Daily Sales Report

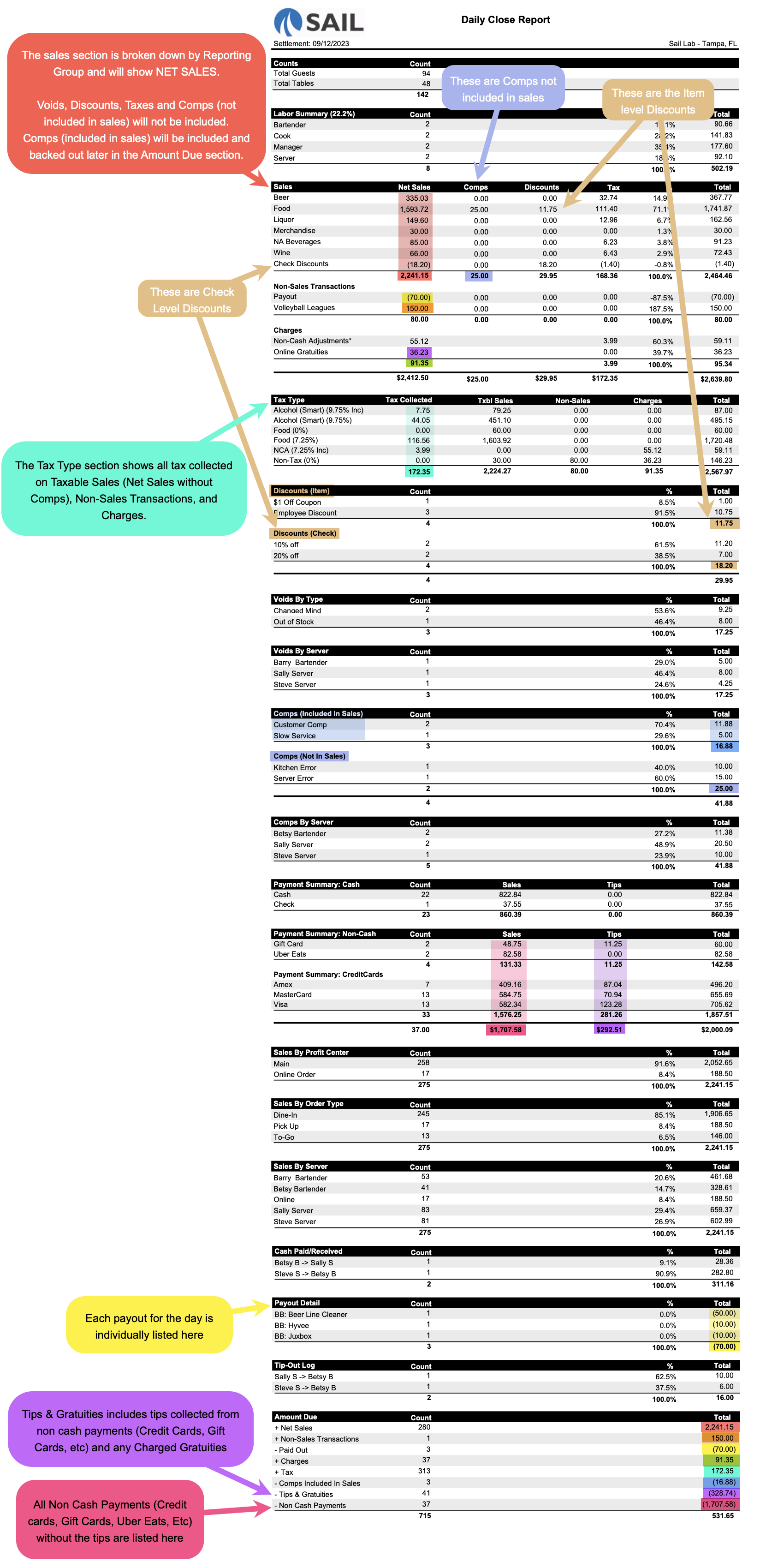

The Daily Close Report shows a complete summary of all sales, payments, and transactions for a single business day (or daily close).

