Release 2024.1.2 "Fusagasuga"

Notes: **This release WILL require you to update your handheld to version 2024.1.2**

If you would like any additional information or help setting up any of these new features, please contact support at:

Support@ingageit.com or call (612) 861-5277

New Features

1. Check Tender Type

- You can now create a check tender type and treat checks a little differently than cash!

- Here is how to set it up:

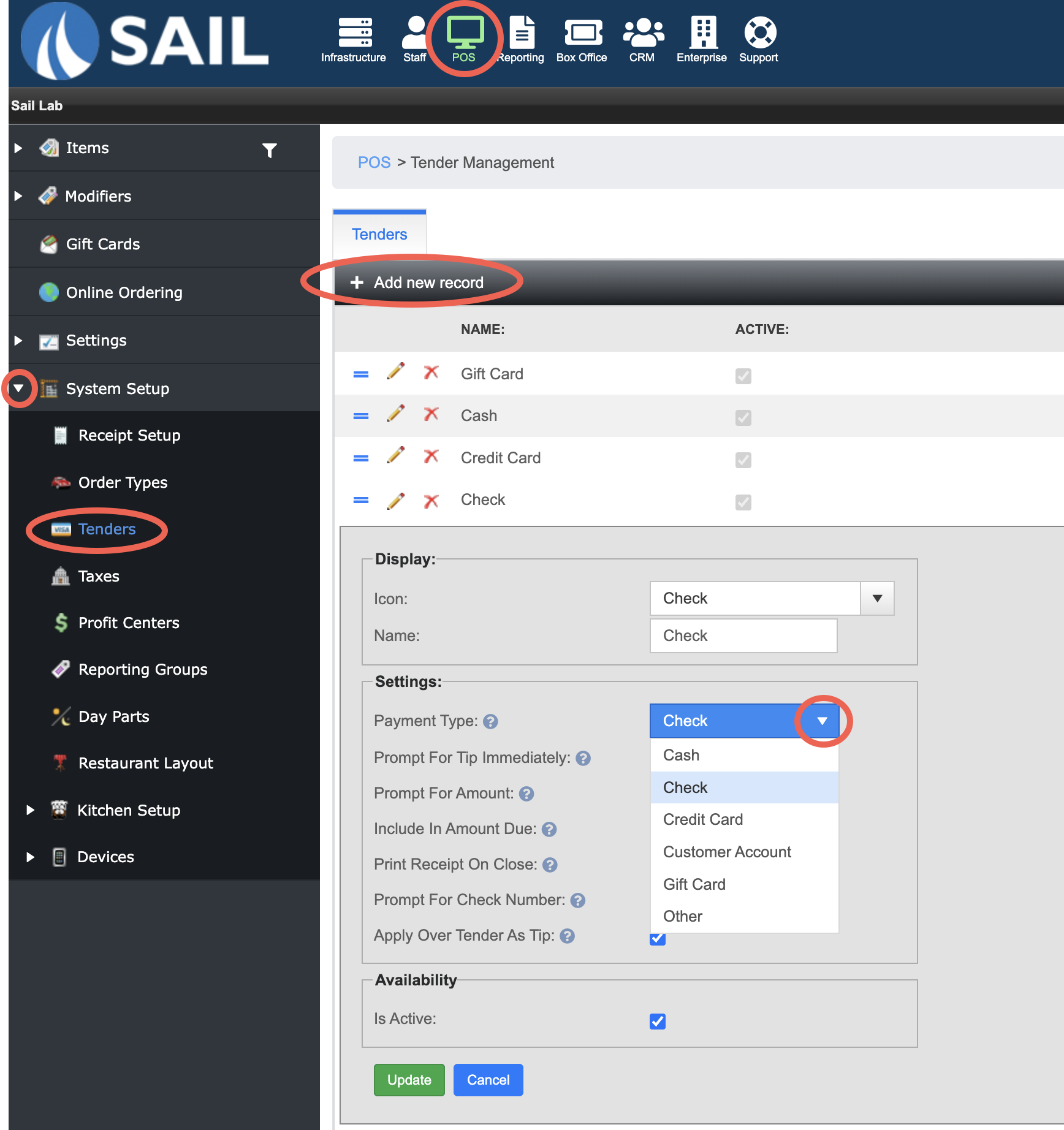

- Navigate to the POS tab --> System Setup --> Tenders --> Click +Add new record

- Set the icon you'd prefer (we do have a check option)

