Backoffice using Settings.

Admins can choose which parts appear, the order they display, and which are required for the report to calculate correctly.

For more details on editing report layouts and understanding each available section, see:

To Find Amount Due

This report uses the same calculation logic as the Daily Close Report, but sums the results for all days in the selected range.

The formula used in the Daily Close Report is:

+ Net Sales

+ Non-Sales Transactions

– Payouts

+ Charges

+ Tax

– Comps (included in sales)

– Cash Paid (when applicable)

+ Cash Received (when applicable)

+ Tip Refund (when applicable)

– Tips & Gratuities (claimed tips from payments, charged gratuities, and online gratuities)

– Non-Cash Payments

= Total Amount Due (Net Cash)

Example from the above report

Net Sales: $3,710.14

Non-Sales Transactions: +292.00

Payouts: –17.00

Charges: +18.44

Tax: +321.67

Comps (Included in Sales): –9.00

Tips & Gratuities: –189.16

Non-Cash Payments: –1,883.77

--------------------------------------------

Total Amount Due (Net Cash): $2,254.32

This total represents the net cash expected to be deposited for the entire reporting range (e.g., the full month of May 2025 in this example)

How to Use This Report

-

Run the report for a full month to gather sales totals for state and local tax reporting.

-

Compare Tax Type totals to ensure each rate aligns with local tax filings.

-

Review Sales by Profit Center and Order Type to track performance by channel (Main, Bar, Online).

-

Use Voids, Comps, and Discounts to identify training opportunities or policy violations.

-

Confirm that all Non-Cash Payments match your processor or accounting deposits.

-

Verify Payouts and Non-Sales Transactions for accurate tracking of expenses and gift card funding.

-

The Amount Due at the bottom represents your total net cash for the period — this number should match your combined bank deposits for the same range.

No Comments