It combines all individual Server Reports and provides a full accounting of the restaurant’s sales, payouts, taxes, comps, and payment types.

This report is most often used to reconcile deposits, verify totals before submitting data to accounting, and review daily sales activity by category and server.

- Each of the important number are color coded to help find easily

Report Parts

Header

Displays the close date, settlement information, and location name.

Each Daily Close represents one completed business day (or shift range). In rare cases, more than one close can occur in the same calendar day.

Organization / Sections

- Counts – Lists total guests, tables, and checks for the day.

- Labor Summary – Shows hours, pay, and sales contribution by job role (Bartender, Server, Cook, etc.).

- Sales w/Details – Displays Net Sales broken down by Reporting Group (Beer, Liquor, Food, etc.) and includes check-level discounts, charges, and non-sales transactions such as payouts.

- Tax Type Summary – Shows all tax collected, grouped by tax type (e.g., Alcohol, Food, Non-Tax). Only taxable sales, non-sales transactions, and charges contribute to this section.

- Discounts – Divided into:

- Discounts (Item) – Applied directly to individual menu items.

- Discounts (Check) – Applied to entire checks.

- Voids – Summarized both by type (e.g., Channel Mind, Out of Stock) and by employee.

- Comps – Split into:

- Comps Included in Sales (such as Employee Meals or Customer Comps)

- Comps Not in Sales (such as Kitchen or Server Error)

- Payments Summary – Divided into:

- Cash & Checks

- Non-Cash Payments (Credit Cards, Gift Cards, Third-Party Services)

- Sales by Profit Center – Compares sales between defined areas (Main, Online Order, Bar, Patio, etc.).

- Sales by Order Type – Breaks down dine-in, pick-up, and to-go transactions.

- Sales by Server – Lists total sales contributions by each server.

- Cash Paid/Received - Show if there were any cash exchanges between staff during the day

- Payout Detail – Displays every payout and paid-in logged during the day, including who performed it and the note entered at the time.

- Tip-Out Log – Records any submitted tip-outs entered between employees.

- Amount Due – The final reconciliation section showing how the total daily cash position is calculated.

The organization and sections of this report may vary by location.

Each section — such as Sales, Tax, Payments, or Amount Due — is fully configurable in Backoffice using settings.

Admins can choose which parts appear, the order they display, and which are required for the report to calculate correctly.

For more details on editing report layouts and understanding each available section, see:

Understanding the Calculation Flow

The Amount Due section at the bottom of the report reflects all the day’s financial activity rolled up from every server close.

It uses the same basic structure as a Server Report but totals all transactions systemwide.

To Find Amount Due

The Amount Due on the Daily Close Report represents the final net cash total for the entire business day.

This total reflects all sales activity, adjustments, payouts, taxes, and tips collected from every server’s shift.

The formula used in the Daily Close Report is:

+ Net Sales

+ Non-Sales Transactions

– Payouts

+ Charges

+ Tax

– Comps (included in sales)

– Cash Paid (when applicable)

+ Cash Received (when applicable)

+ Tip Refund (when applicable)

– Tips & Gratuities (claimed tips from payments, charged gratuities, and online gratuities)

– Non-Cash Payments

= Total Amount Due (Net Cash)

Example from the above report

Net Sales: $2,241.15

Non-Sales Transactions: -70.00

Payouts: -70.00

Charges: 85.12

Tax: 172.35

Comps (Included in Sales): -63.84

Tips & Gratuities: -292.51

Non-Cash Payments: -1,797.58

-------------------------------------

Total Amount Due (Net Cash): $531.65

How to Use This Report

- Use the Sales and Tax Type sections to verify totals for accounting or tax submission.

-

Confirm that all Comps and Discounts are appropriate and approved.

-

Check Non-Cash Payments to ensure that credit card and online order deposits match processor reports.

-

Verify that Payout Details include clear manager notes for each entry.

-

Confirm Tip-Out Logs match what’s been recorded in the payroll or POS system.

-

Compare the Amount Due at the bottom of the report to the actual cash deposit.

-

If discrepancies exist, use the Server Reports from the same date to isolate which shift or employee contributed to the imbalance.

No Comments