- Name the tender "Check"

- Then be sure to use the dropdown for payment types and select "Check" (This will bring the option for check that you need)

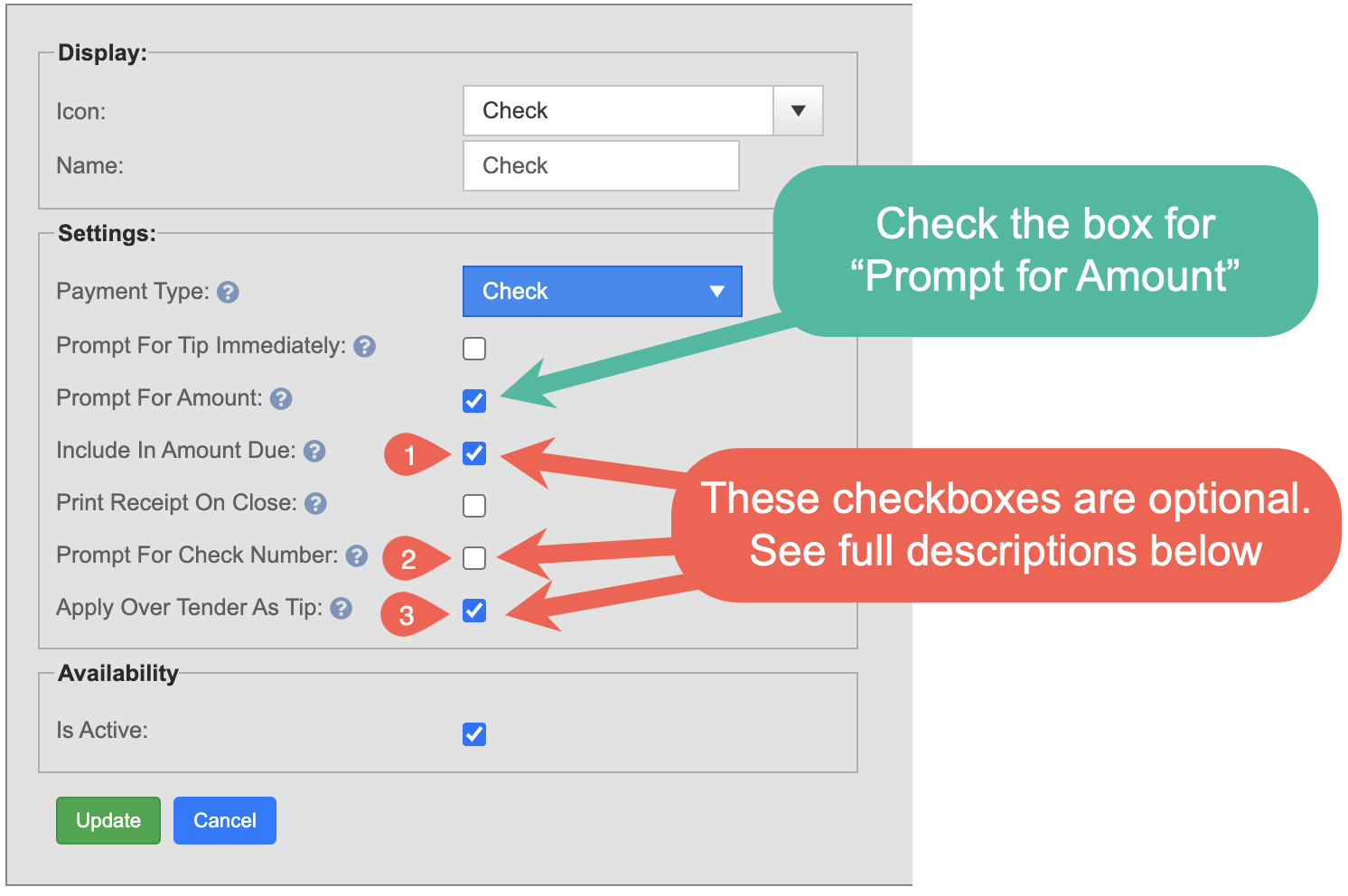

- Select the checkboxes from the settings you'd like. (the two that need to be checked are Active and Prompt for Amount)

- Include in Amount Due

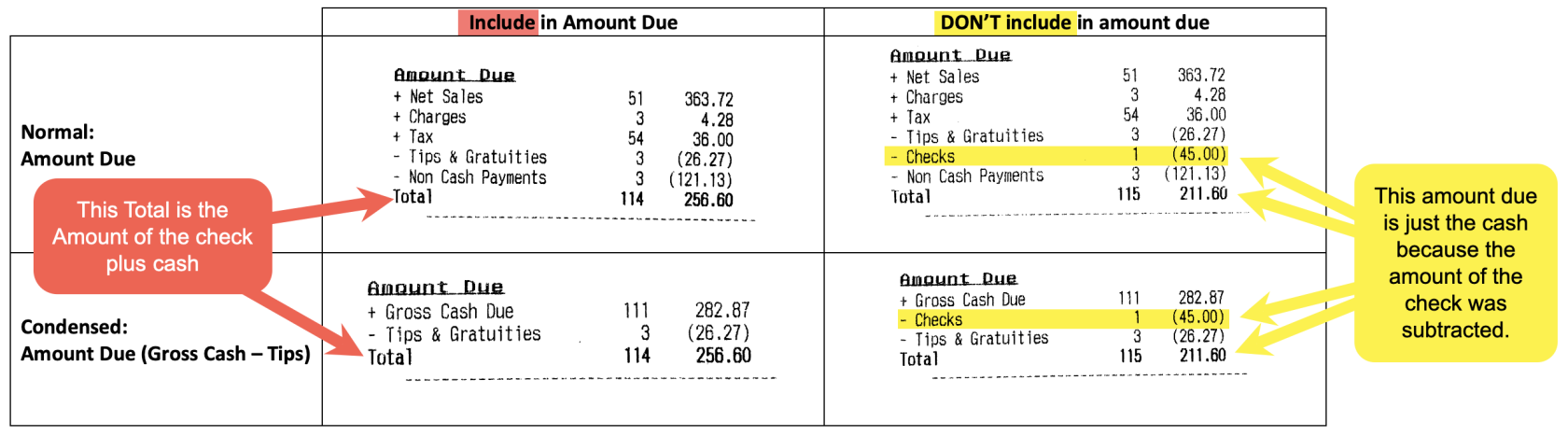

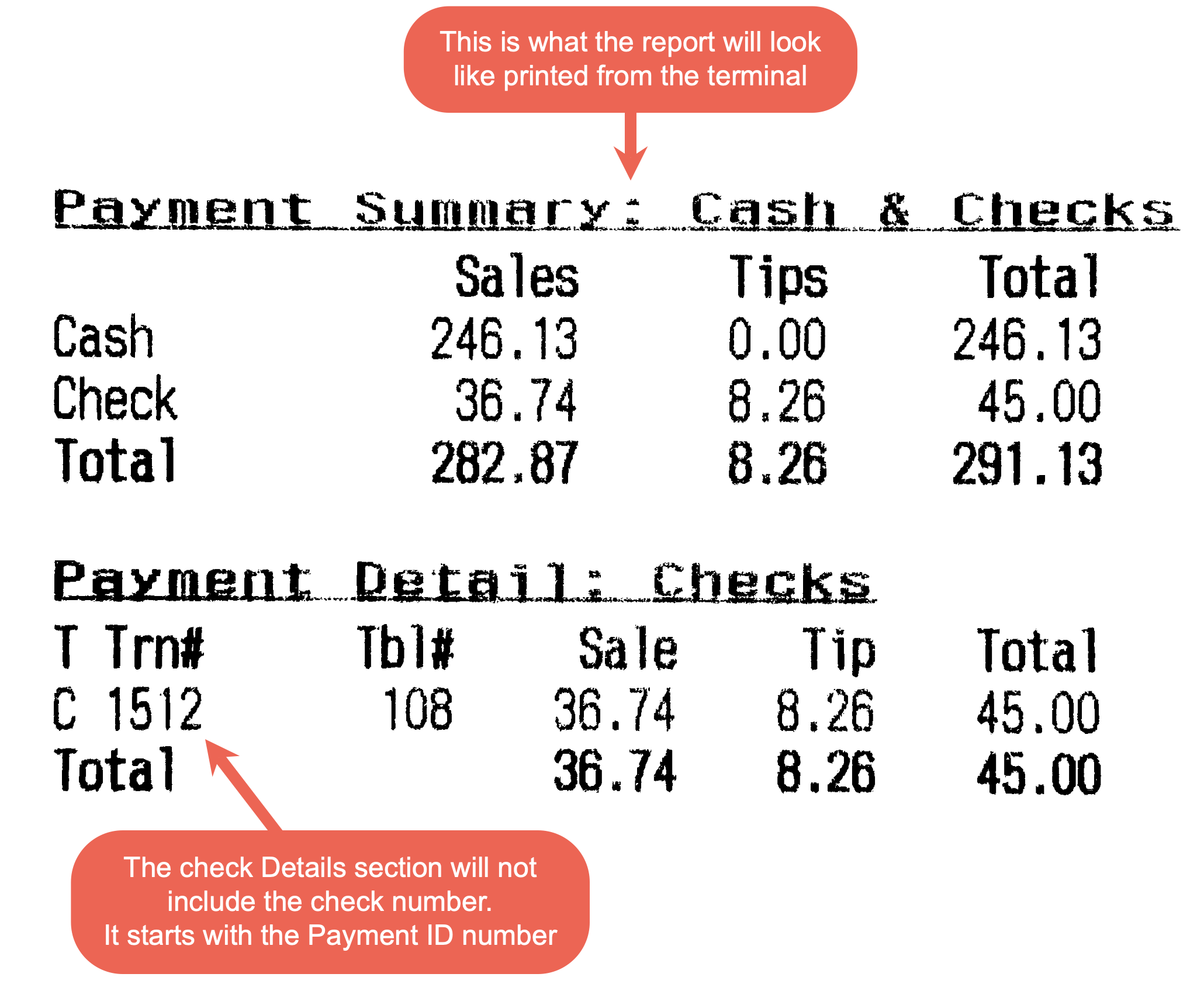

- If you choose to "Include" the check in the amount due section, then the check will still be counted as Cash. So in the examples below, the Amount due is $254.60 - Which means you'll need to turn in the $45 check plus an additional $211.60 cash. (So Total amount due is your CASH & CHECKS together)

- If you DO NOT include in the amount due, Then the check will be subtracted in the amount due section. and the Total at the bottom is the CASH that is owed only. The server will still need to turn in the check.

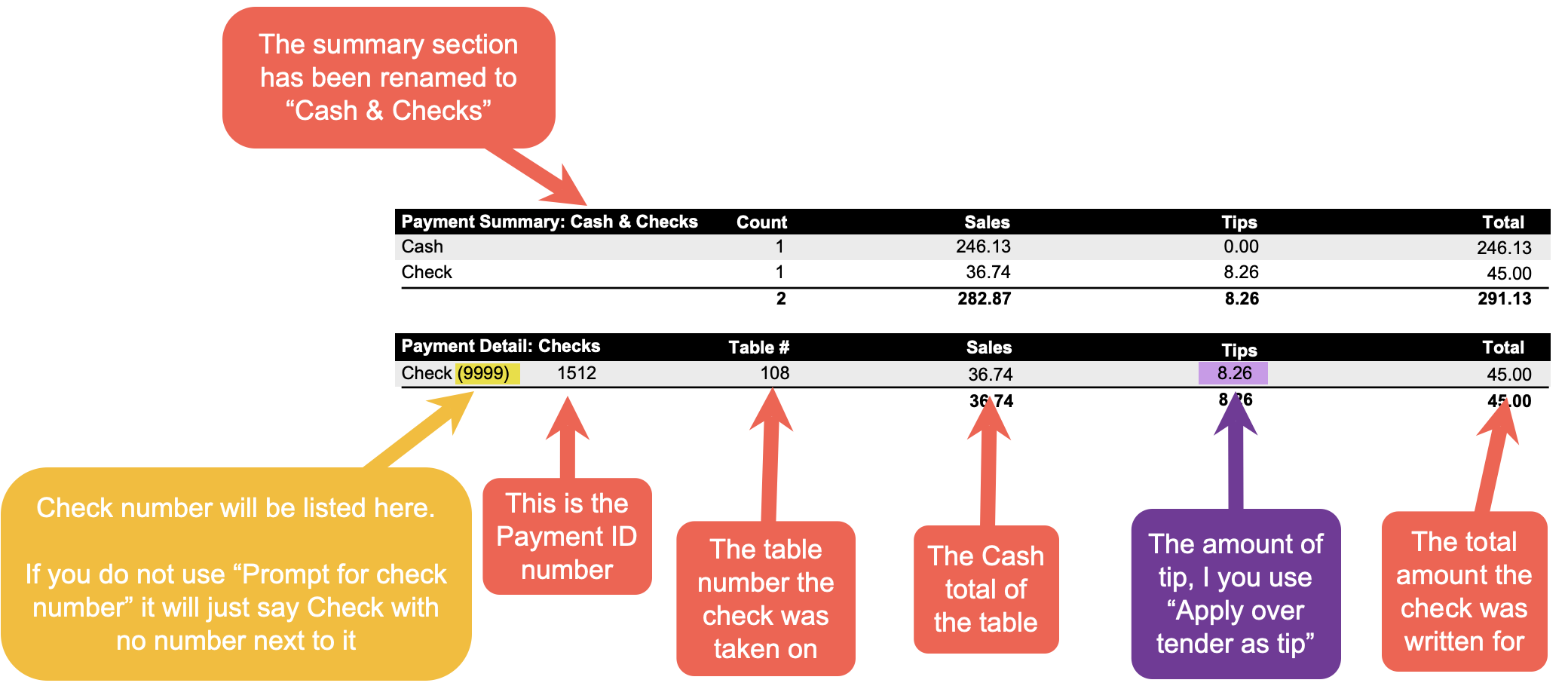

- Prompt for Check Number

- Apply Over Tend As Tip

- If you check this box, and If the amount you put in for the payment is more than the cash amount due, then the over tender amount will automatically be counted as a tip.

- For example (like above): If the amount is the cash due amount is $36.74, and when it prompts for the amount due, you put in $45 (which is the amount the check is written for), Then the $8.26 will be the tip amount.

- Please note that this tip will automatically be tracked and accounted for on their payroll report in the "CC, Gift Cards, $ HA Tips" Line

- For example (like above): If the amount is the cash due amount is $36.74, and when it prompts for the amount due, you put in $45 (which is the amount the check is written for), Then the $8.26 will be the tip amount.

- If you do not check this box, Then even if you put in $45 for the amount, it will still only record the check as the amount of the sale $36.74. (I would recommend, if you're going to use this method, then you also "include in amount due" So the check amount plus cash is the total amount due)

- If you check this box, and If the amount you put in for the payment is more than the cash amount due, then the over tender amount will automatically be counted as a tip.

No Comments